COL17c age-depth model. The chronostratigraphic markers used for the... | Download Scientific Diagram

High-resolution sequence stratigraphy as a tool in hydrogeological exploration in the Atacama Desert | Quarterly Journal of Engineering Geology and Hydrogeology

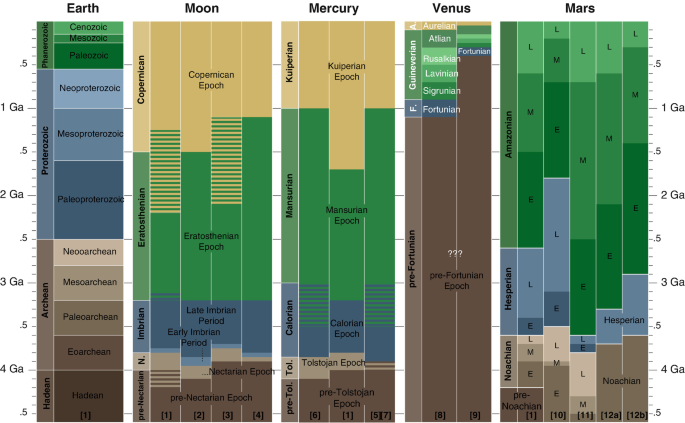

Pliocene integrated chronostratigraphy from the Anno Formation, Awa Group, Boso Peninsula, central Japan, and its paleoceanographic implications | Progress in Earth and Planetary Science | Full Text

PDF) Correlation of Sturtian diamictite successions in southern Australia and northwestern Tasmania by Re–Os black shale geochronology and the ambiguity of “Sturtian”-type diamictite–cap carbonate pairs as chronostratigraphic marker horizons | Brian ...

Chronostratigraphic and sequence stratigraphic chart for the Colorado... | Download Scientific Diagram

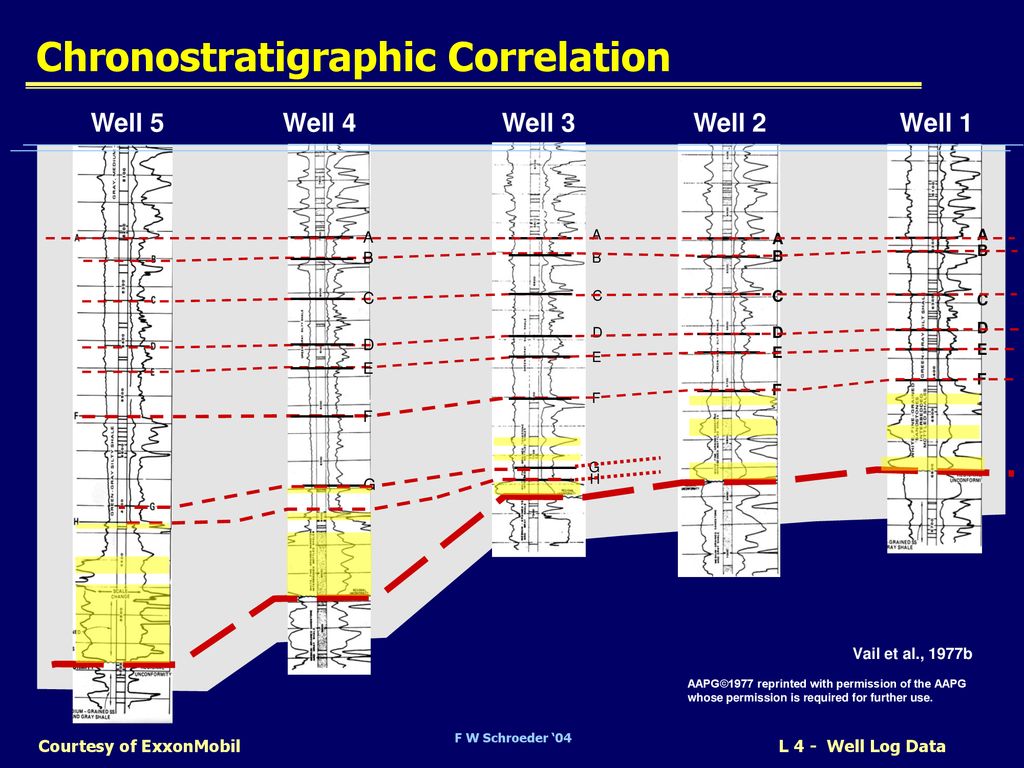

PDF) INTEGRATED CHRONOSTRATIGRAPHIC CORRELATION AND ITS DILEMMA: A CASE STUDY IN WEST NATUNA BASIN BLOCK " B " ARANG FORMATION | Hanaga Simabrata and Budi R Permana - Academia.edu