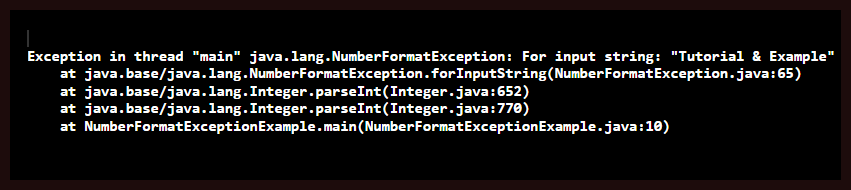

Exception in thread “main“ java.lang.NumberFormatException: For input string: “7124442171“_qq_40176964的博客-CSDN博客

Exception in thread "main" java.lang.NumberFormatException: For input string: "" in Java - Stack Overflow

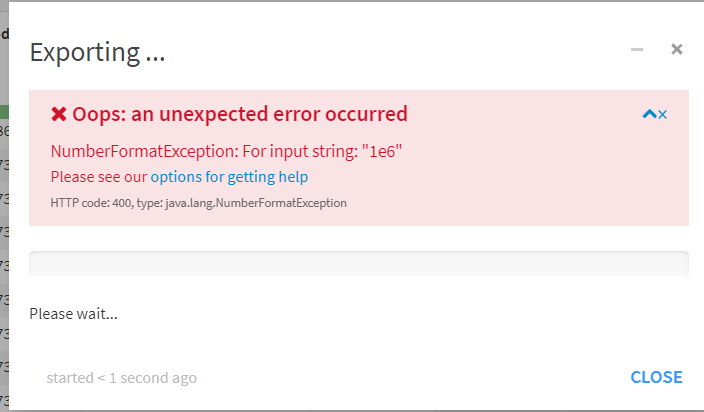

Exception in thread "main" java.lang.NumberFormatException: For input string: "" · Issue #67 · jenkinsci/allure-plugin · GitHub

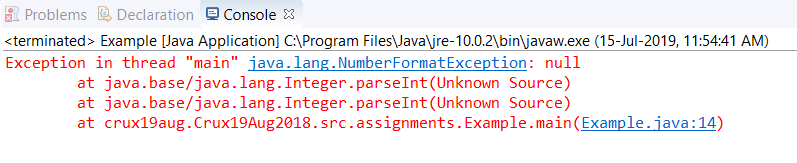

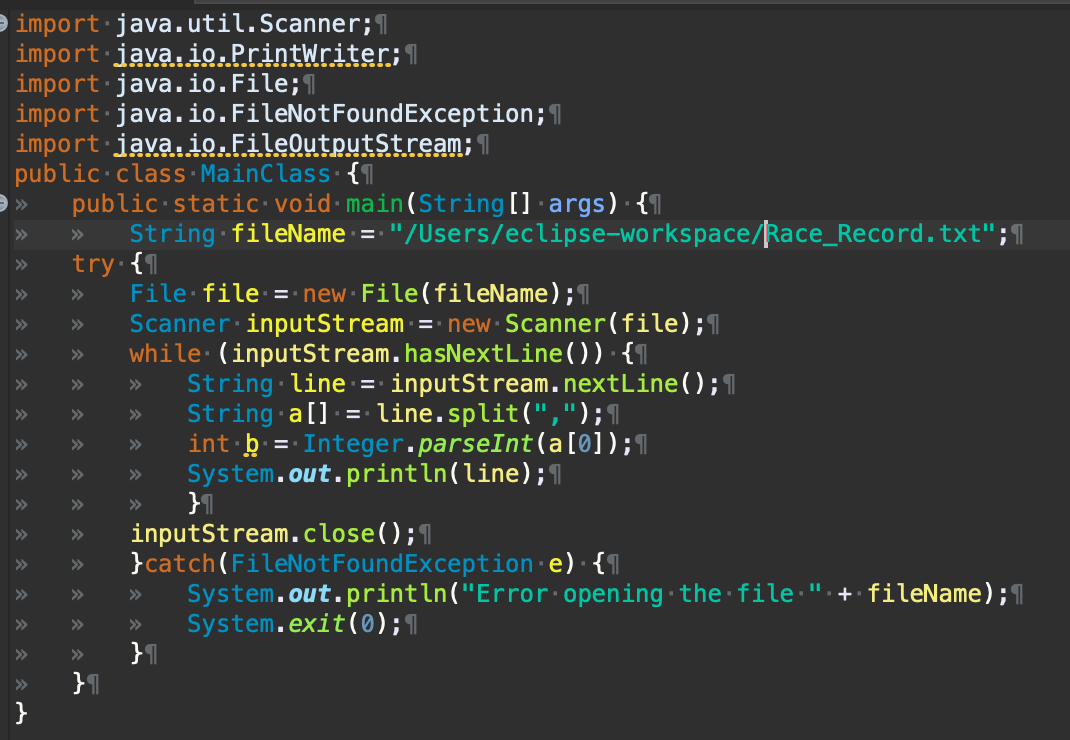

![JAVA - NetBeans 8.2] Exception in thread "AWT-EventQueue-0" java.lang. NumberFormatException: For input string: "" : r/learnprogramming JAVA - NetBeans 8.2] Exception in thread "AWT-EventQueue-0" java.lang. NumberFormatException: For input string: "" : r/learnprogramming](https://i.imgur.com/ammxR56.jpg)

JAVA - NetBeans 8.2] Exception in thread "AWT-EventQueue-0" java.lang. NumberFormatException: For input string: "" : r/learnprogramming

