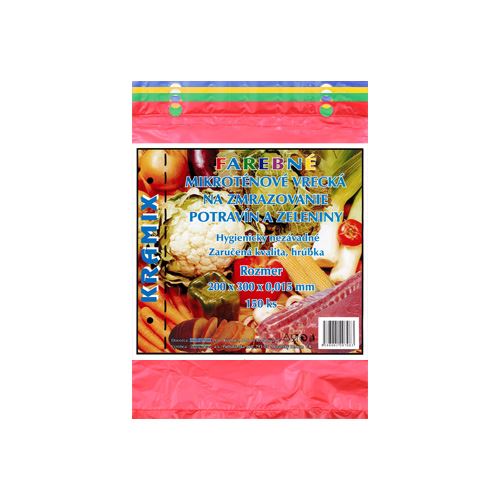

Svačinové sáčky 20x30 cm/12my, 50ks/bal - zelené - Hafyso - obalový materiál, igelitové pytle, mikroténové sáčky

![Mikrotenové sáčky 20x30 cm<br> silné Mikrotenové sáčky 20x30cm Granitol [20211] - 450,00Kč : VABA , výroba a prodej obalů,doprava zdarma , VABA PLUS TRADE s.r.o Mikrotenové sáčky 20x30 cm<br> silné Mikrotenové sáčky 20x30cm Granitol [20211] - 450,00Kč : VABA , výroba a prodej obalů,doprava zdarma , VABA PLUS TRADE s.r.o](https://vaba.cz/shop/images/prirez_odtrh.jpg)

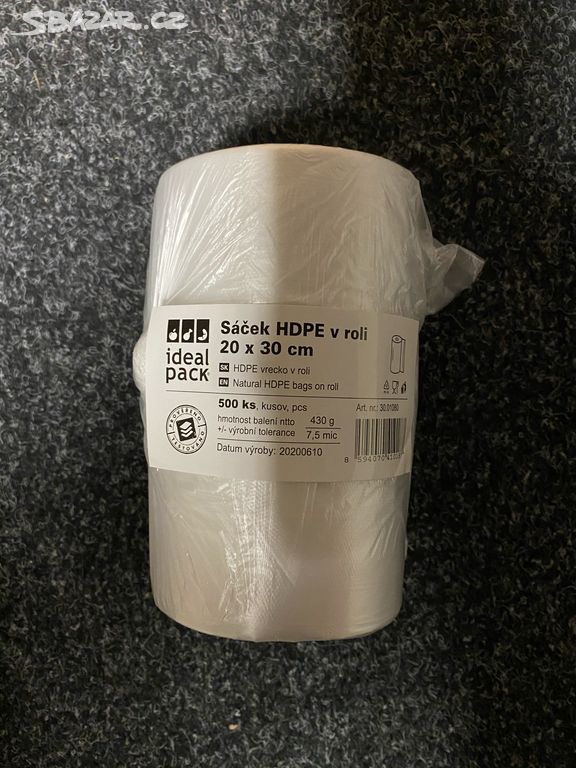

Mikrotenové sáčky 20x30 cm<br> silné Mikrotenové sáčky 20x30cm Granitol [20211] - 450,00Kč : VABA , výroba a prodej obalů,doprava zdarma , VABA PLUS TRADE s.r.o