Emerging WS2/montmorillonite composite nanosheets as an efficient hydrophilic photocatalyst for aqueous phase reactions | Scientific Reports

First‐Principles Design of Na‐ion Superionic Conductors: Interstitial‐Based Na Diffusion in NaCuZrS3 - Wang - 2022 - Chemistry – A European Journal - Wiley Online Library

Synthesis and characterization of montmorillonite/ciprofloxacin/TiO2 porous structure for controlled drug release of ciprofloxacin tablet with oral administration - ScienceDirect

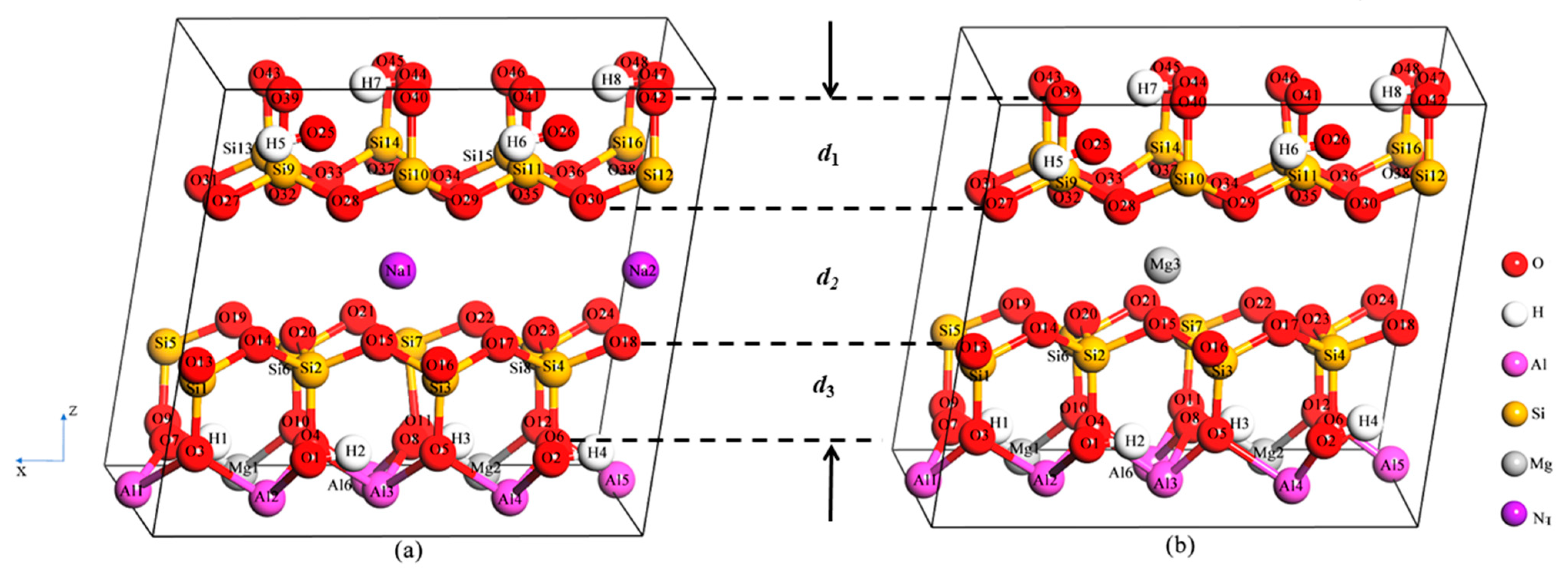

Minerals | Free Full-Text | Investigation on Atomic Structure and Mechanical Property of Na- and Mg-Montmorillonite under High Pressure by First-Principles Calculations

Structure of Clays and Polymer–Clay Composites Studied by X-ray Absorption Spectroscopies | IntechOpen

Photocatalytic reduction of carbon dioxide with water vapors over montmorillonite modified TiO2 nanocomposites - ScienceDirect

Structural and Electronic Properties of Iron-Doped Sodium Montmorillonite Clays: A First-Principles DFT Study | ACS Omega

