Uptake of lung cancer screening with low-dose computed tomography in China: A multi-centre population-based study - eClinicalMedicine

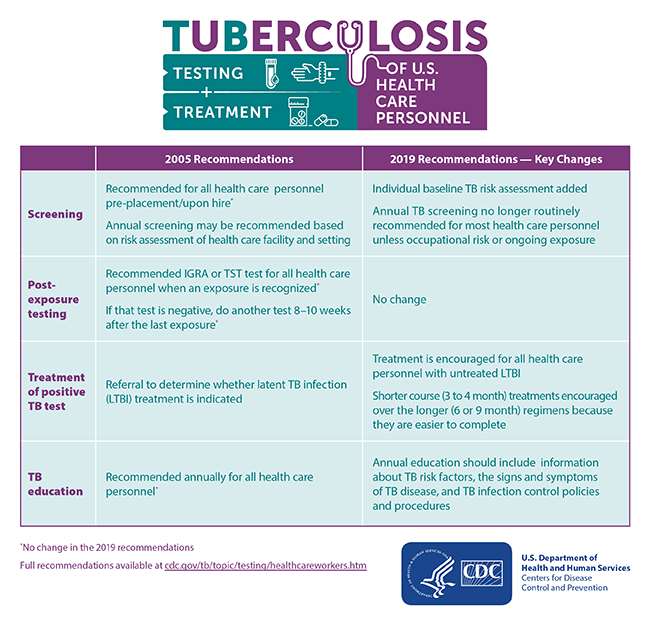

Updated Recommendations for TB Screening, Testing, and Treatment of U.S. Health Care Personnel | CDC

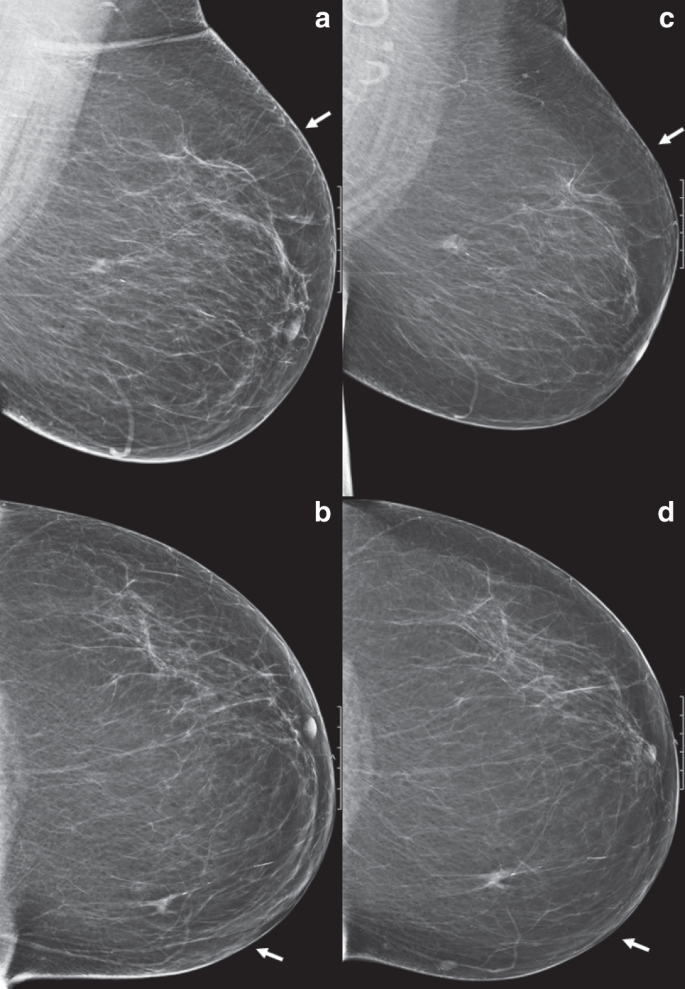

Consensus Review of Discordant Imaging Findings after the Introduction of Digital Screening Mammography: Irish National Breast Cancer Screening Program Experience | Radiology

