Kurtka motocyklowa skórzana REV'IT! Apex czarno-fluo żółta black-fluo yellow | ODZIEŻ \ Odzież skórzana \ Kurtki | sklep-revit.pl

Diana. PW. Kożuchy, odzież skórzana, Skórzana odzież, galanteria - produkcja, hurt - Wyszukiwarka firm BiznesFinder.pl

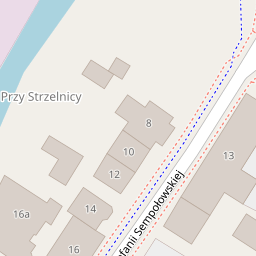

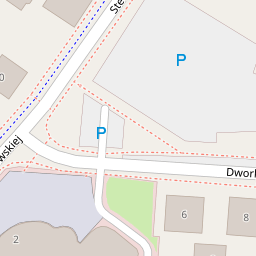

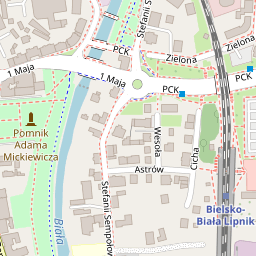

Bielsko-Biała - Odzież z drugiej ręki - Militaria - Zdarzenia, historia Bielsko - Biała stare zdjęcia, archiwalna fotografia, filmy Bielsko – stare filmy bielsko - wehikuł czasu - beskidia.pl

Bielsko-Biała: Straż Graniczna przechwyciła podrobioną odzież i galanterię skórzaną warte milion złotych | Dziennik Zachodni