B.B.B. Filati - Amigurumi - Gomitolo filato puro cotone morbidissimo adatto per creare bambole e pupazzi lavabile in lavatrice per Ferri/Uncinetto: 3 - 4 Beige 2140 2pz 100 gr : Amazon.it: Casa e cucina

B.B.B. Filati - Amigurumi - Gomitolo filato puro cotone morbidissimo adatto per creare bambole e pupazzi lavabile in lavatrice per Ferri/Uncinetto: 3 - 4 Rosa Baby 101 6pz 300 gr : Amazon.it: Casa e cucina

Varanasi Katia Filati Misto Lana 150 Gr » Shop Online Merceria | Il Mio Lavoro A Vallo Della Lucania

B.B.B. Filati - Amigurumi - Gomitolo filato puro cotone morbidissimo adatto per creare bambole e pupazzi lavabile in lavatrice per Ferri/Uncinetto: 3 - 4 Ciclamino 3224 6pz 300 gr : Amazon.it: Casa e cucina

B.B.B Filati - Picasso - Filato 100% Acrilico Sfumato Ideale per Capi di Maglieria e Scialli Colorati per Ferri: 3.50/4.00 o Uncinetto: 4.50 5pz 500 gr Misto Blu Lilla 912 : Amazon.it: Casa e cucina

B.B.B Filati - Picasso - Filato 100% Acrilico Sfumato Ideale per Capi di Maglieria e Scialli Colorati per Ferri: 3.50/4.00 o Uncinetto: 4.50 5pz 500 gr Misto Blu Lilla 912 : Amazon.it: Casa e cucina

FILATI ON LINE - VENDITA FILATI ITALIANI PREGIATI DI STOCK | FILATI ITALIANI - Filati a prezzi stock, solo rimanenze di produzione di aziende dell'alta moda italiana. Vendita filati (yarns, wool) per

B.B.B. Filati - Amigurumi - Gomitolo filato puro cotone morbidissimo adatto per creare bambole e pupazzi lavabile in lavatrice per Ferri/Uncinetto: 3 - 4 Blu Notte 69 2pz 100 gr : Amazon.it: Casa e cucina

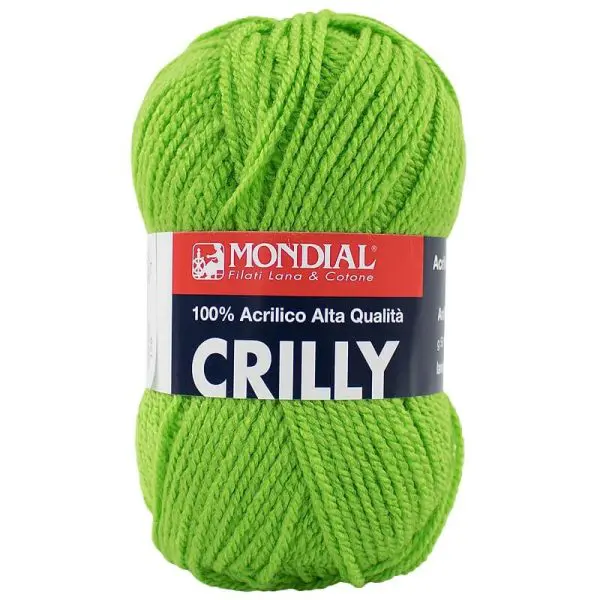

Lana Crilly Lane Mondial 100% Acrilico 50 Gr » Shop Online Merceria | Il Mio Lavoro A Vallo Della Lucania

-502x502.jpg)

-502x502.jpg)