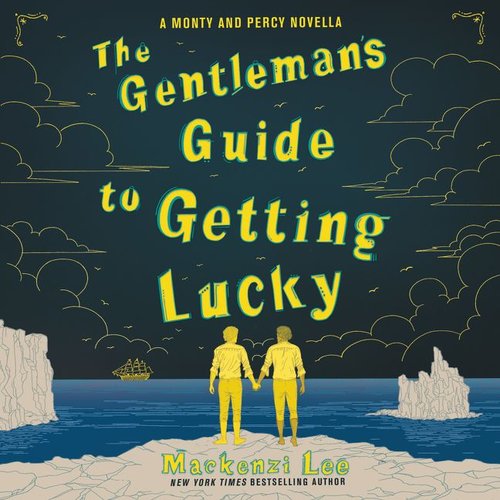

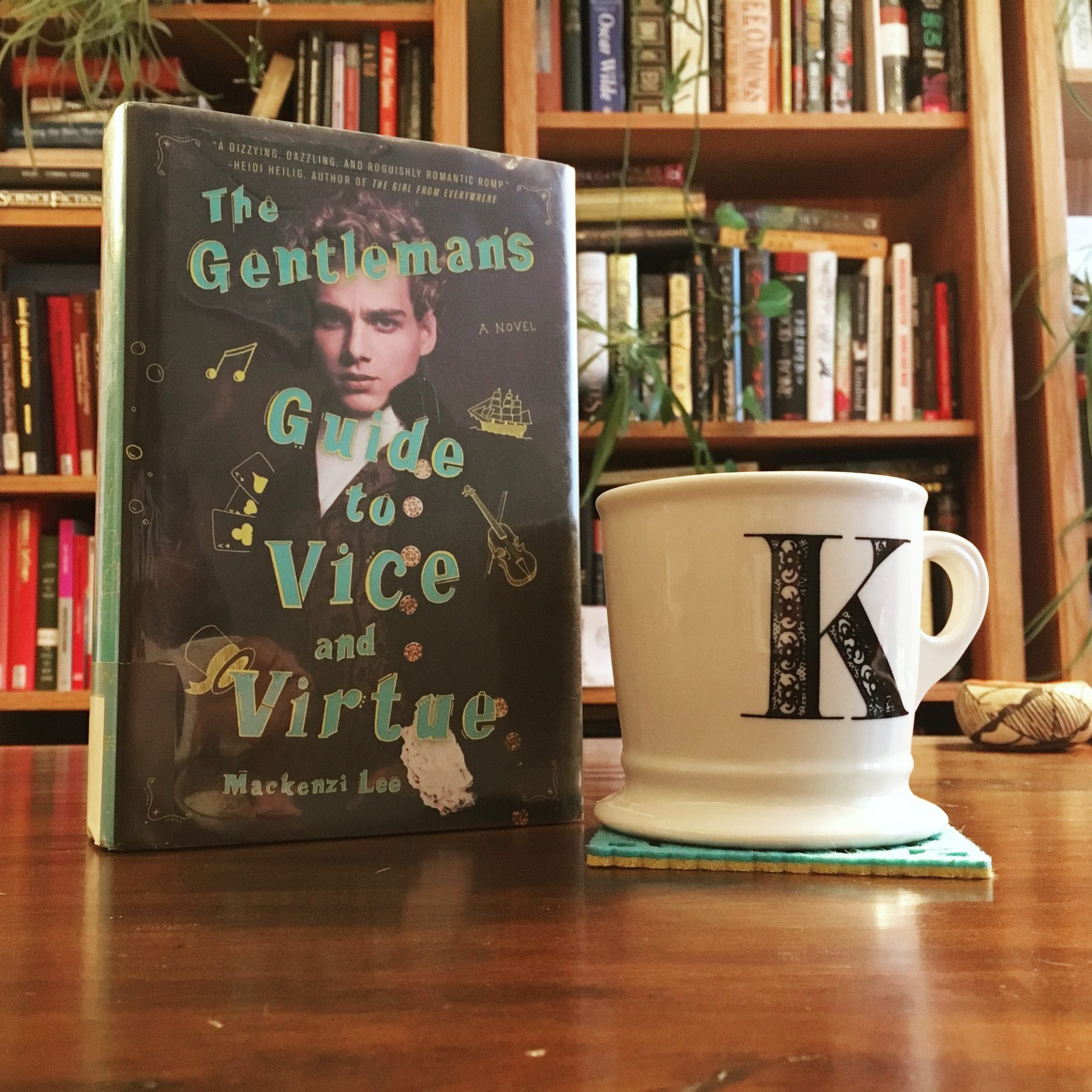

