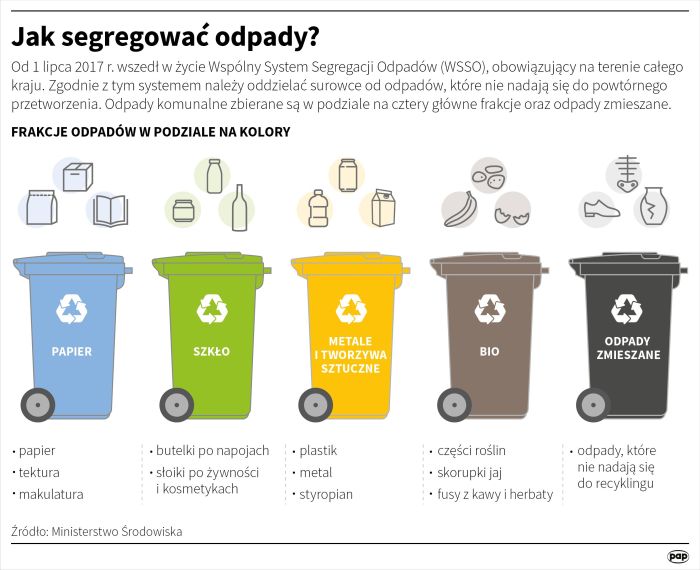

Obowiązek stosowania ujednoliconej kolorystyki pojemników i worków na selektywną zbiórkę wybranych frakcji odpadów - Rekopol

![Nowe zasady segregowania śmieci 2019 w Warszawie. Jak poprawnie segregować śmieci? [WYJAŚNIAMY] | Warszawa Nasze Miasto Nowe zasady segregowania śmieci 2019 w Warszawie. Jak poprawnie segregować śmieci? [WYJAŚNIAMY] | Warszawa Nasze Miasto](https://d-art.ppstatic.pl/kadry/k/r/32/76/5c62e5354e391_o_medium.jpg)

Nowe zasady segregowania śmieci 2019 w Warszawie. Jak poprawnie segregować śmieci? [WYJAŚNIAMY] | Warszawa Nasze Miasto

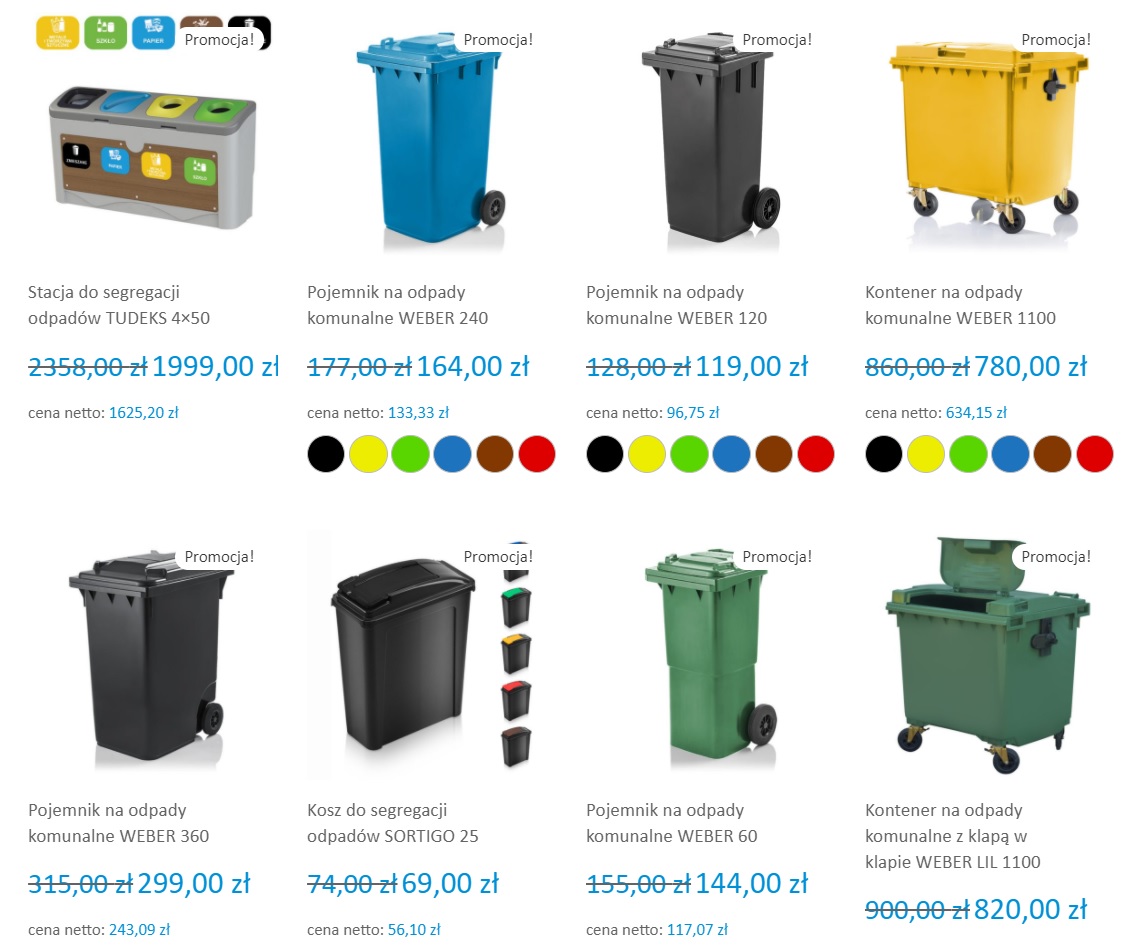

Komplet pojemników na odpady 120l pięć kolorów zielony, niebieski, żółty, brązowy, czarny - Tanio | ToHurt.pl