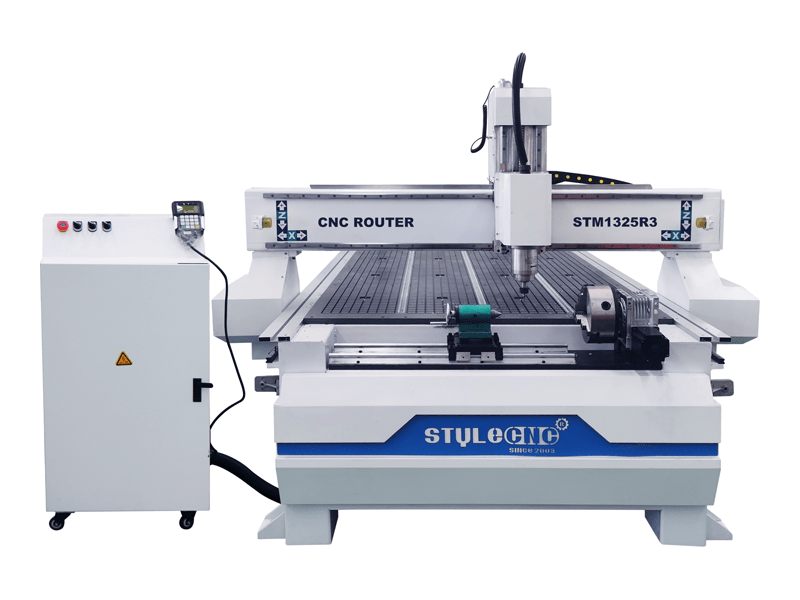

FoxAlien CNC Router Machine 4040-XE, 300W Spindle 3-Axis Engraving Milling Machine for Wood Metal Acrylic MDF Nylon Carving Cutting Arts and Crafts DIY Design, Black - - Amazon.com

500W CNC Router Machine, MYSWEETY 4540 CNC Wood Router 3 Axis Metal Milling Machine for Engraving Carving Wood Acrylic MDF PCB Plastic, Working Area: 430*390*90mm(16.9*15.4*3.5inch) - - Amazon.com

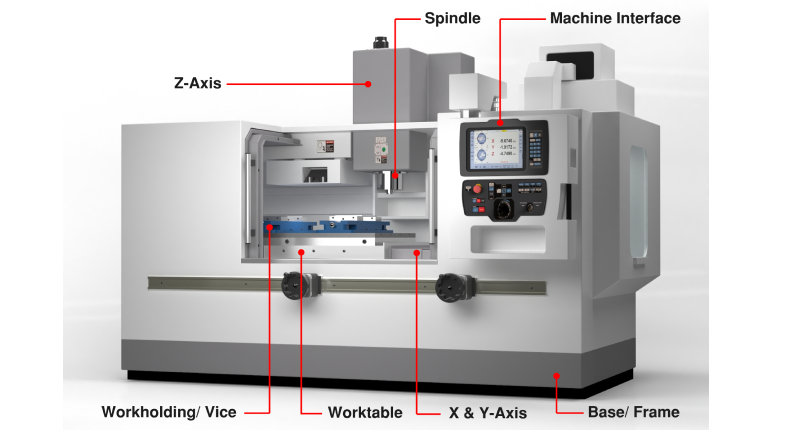

![What is CNC, CNC Machining and CNC Machines? [Easy Introduction] What is CNC, CNC Machining and CNC Machines? [Easy Introduction]](https://www.cnccookbook.com/wp-content/uploads/2020/10/WhatIsCNCMachining.jpg)