Pompa ciepła PRIMA 10GT + Wymiennik c.w.u. TOWER GRAND 200 + Bufor 40 l + Zawór GALMET SG-000046 GALMET | Hurtownia instalacyjna on-line | HAP Armatura

Ogrzewacze elektryczne - wymienniki c.w.u. pionowe i poziome - zbiorniki akumulacji ciepła - zbiorniki warstwowe - Galmet

Ogrzewacze elektryczne - wymienniki c.w.u. pionowe i poziome - zbiorniki akumulacji ciepła - zbiorniki warstwowe - Galmet

Pakiet: Pompa ciepła PRIMA 10GT + zbiornik TOWER GRAND 200 l + bufor c.o. 40 l + zawór trójdrogowy Galmet SG-000046 1009276

AKWENA - Arcado 460 l - zbiornik ozdobny na deszczówkę, granitowy/piaskowy/czarny granit/Zbiorniki dekoracyjne na deszczówkę/3P TECHNIK

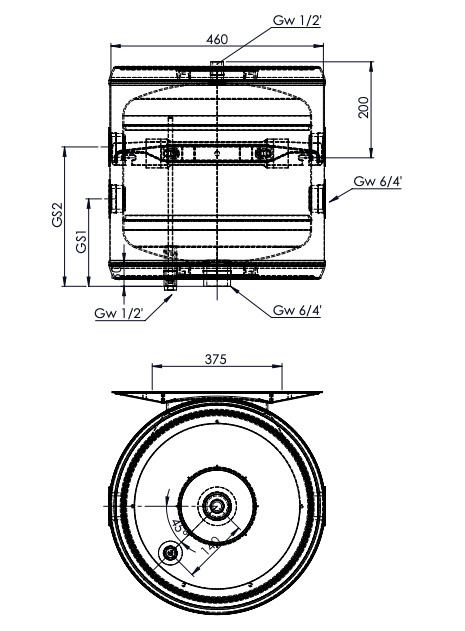

GALMET SG(B) ZBIORNIK BUFOROWY WOLNOSTOJĄCY NIEEMALIOWANY BEZ WĘŻOWNIC 4000 L NIEOCIEPLONY 85-400000 Auroks - Centrum Budowlane

AKWENA - Arcado 460 l - zbiornik ozdobny na deszczówkę, granitowy/piaskowy/czarny granit/Zbiorniki dekoracyjne na deszczówkę/3P TECHNIK