Calvin Klein Fay North/South Small Crossbody, Almond/Taupe/Bloodstone Logo,One Size: Handbags: Amazon.com

Borsa Guess Tracolla Uomo Vezzola Smrt Top Zp Xbody Flt Saffiano Dark Black UBS23GU03 HMEVZLP2258, dark black : Amazon.se: Fashion

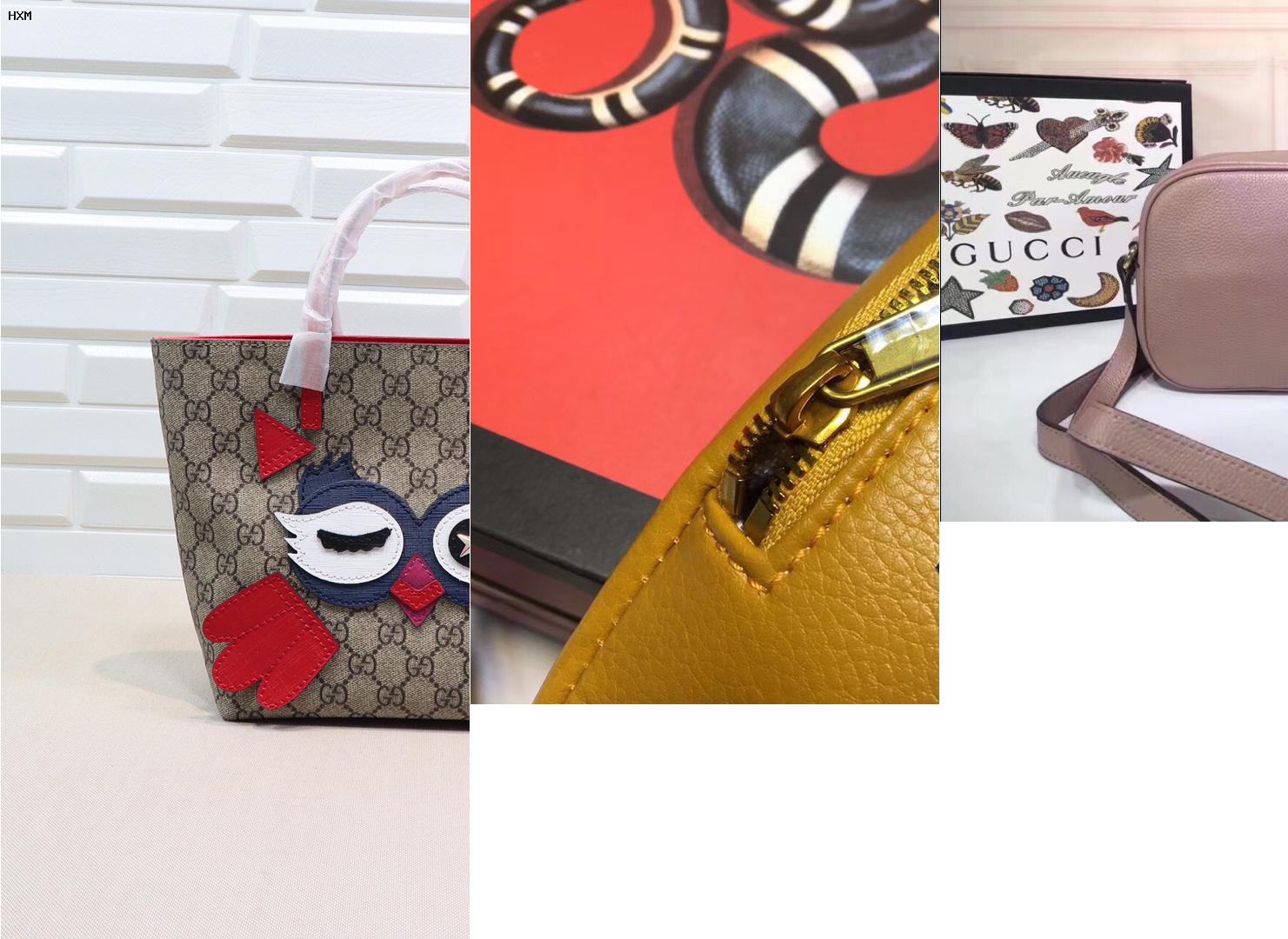

Gucci tracolla uomo Signature • Revivaluxuryboutique Gucci tracolla uomo Signature louis vuitton gucci fendi ysl • borse lusso usate