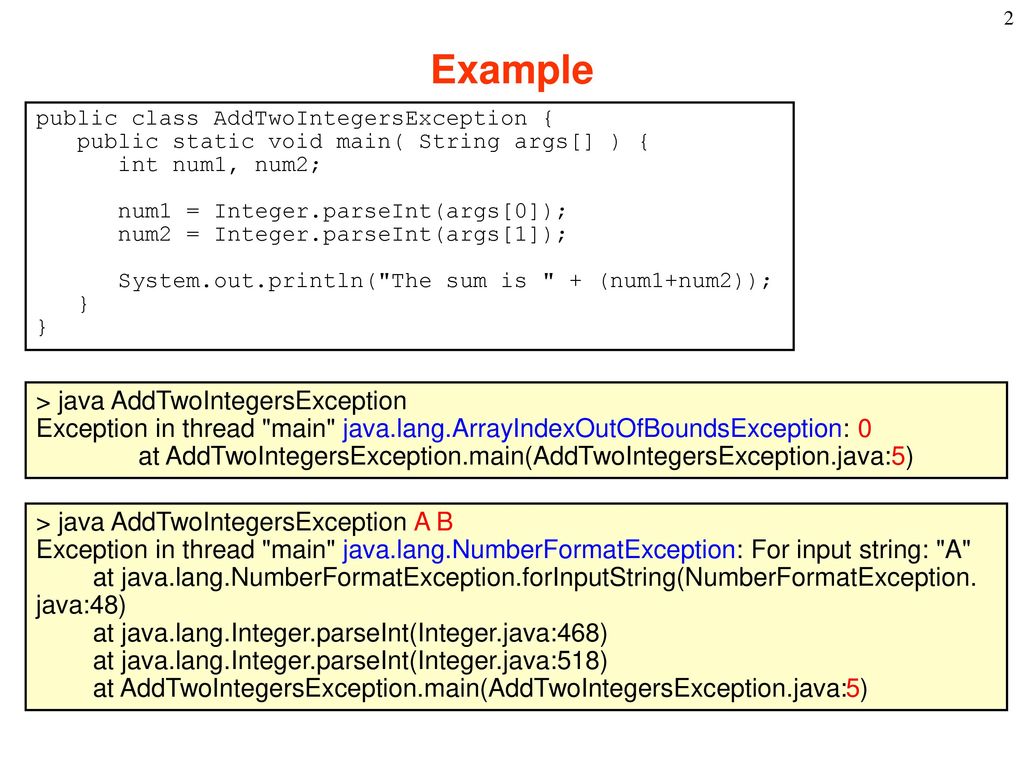

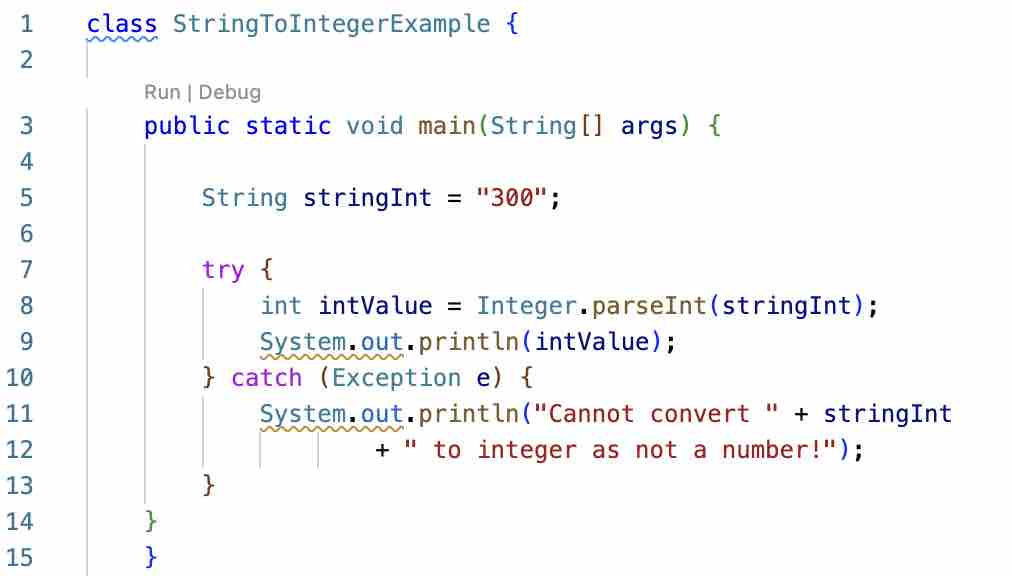

![JAVA-2j] Building a Simple Calculator: Using Try-Catch to Gracefully Handle User Mistakes | by Jack Boyuan Xu | Medium JAVA-2j] Building a Simple Calculator: Using Try-Catch to Gracefully Handle User Mistakes | by Jack Boyuan Xu | Medium](https://miro.medium.com/max/1400/1*6l-b8PQWGdp1fj-zuXJVXQ.png)

JAVA-2j] Building a Simple Calculator: Using Try-Catch to Gracefully Handle User Mistakes | by Jack Boyuan Xu | Medium

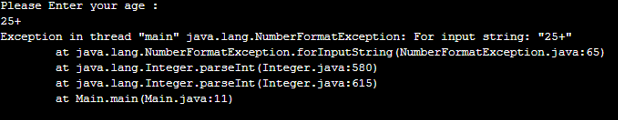

automated testing - Error: Exception in thread "main" java.lang. NumberFormatException: For input string: "" - Software Quality Assurance & Testing Stack Exchange