Strik, garn, strikkeopskrifter og smykker på bestilling: Islandsk trøje ala Mads Nørgaard | Strikketeknikker, Strikkeopskrifter, Garn

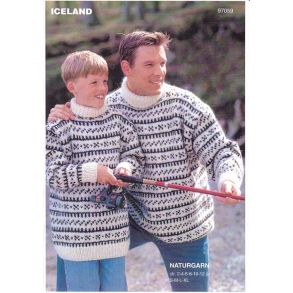

Sweater med raglanærmer - Sælges kun med garn - Hjertegarn - Garnbutik - Kvalitet og service i højsæde. Brug for råd, ring på 26 74 72 04

Sweater med raglanærmer - Sælges kun med garn - Hjertegarn - Garnbutik - Kvalitet og service i højsæde. Brug for råd, ring på 26 74 72 04

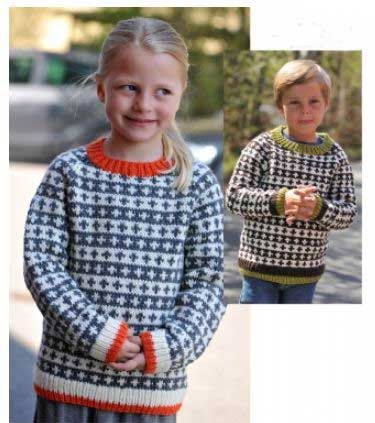

Mønster til børnesweater med raglanærmer - sælges kun sammen med garn - Opskrifter - Børn - Garnbutik - Kvalitet og service i højsæde. Brug for råd, ring på 26 74 72 04

Strik & Design | Strik, garn, strikkeopskrifter og smykker på bestilling: Islandsk trøje ala Mads Nørgaard endelig færdig

Knithouse - Strik din egen Mads Nørgaard-trøje! Du kan købe strikkekittet til denne trøje på vores nye webshop med garn og opskrifter, www.knithouse.dk. Hele overskuddet går til Red Barnet. Det er også

Islandsk trøje ala Mads Nørgaard endelig færdig - Strik & Design | Strik, garn, strikkeopskrifter og smykker på bestilling