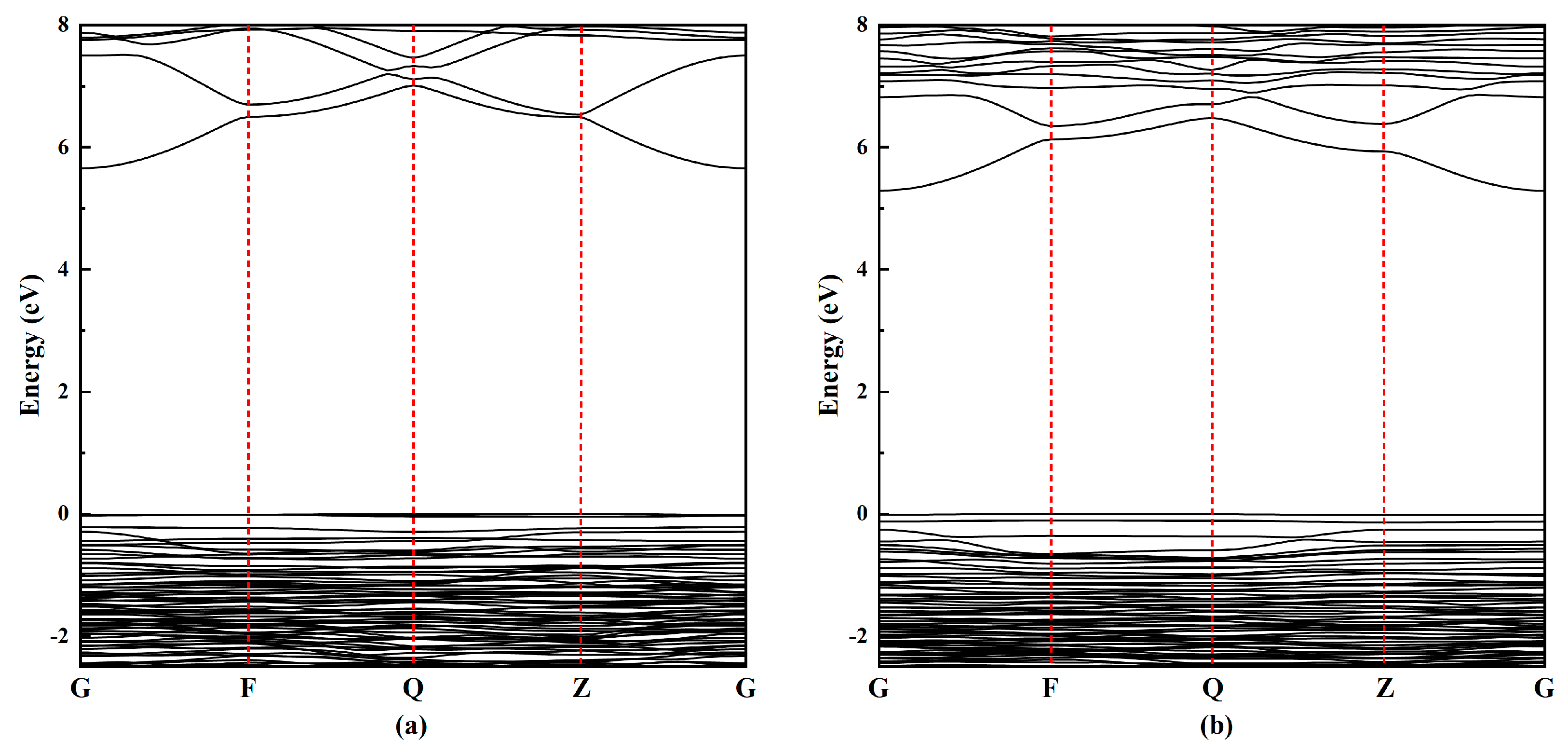

Minerals | Free Full-Text | Investigation on Atomic Structure and Mechanical Property of Na- and Mg-Montmorillonite under High Pressure by First-Principles Calculations

