Mensole laccate su misura in legno MDF | Mensole laccate colorate | Verniciatura colori RAL | Mensole On Line

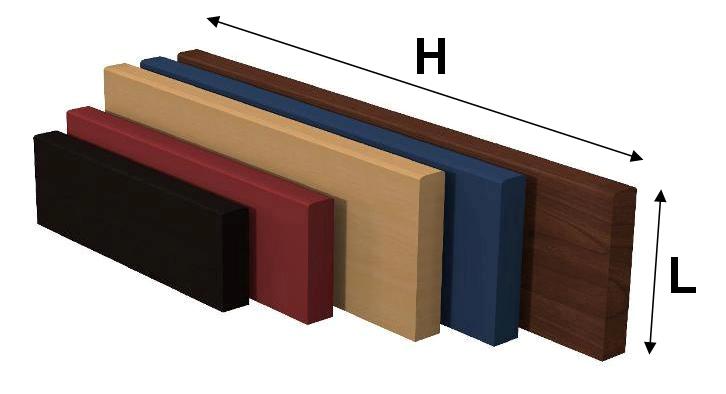

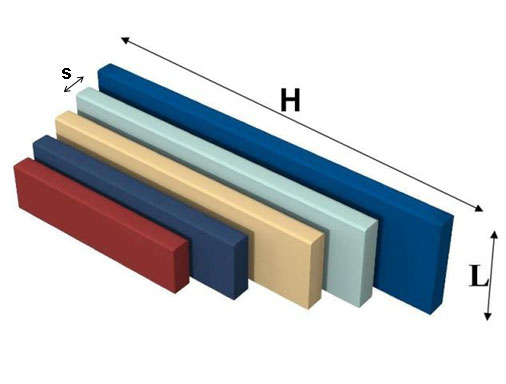

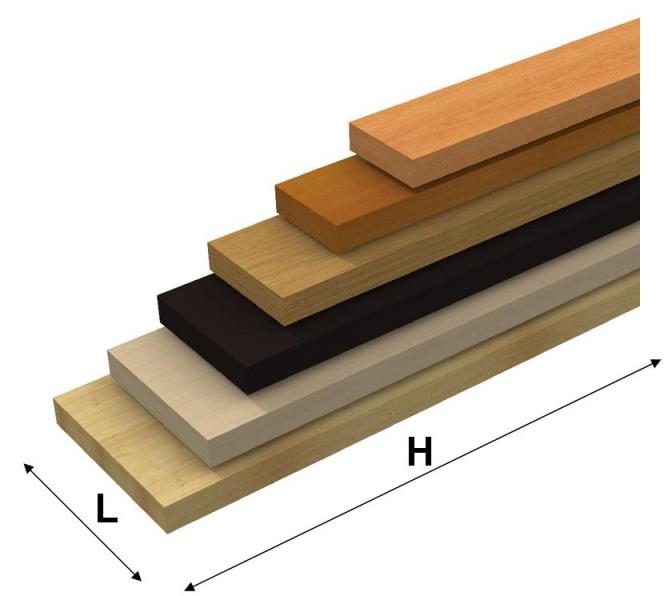

Mensole su misura in legno | Mensole laccate | Mensole a muro | Verniciatura, laccatura, colori RAL | Mensole On Line

Henor Mensola in legno 50 x 20 x 2.5 cm. Carico massimo. 25 kg. Ferramenta completamente nascosta Bianco : Amazon.it: Casa e cucina

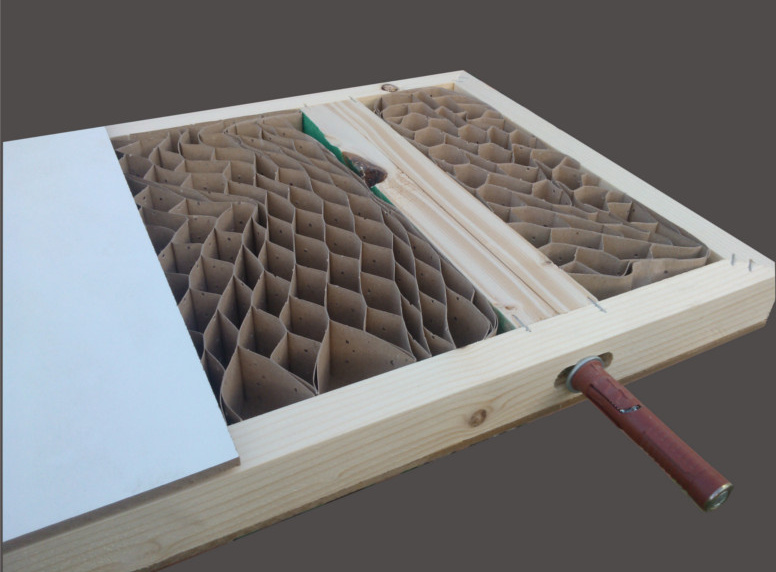

ITALFROM Conf. 3 Pz Mensole Tamburate 38X600X235mm Vari Colori (Alluminio) : Amazon.it: Casa e cucina

3.jpg)

1.jpg)