Pomoc drogowa Skierniewice autolaweta, holowanie, lawety, holownik, holowanie pojazdu w Skierniewicach

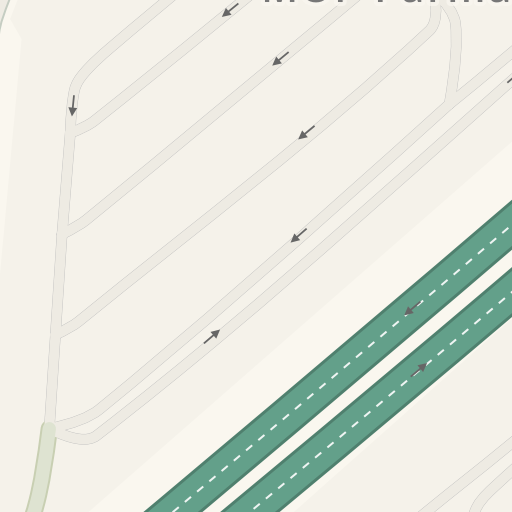

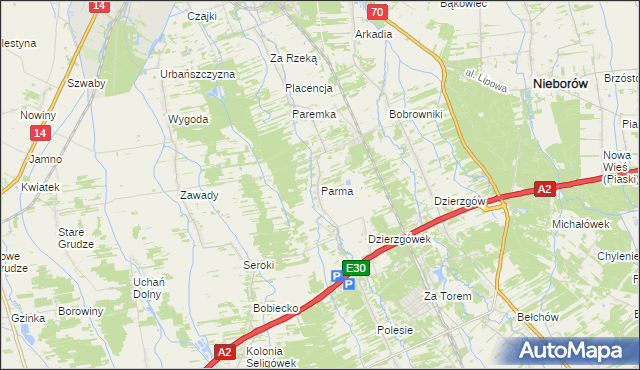

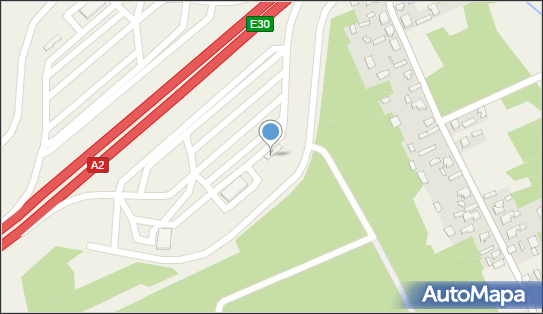

Plaga much na autostradzie A2 w województwie łódzkim. Nocne utrudnienia na MOP Parma i MOP Polesie na odcinku między Łodzią a Warszawą 31.07 | Dziennik Łódzki