Vintage ženske črno Lakasto Usnje Torba Modno Oblikovanje Dame Vrečko Pod Pazduho Retro Y2k Kul Dekleta Majhno Torbico Torbice > Ženske torbe ~ www.ssk-mislinja.si

Črno Lakasto Usnje ženske Tote Vrečko Ramenski Crossbody Torbice Trdna Big Torbici Tassel Velike Zmogljivosti Vrh-ročaj Vrečke Torbici | Vtičnice ~ Smelt.si

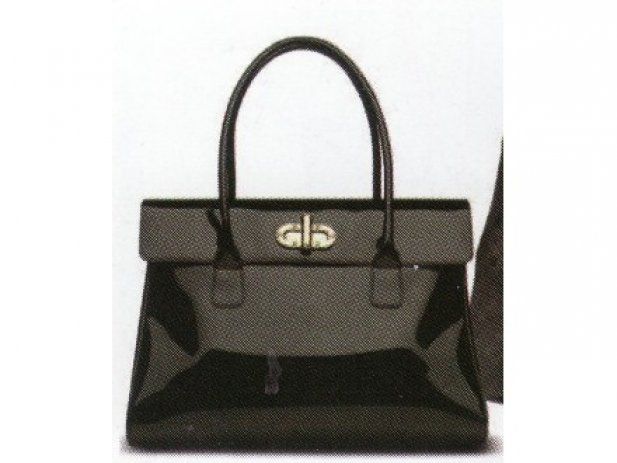

Lakasta ročna torbica z zgornjim ročajem in paščkom za čez ramo, črna La Redoute Collections | La Redoute

Lakasta ročna torbica z zgornjim ročajem in paščkom za čez ramo, črna La Redoute Collections | La Redoute

Lakasta ročna torbica z zgornjim ročajem in paščkom za čez ramo, črna La Redoute Collections | La Redoute

Bleščica, Vezenje ženske Ramo Torbe, Lakasto Usnje Messenger Vrečke Za ženske 2021 Torbico, Modni Diamant Crossbody Vrečko Bolsa \ Ženske Torbe ~ www.drhorvat.si