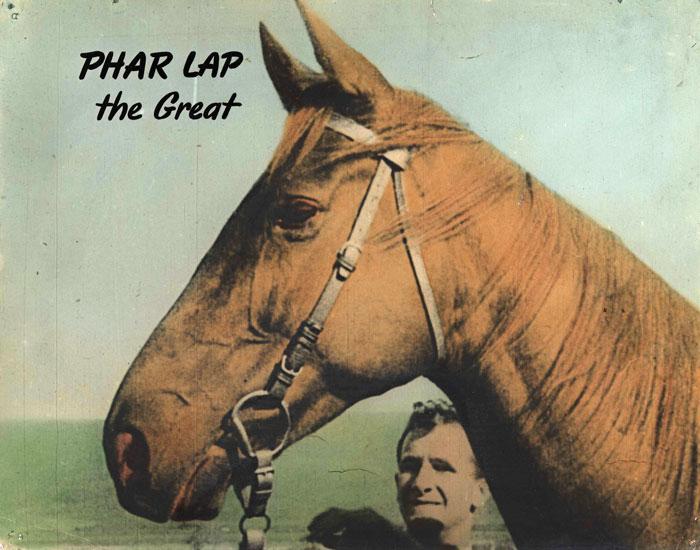

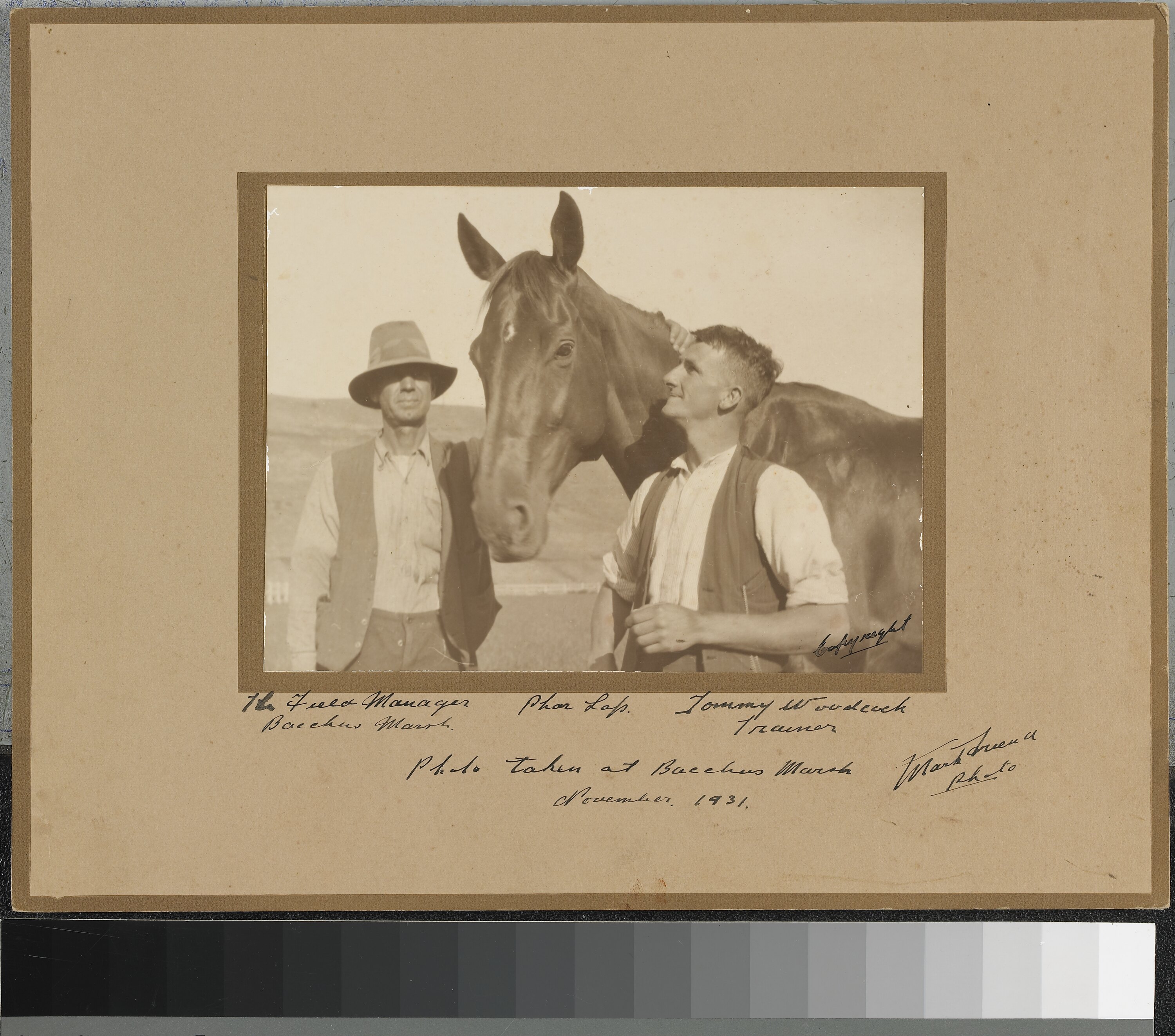

A mummified Pharlap and his strapper Tommy Woodcock at Melbourne Museum | Throughbred horses, Thoroughbred horse, Pony breeds

