I couldn't think of anywhere else to post this. My moped was stolen this morning between 4AM and 6 AM. Ladson, SC, tag A-20821. It's my only means of transportation currently and

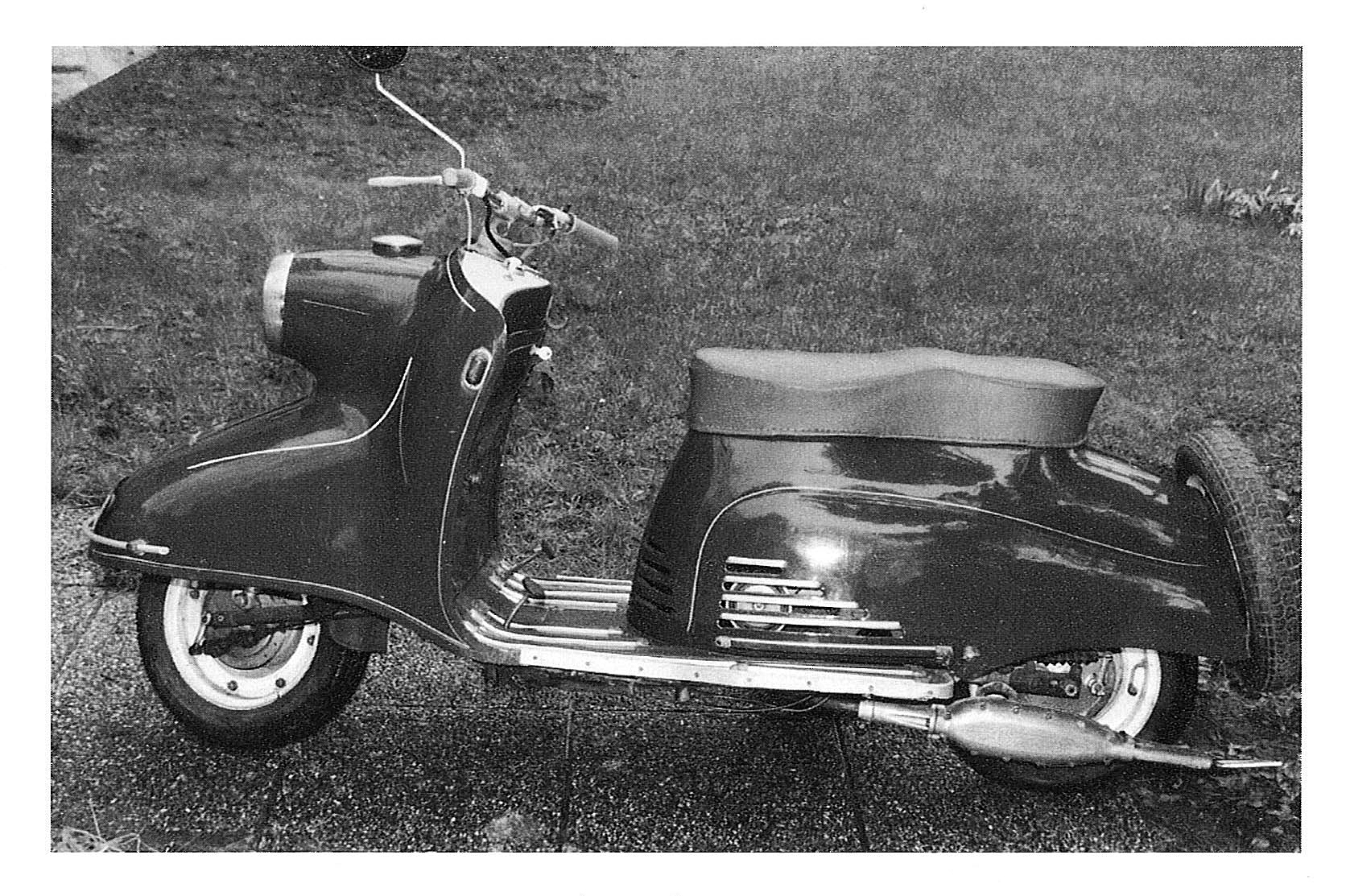

No Reserve: 1964 Sears Allstate Compact DS for sale on BaT Auctions - sold for $2,000 on April 24, 2019 (Lot #18,220) | Bring a Trailer