Nye Mat Laptop Taske til Macbook Air 13 12 Pro 13 Tilfælde Ærme Kvinder Mænd Vandtæt Taske til Mac book Touchbar 13 15 Case Cover rabat | Bærbar Computer Tilbehør \ Groendalspark.dk

Pu Læder Laptop Dokumentmapper 14 15 15.6 Taske Til Macbook Air 13 Taske Pro 13.3 15.4 Tilfælde Laptop Taske Kvinder Skulder Kontor Tasker Tilbud < Bærbar computer tilbehør ~ www.slaegtsbog.dk

Kvinders Taske Computer 14 Tommer Taske Til Macbook Air Læder Laptop Taske Arbejde Kontor Damer Crossbody Tasker Til Dell, Acer, Hp køb online - Bærbar Computer Tilbehør > www.bujinkan-vejle.dk

Knomo Saxby Messenger / Computer Taske op til 15"- Sort Gloss ** GØR ET KUP ** - 13" - Tasker & Etuier - Mac

På tilbud! Baseus laptop taske case til macbook air pro 13 14 15 15.6 16 tommer sleeve taske til bærbare mac ipad pro tablet cover coque funda < Bærbar Computer Tilbehør \ Trekloeveret.dk

Laptop taske til macbook air pro retina 12 13 14 15 15.6 tommer laptop sleeve tilfælde pc case cover til xiaomi hp dell tablet taske sag - Bærbar Computer Tilbehør \ www.jl-energy.dk

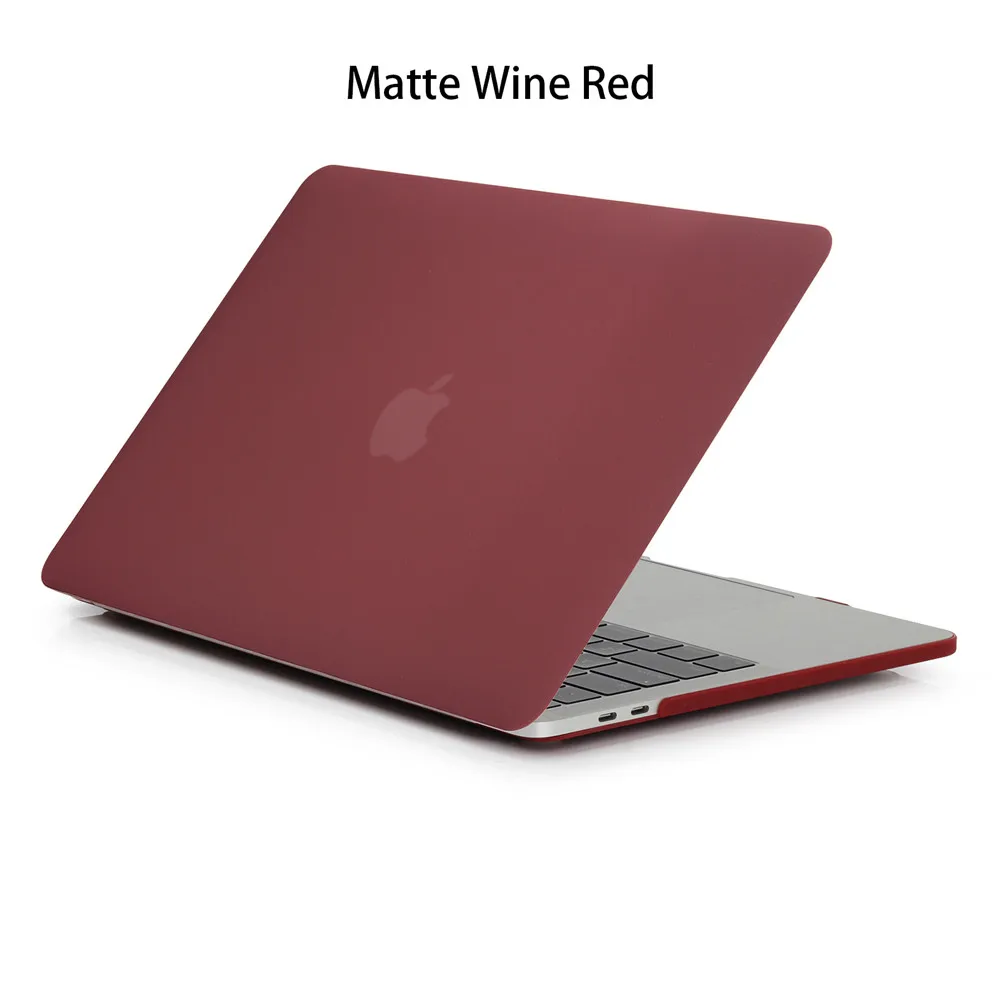

Rabat Crystal Mat Sager For Apple Macbook Air Pro Retina 11 12 13 15 Laptop Tasker Til Macbook Pro 13 A2289 A2251 2019 Pro Cover - Bærbar Computer Tilbehør \ www.superkryds.dk

Speck Alu SeeThru cover til laptop | Macbook pro case, Macbook pro accessories, Apple laptop macbook

Rabat Crystal Mat Sager For Apple Macbook Air Pro Retina 11 12 13 15 Laptop Tasker Til Macbook Pro 13 A2289 A2251 2019 Pro Cover - Bærbar Computer Tilbehør \ www.superkryds.dk

2020 Nye 13 tommer Luksus Laptop Sleeve Taske Til Macbook Air 13.3 A2179 newpro 2019 13,3-tommer tasker Tilfældet For Air 13,3 tommer Retina / Bærbar Computer Tilbehør ~ www.okocater.dk

2020 Nye 13 tommer Luksus Laptop Sleeve Taske Til Macbook Air 13.3 A2179 newpro 2019 13,3-tommer tasker Tilfældet For Air 13,3 tommer Retina / Bærbar Computer Tilbehør ~ www.okocater.dk