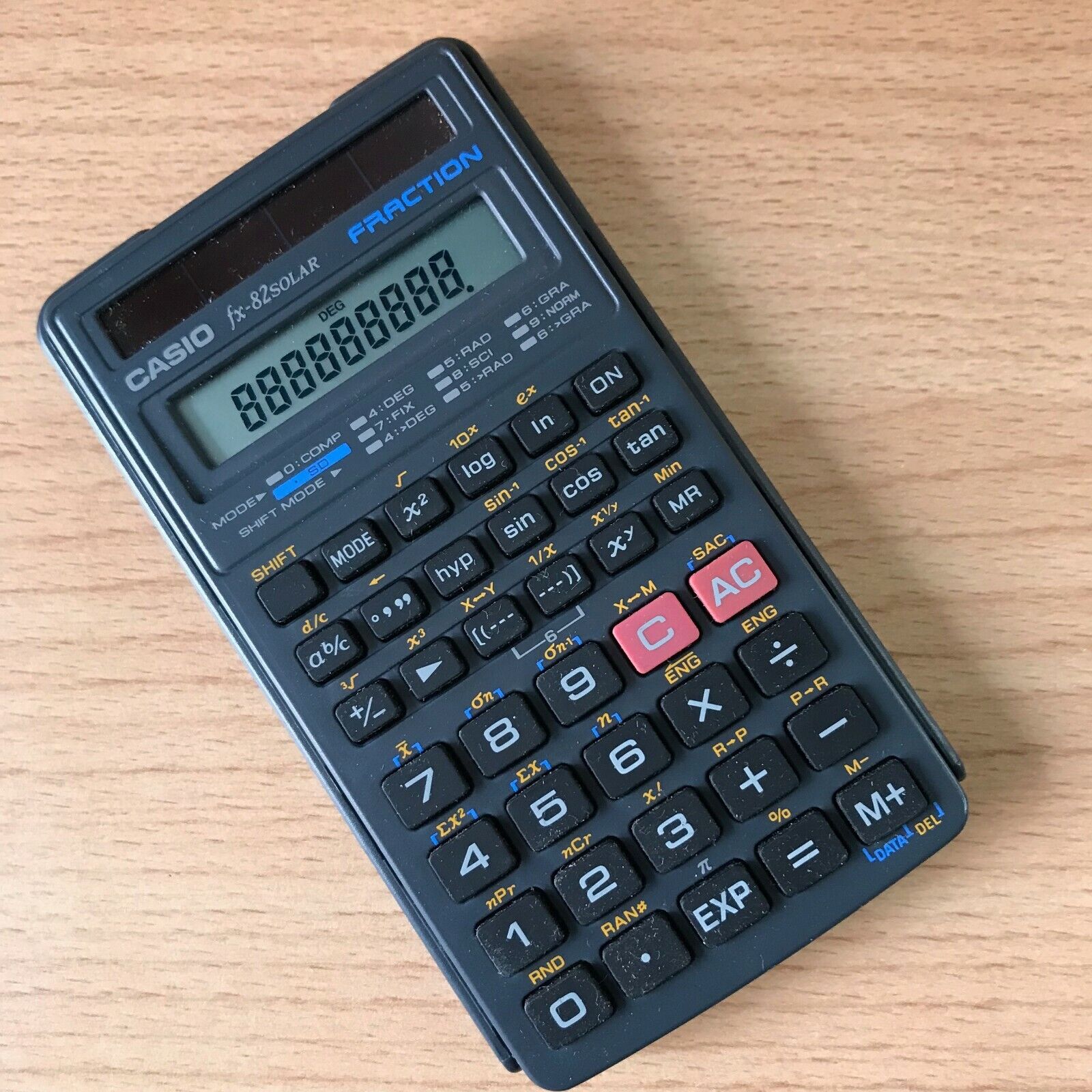

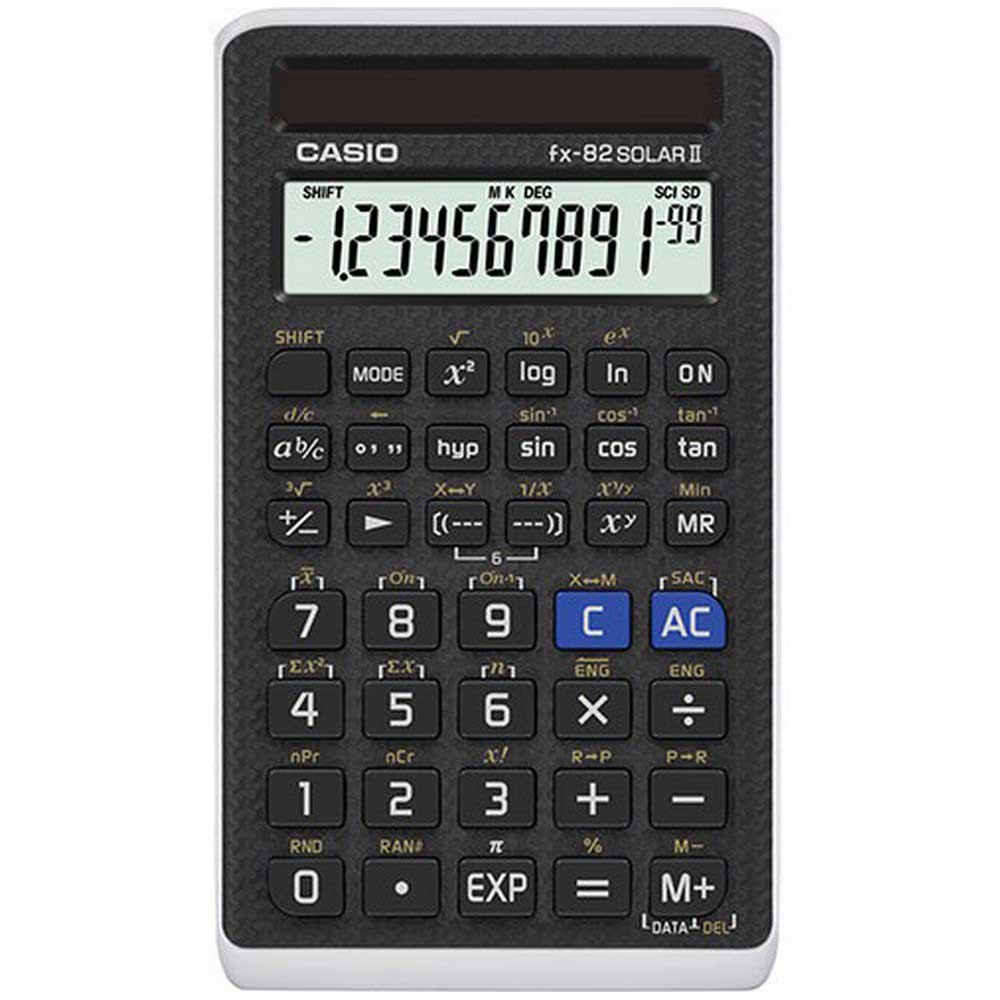

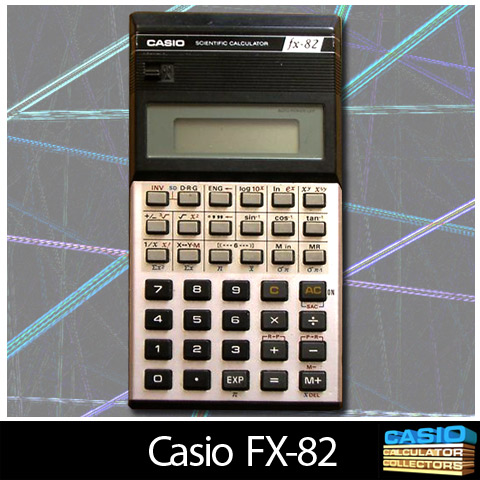

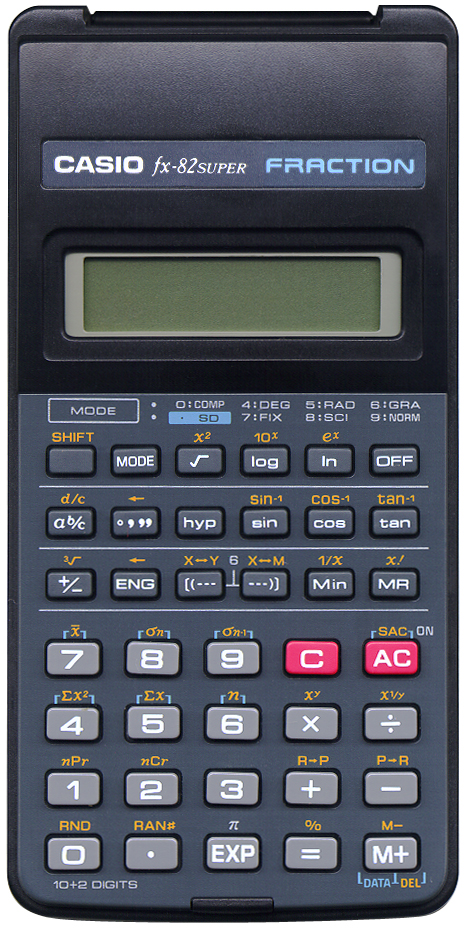

Casio - fx-82 Super Fraction - - Scientific calculator - Casio fx82 Super Fraction - Casio.ledudu.com - Casio pocket computer, calculator, game and watch library. - RETRO CALCULATOR FX PB SF LC SL HP FA