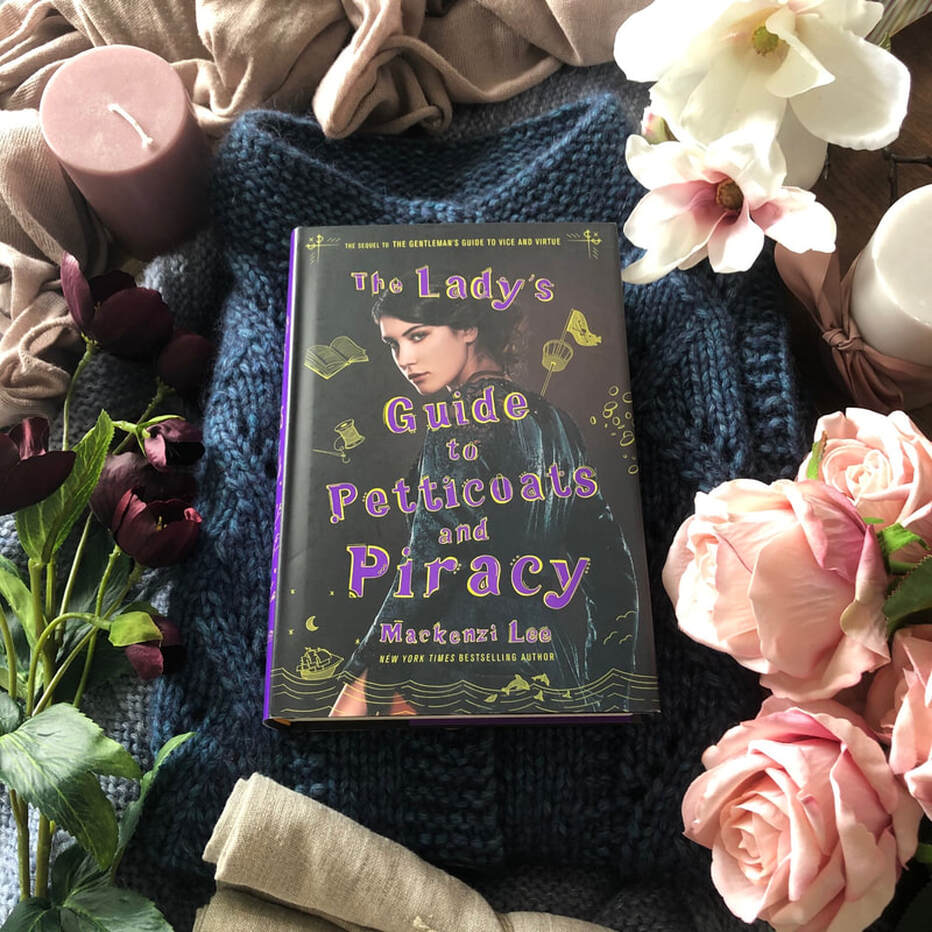

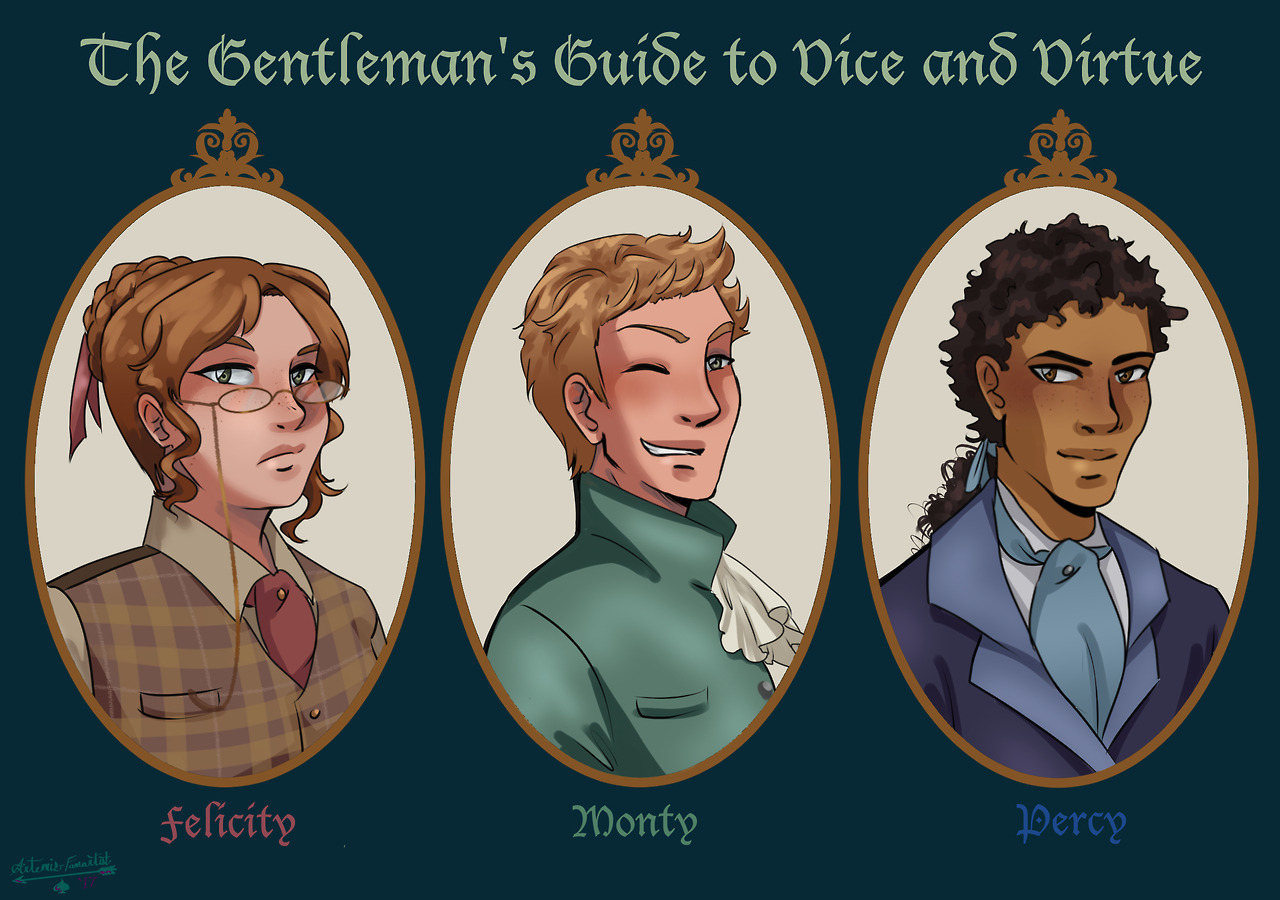

Much Anticipated Book Review: The Gentleman's Guide to Vice and Virtue by Mackenzi Lee – The Written Voice of Is

