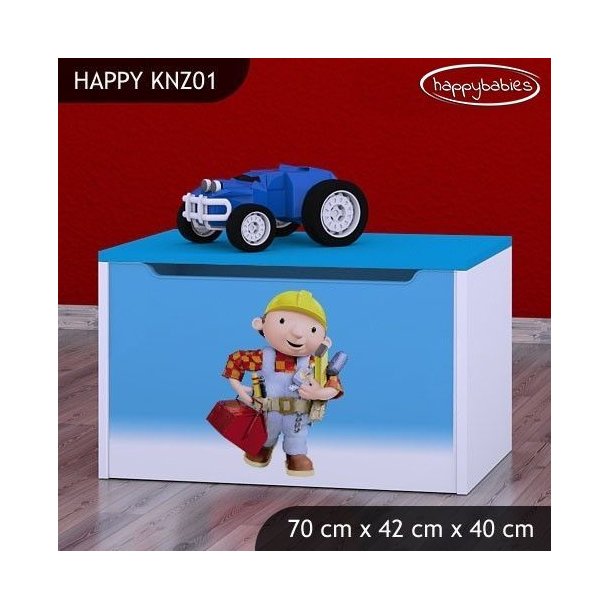

Bořek stavitel set auto volný chod + figurka s doplňky různé druhy kov | Disneybaby.cz | Hračky a oblečení - Disney

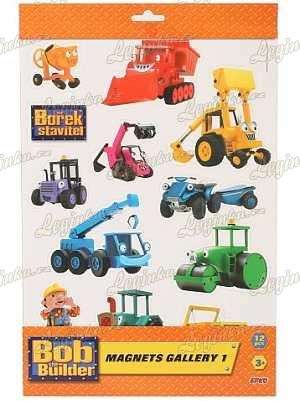

Hračka-Bořek Stavitel - Traktor s přívěsem - Levné knihkupectví - prodej knih se slevami, levné knihy.

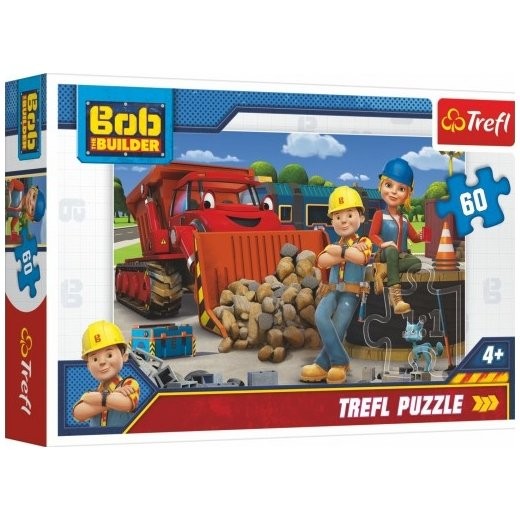

Desky na cislice - Bob the Builder - škola - Bořek stavitel - složky - Desky na pismenka, podložky | Hračky Mihaj