سحبة كالبيورن كوكو Ak3 من يوويل uwell caliburn koko Ak3 شيشة الرياض - فيب برو متجر متخصص في بيع منتجات الفيب من مزاج وجميع منتجات الفيب

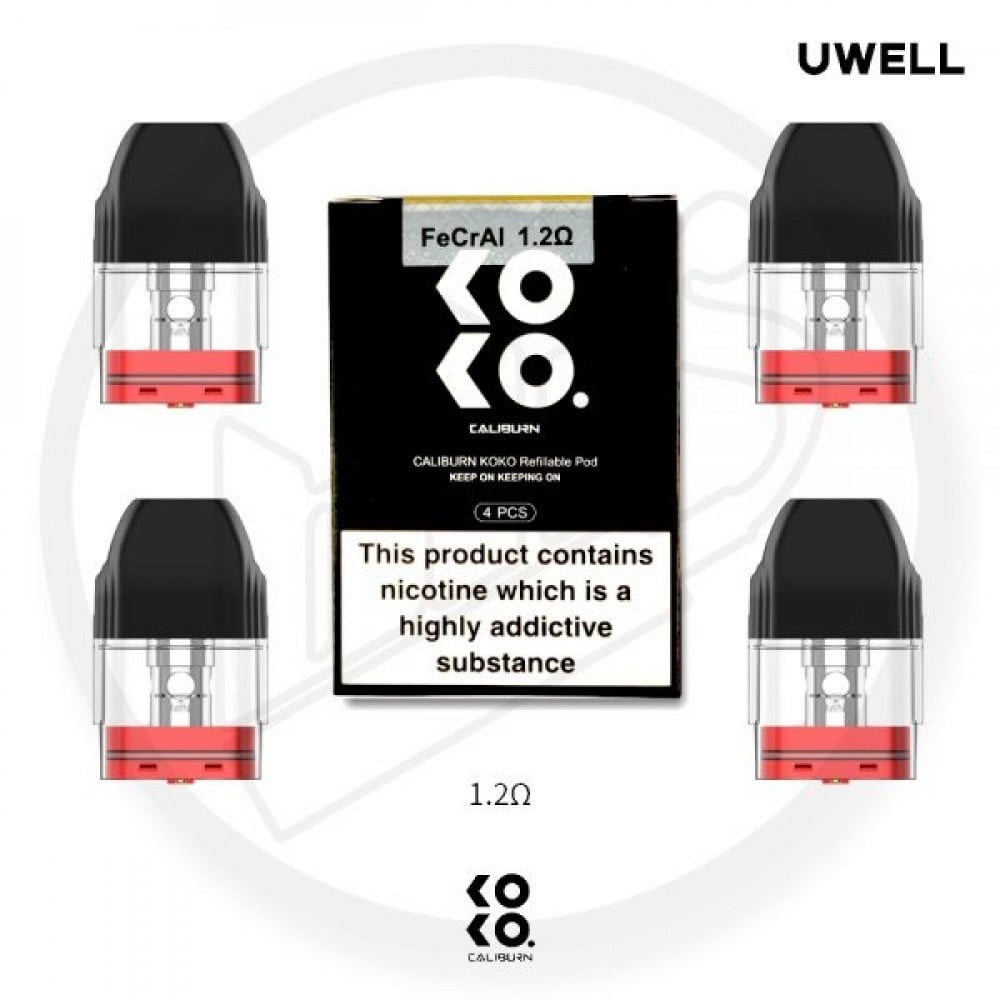

بودات يو وبل كوكو - Uwell Koko Pod - متجر زيرو فيب - شيشة الكترونية - نكهات فيب - فيب السعودية ZERO VAPE

Sweet Coco Cream Jam 24x340gm كوكو كريم حلو- مربى - طبلية منصة تسوق التجار البيع بالجملة عبر الانترنت