Gumka do mazania kauczukowa do ołówka SP30 PELIKAN | Przybory \ Gumki Pelikan | BezpiecznyDzieciak.pl, zabezpieczenia dla dzieci, bramki ochronne zabezpieczajace, kask do nauki chodzenia, monitory nianie, Reer, Angelcare, tornistry plecaki szkolne

Gumki do mazania - Szał dla Plastyków - profesjonalny sklep plastyczny - Szał dla Plastyków - Prawdziwy Sklep Plastyczny

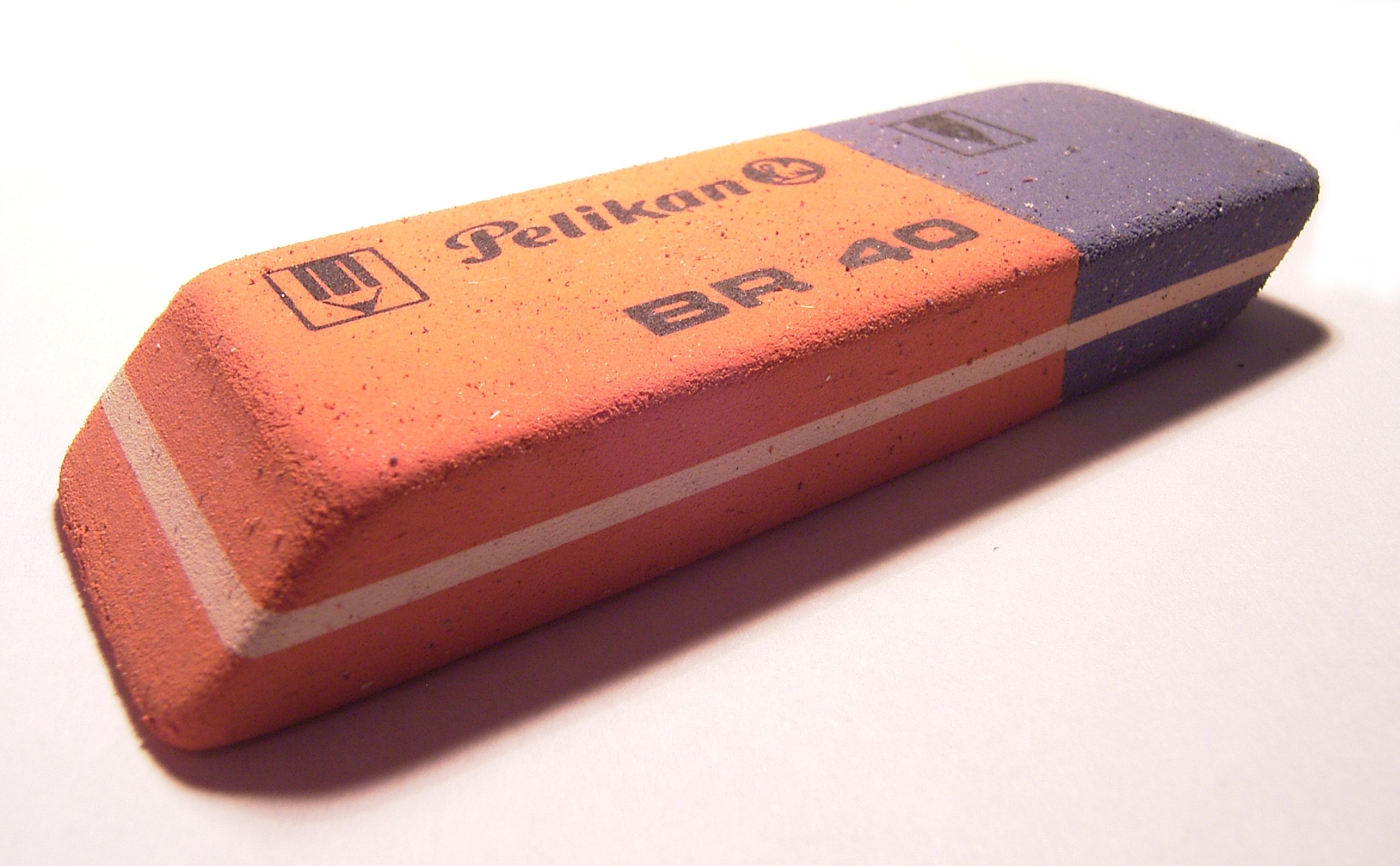

Zauważyliście, że wiele gumek ma niebieską stronę? Oto czemu służy Obie strony gumki zdecydowanie różnią się budową. Pomarańczowa jest miękka i giętka, a niebieska jest sztywna. I nie bez powodu – Demotywatory.pl