Amazon.com: HIC Splatter Screen Guard Strainer, 18/8 Stainless Steel, Fine Mesh, 11-Inches: Home & Kitchen

Buy Superfine Stainless Steel Oil Spill Filter Colander Oil Across Mesh Sieve Oil Scoop Kitchen Scoop at affordable prices — free shipping, real reviews with photos — Joom

Купить Сетка для защиты от брызг масла с ручкой 30 см GIPFEL 5677 по низкой цене в москве. Интернет магазин POSUDAOK.

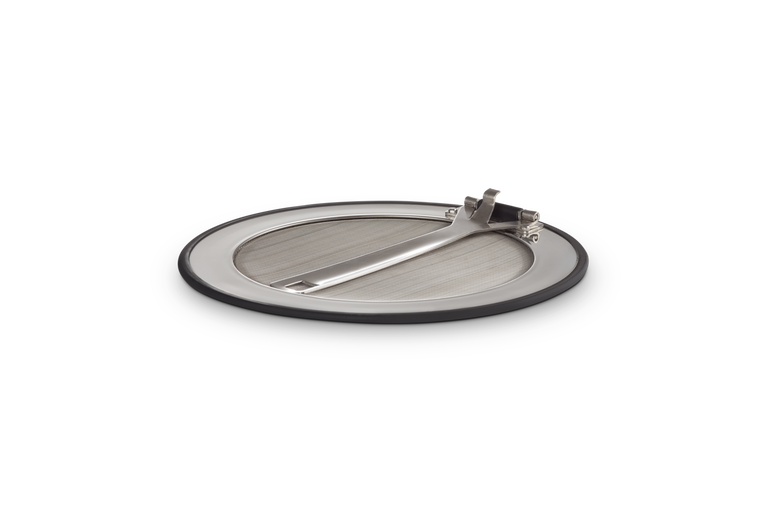

Stainless Steel Splatter Screen Handle Anti Grease Splash Scald Proof Frying Pan Cover Cooking Tools Oil Net|Colanders & Strainers| - AliExpress

キッチンネット 23cm 日本製 水切りネット ザル ストレーナー 油跳ね防止 油ガード 裏漉し ロングセラー 丈夫 軽い 片手 :0241600:渋谷の食器屋さん食喜屋 ヤフー店 - 通販 - Yahoo!ショッピング