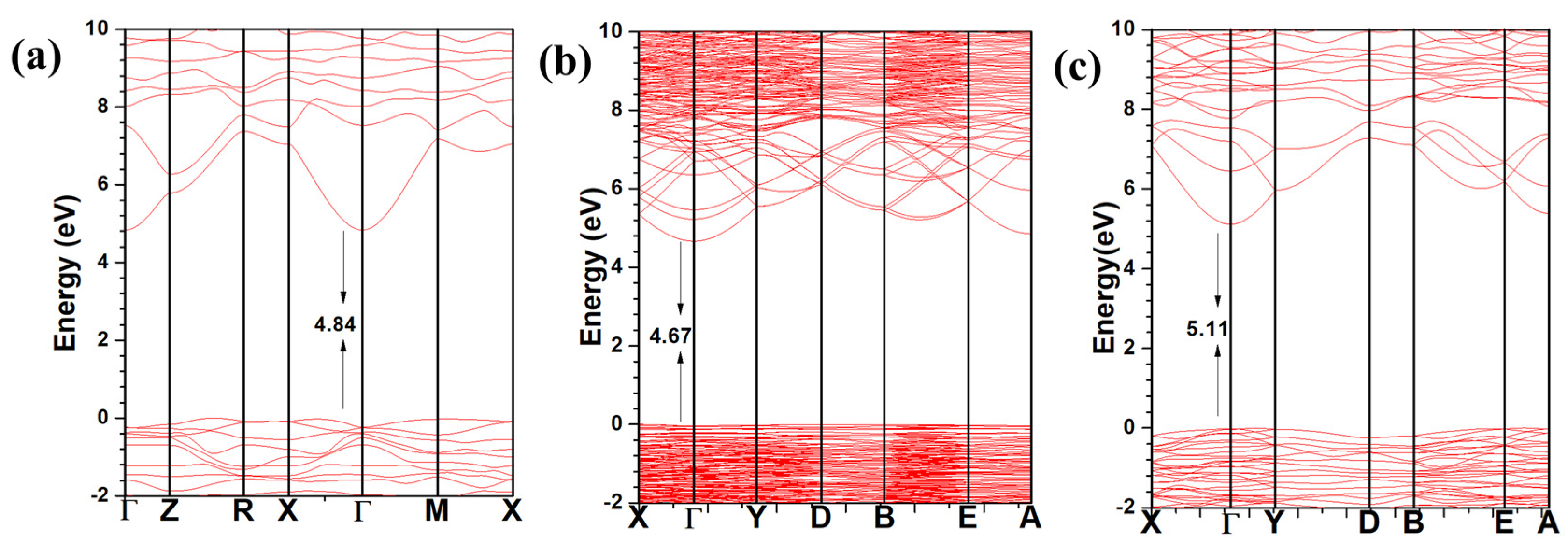

Crystals | Free Full-Text | DFT Study of Electronic Structure and Optical Properties of Kaolinite, Muscovite, and Montmorillonite

Competitive Adsorption of Uranyl and Toxic Trace Metal Ions at MFe2O4- montmorillonite (M = Mn, Fe, Zn, Co, or Ni) Interfaces | SpringerLink

Variations of Chemical Composition and Band Gap Energies in Hectorite and Montmorillonite Clay Minerals on Sub-Micron Length Sca

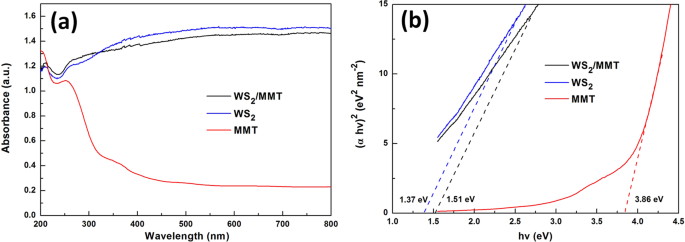

Emerging WS2/montmorillonite composite nanosheets as an efficient hydrophilic photocatalyst for aqueous phase reactions | Scientific Reports

a Diffractogram of multi composites, b energy band gap of TiO2 pristine... | Download Scientific Diagram