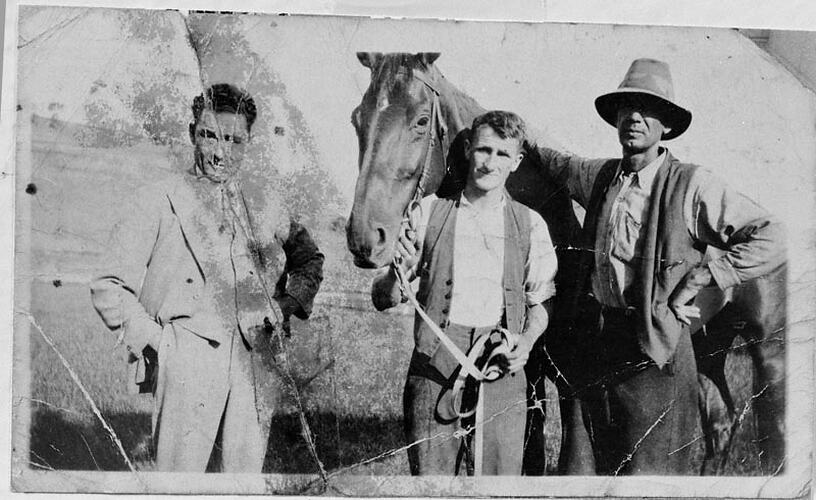

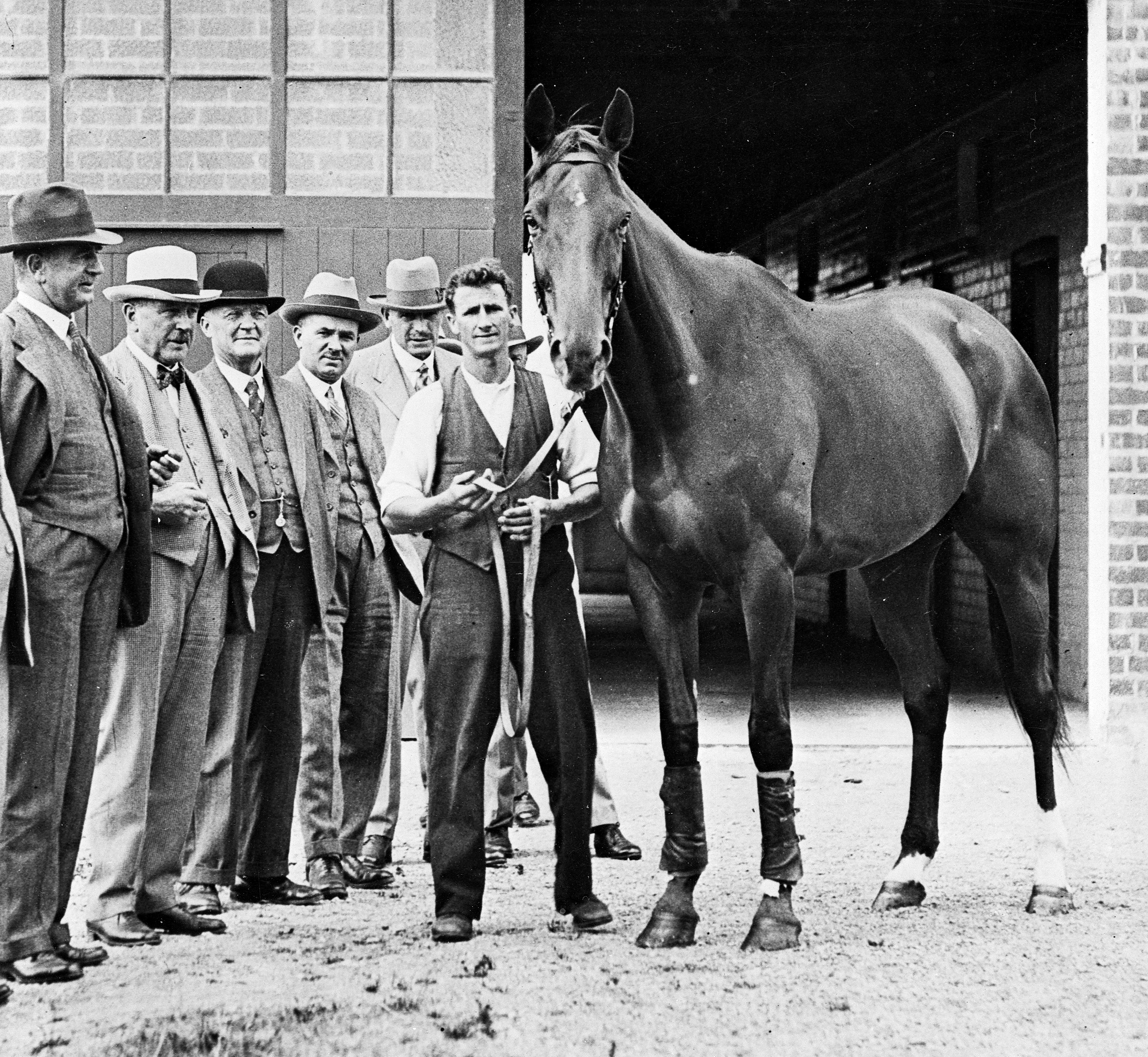

Photograph - Bill Elliot, Tommy Woodcock & Phar Lap at the Agua Caliente Handicap, Framed, 20 Mar 1932, Framed hand coloured photograph of Bill Elliot sitting on the back of Phar Lap

/cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/TILZLXELGDLCFVW3D6QC7CA4SA.jpg)