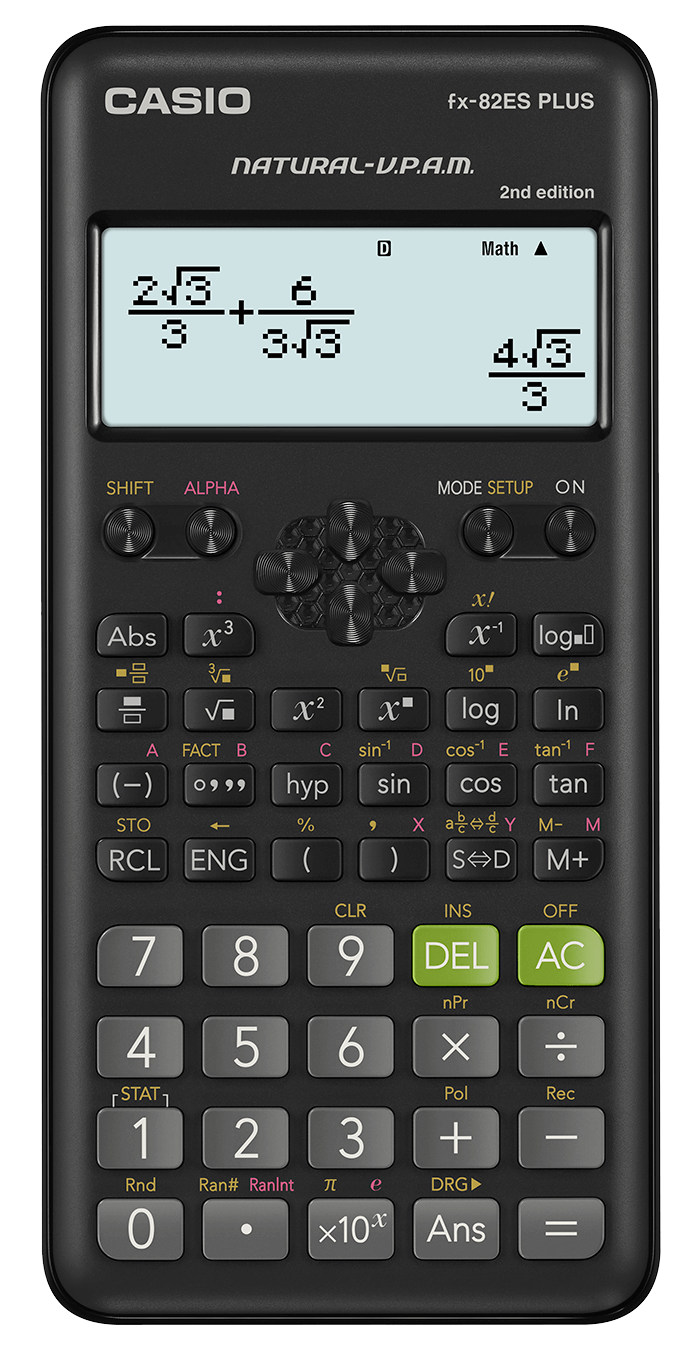

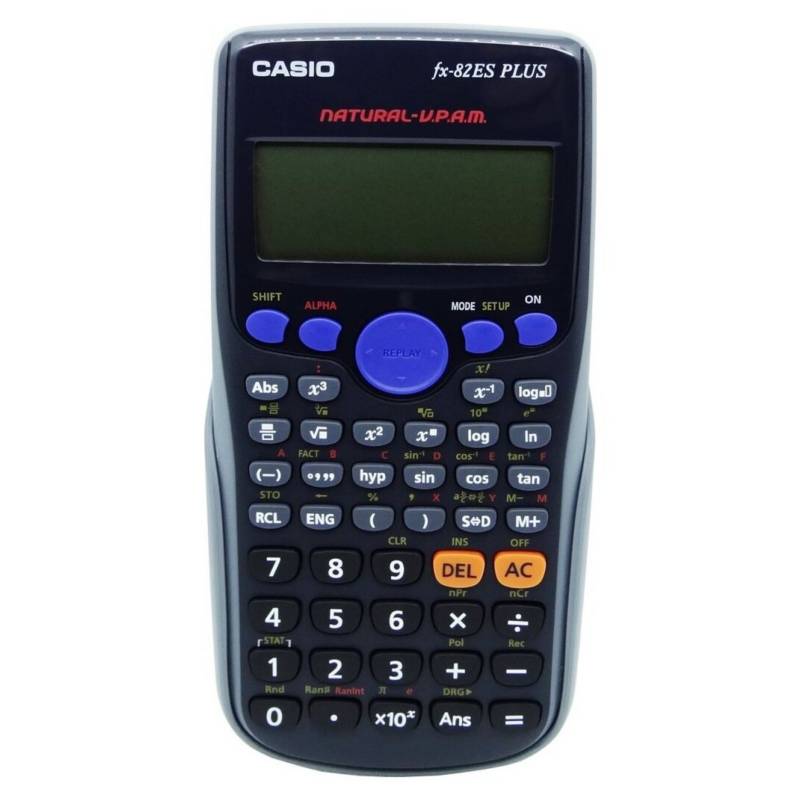

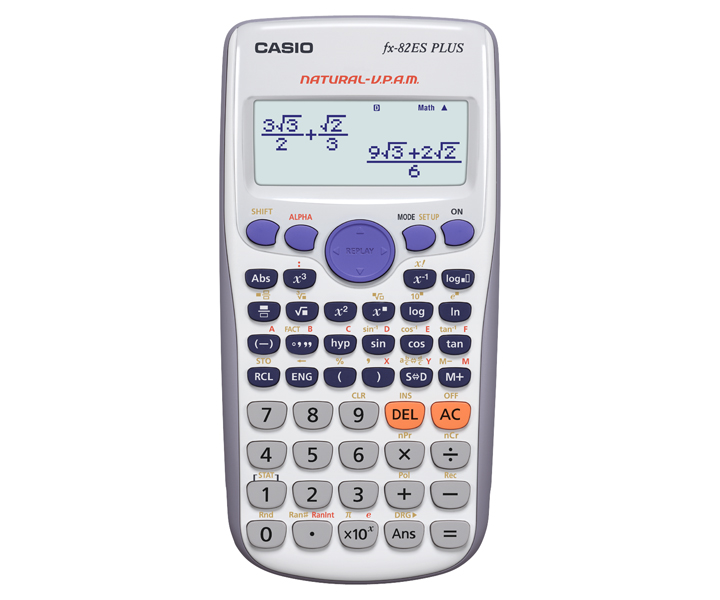

Amazon.com: Casio Fx-82es Fx82es Plus Bk Display Scientific Calculations Calculator with 252 Functions : Office Products