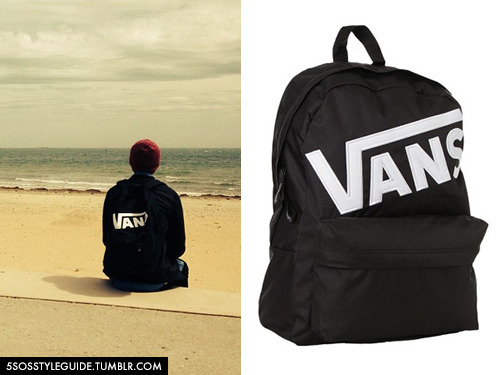

Weskus Mall - Stay fully kitted in the freshest Vans Apparel, Accessories and Footwear 🔥 Available in-store at @streetfeverofficial. buff.ly/3hFphPF #vans #authentic #oldskool #style36 #dropv #classicholder #tee #bag # backpack #essential #sneakers ...

me #myself #tumblr #friend #black #vans #backpack #hands | Estilo pessoal, Modelos, Acessórios escolares

Not All Heroes Use Stairs (Backpack) Comic Book Speech Bubbles Pattern – Sammi Haney's DisabilityShirts.com