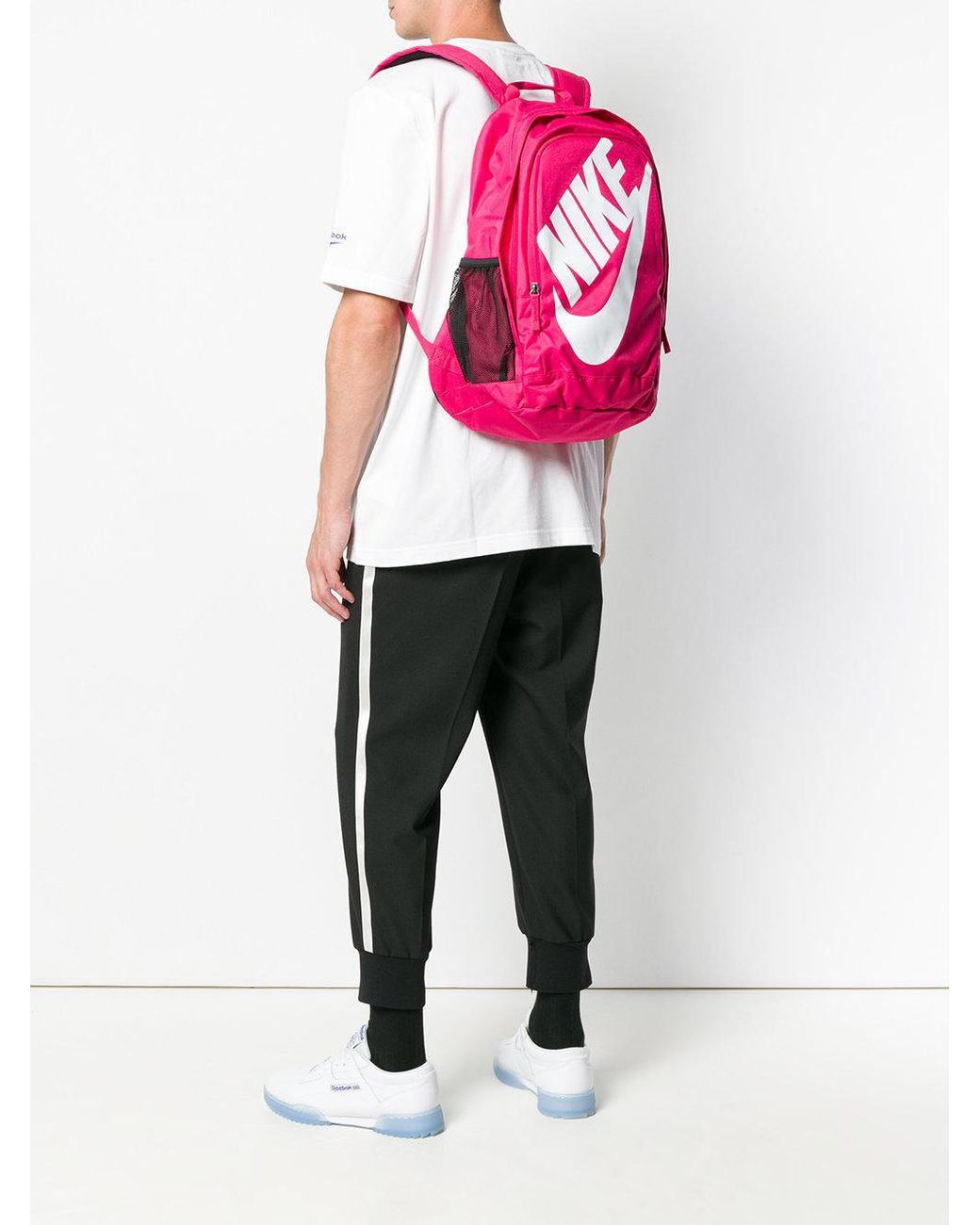

Nike Unisex's NK Hayward Futura BKPK-Solid Backpack, Atmosphere Grey/Barely Rose, One Size: Buy Online at Best Price in UAE - Amazon.ae

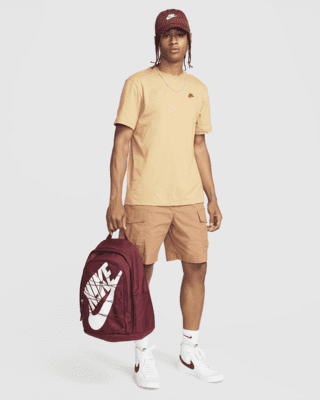

Nike Hayward Futura M 2.0 Backpack - Rose Gold / Dusty Peach / Red Bronze | Backpacks, Nike backpack, Bags

Nike Unisex's NK Hayward Futura BKPK-Solid Backpack, Atmosphere Grey/Barely Rose, One Size: Buy Online at Best Price in UAE - Amazon.ae

)