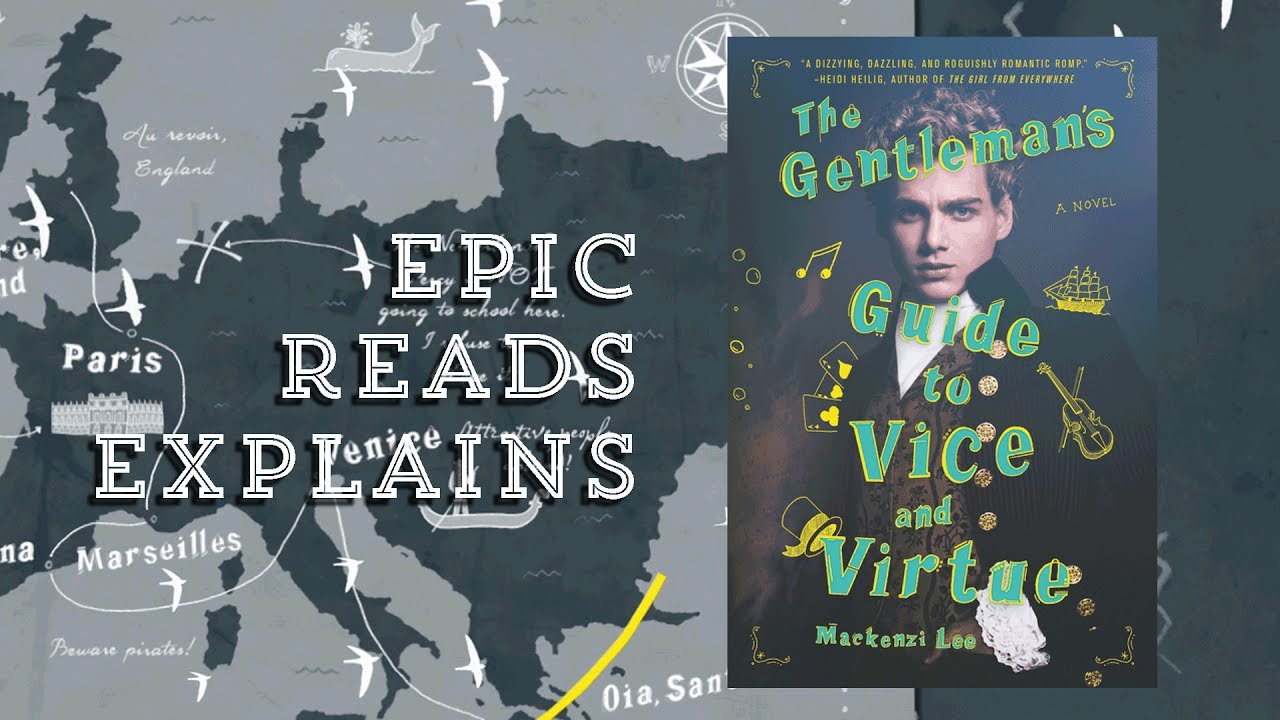

The Gentleman's Guide To Vice and Virtue by Mackenzi Lee | Epic Reads Explains | Book Trailer - YouTube

Arielle Jovellanos ✨ on Twitter: "📚✨ 2020 books #1: "The Gentleman's Guide to Vice and Virtue" by Mackenzi Lee https://t.co/wyOmYsETfm" / Twitter

The Gentleman's Guide to Vice and Virtue by Mackenzi Lee aesthetic | Gentleman's guide to vice and virtue, Gentlemans guide, Gentleman aesthetic

Amazon.com: The Gentleman's Guide to Vice and Virtue (Montague Siblings, 1): 9780062382801: Lee, Mackenzi: Books

The Gentleman's Guide to Vice and Virtue (Montague Siblings, 1): 9780062382801: Lee, Mackenzi: Books - Amazon.com

Amazon.com: The Gentleman's Guide to Vice and Virtue (Montague Siblings, 1): 9780062382801: Lee, Mackenzi: Books

:format(jpeg)/cdn.vox-cdn.com/uploads/chorus_image/image/55491973/TheGentleman_sGuidetoViceandVirtue_HC_C.0.jpeg)

/cdn.vox-cdn.com/uploads/chorus_image/image/55491975/TheGentleman_sGuidetoViceandVirtue_HC_C.0.jpeg)