Lenovo Yoga Tab 13 128 GB 33 cm (13") Qualcomm Snapdragon 8 GB Wi-Fi 6 (802.11ax) Android 11 Must ZA8E0005SE osta veebipoest Frog.ee

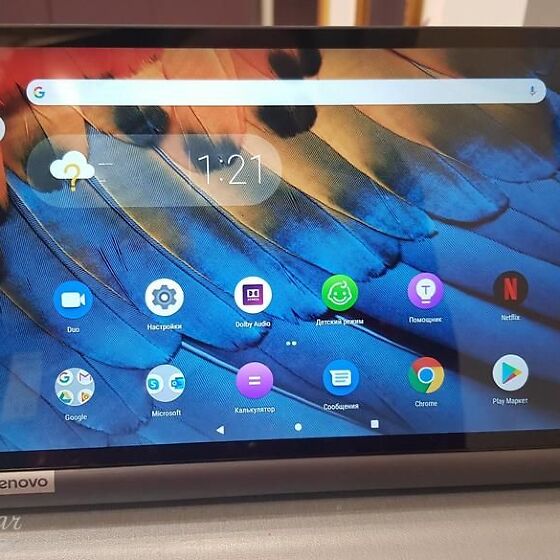

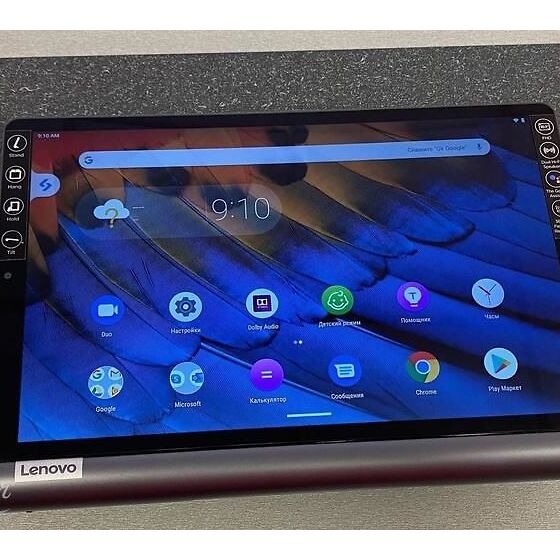

Arvutitark.ee - Tootekataloog » Lenovo Yoga Smart IdeaTab X705F 10.1 ", Iron hall, IPS, 1920 x 1200, Qualcomm

Tahvelarvuti Lenovo IdeaTab Yoga K606F 13 13" Wi-Fi 8GB/128GB Black, ZA8E0005SE, madal hind - BIGBOX.EE

10,1" Tahvelarvuti Lenovo YOGA Tablet 2, windows BT garantii - Tallinn - Tahvelarvutid, iPad ja e-lugerid, iPad, tahvelarvutid osta ja müü – okidoki

Lenovo YOGA TAB3 10 ZA0J0023PL 5.1 MSM8909/2G/16/LTE/10.1" Black | Hinnavaatlus - Tehnikakaupade hinnavõrdlus- ja IT- teemaline portaal - leia soodsaim hind!