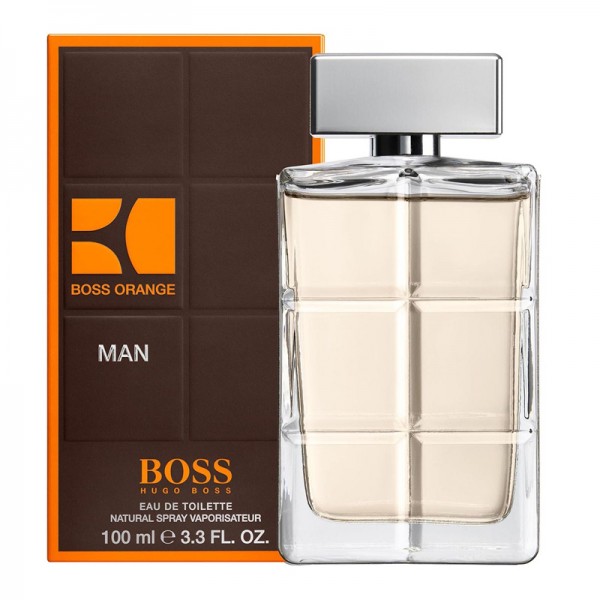

Hugo Boss Orange Man Review Eau de Toilette (AKA Hugo Boss Man) – Released 2011, The Bayview Informer

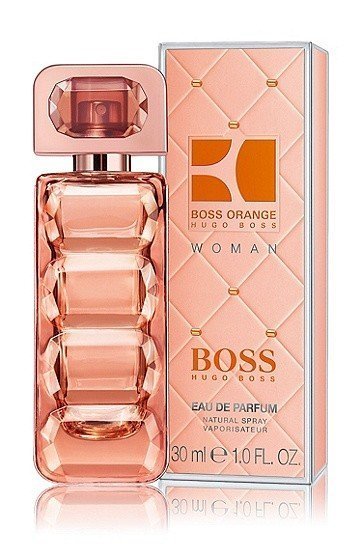

Hugo Boss - Boss Orange Man Eau De Toilette Spray 100ml/3.3oz (M) - Eau De Toilette | Free Worldwide Shipping | Strawberrynet USA

Hugo Boss Boss Orange / Hugo Boss EDT Spray 3.3 oz (m) 737052347974 - Fragrances, Hugo Boss Fragrances - Jomashop