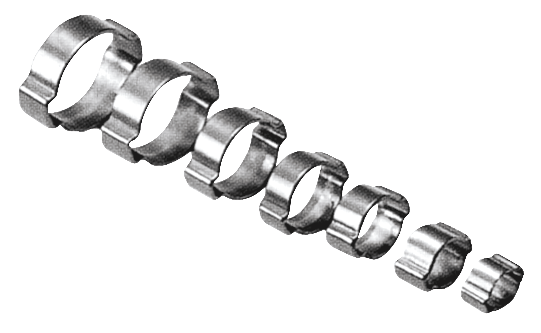

Collier de Serrage Inox AMTOVL 130pcs Serre-Joints à Tuyau 7-21mm Collier de Serrage Tuyau en Acier Inoxydable Certification TUV pour Fixation Souples Durites : Amazon.fr: Bricolage

Collier de serrage 2 oreilles pour tuyaux à air comprimé et tous les types de fluides acier W1 et inox W4 - Easyflex - Easyflex