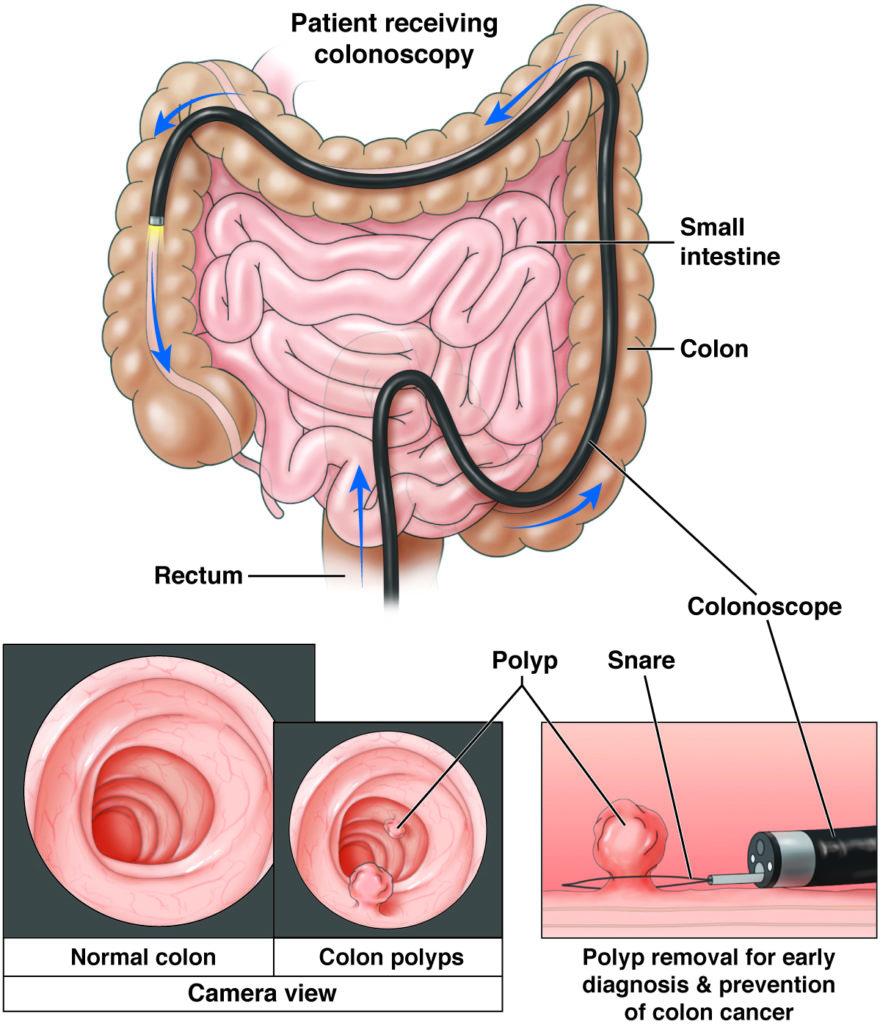

Faecal immunochemical test after negative colonoscopy may reduce the risk of incident colorectal cancer in a population-based screening programme | Gut

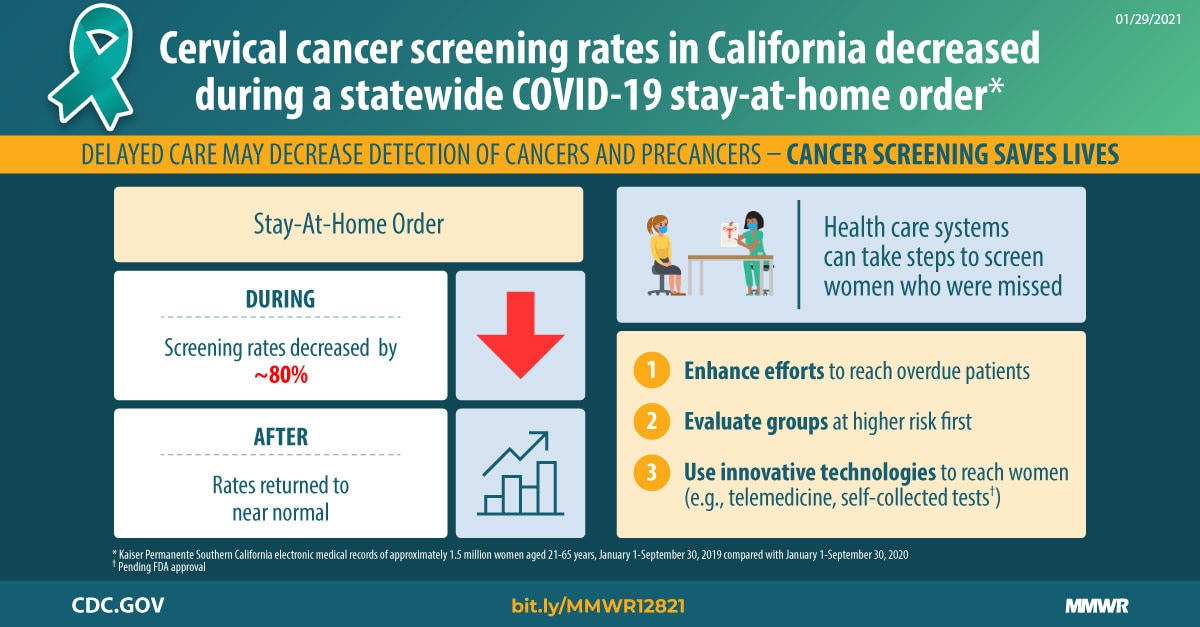

Impact of COVID-19 on Cervical Cancer Screening Rates Among Women Aged 21–65 Years in a Large Integrated Health Care System — Southern California, January 1–September 30, 2019, and January 1–September 30, 2020 | MMWR

Delayed breast cancer diagnosis after repeated recall at biennial screening mammography: an observational follow-up study from the Netherlands | British Journal of Cancer