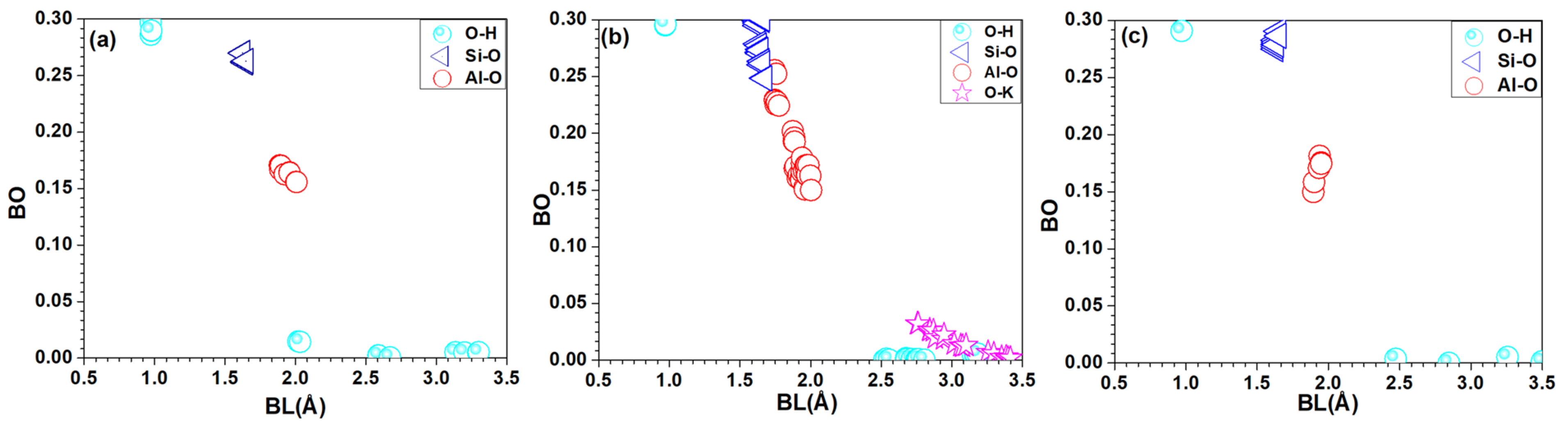

Structural and Electronic Properties of Iron-Doped Sodium Montmorillonite Clays: A First-Principles DFT Study | ACS Omega

Crystals | Free Full-Text | DFT Study of Electronic Structure and Optical Properties of Kaolinite, Muscovite, and Montmorillonite

Synthesis and characterisation of a ternary composite of polyaniline, reduced graphene-oxide and chitosan with reduced optical band gap and stable aqueous dispersibility - ScienceDirect

Crystals | Free Full-Text | DFT Study of Electronic Structure and Optical Properties of Kaolinite, Muscovite, and Montmorillonite

Minerals | Free Full-Text | Investigation on Atomic Structure and Mechanical Property of Na- and Mg-Montmorillonite under High Pressure by First-Principles Calculations

Relationships between Distortions of Inorganic Framework and Band Gap of Layered Hybrid Halide Perovskites | Chemistry of Materials

![Structure of montmorillonite (phyllosilicate clay). Adapted from [133]. | Download Scientific Diagram Structure of montmorillonite (phyllosilicate clay). Adapted from [133]. | Download Scientific Diagram](https://www.researchgate.net/publication/315718218/figure/fig4/AS:477993161236483@1490973858739/Structure-of-montmorillonite-phyllosilicate-clay-Adapted-from-133.png)

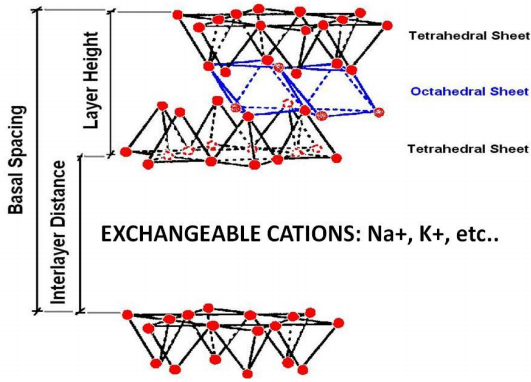

Structure of montmorillonite (phyllosilicate clay). Adapted from [133]. | Download Scientific Diagram

![The molecular structure of montmorillonite [18]. | Download Scientific Diagram The molecular structure of montmorillonite [18]. | Download Scientific Diagram](https://www.researchgate.net/publication/281772470/figure/fig1/AS:714962968276996@1547471863915/The-molecular-structure-of-montmorillonite-18.png)