Cablu Otel cu Bucla si Ace de Prindere Directa pentru Etichete Antifurt Detasabile Lanyard-04 » SmartPOS.ro

Dedeman - Clema cu surub lateral, pentru cablu otel 0 - 3 mm, Cablero, 10 bucati - Dedicat planurilor tale

Bride Cablu | Capete de Prindere pentru Cabluri | Elemente de Retinere si Siguranta | Elemente de Asamblare, Fixare si Montaj | UNSPSC | Categorii | SEA Romania

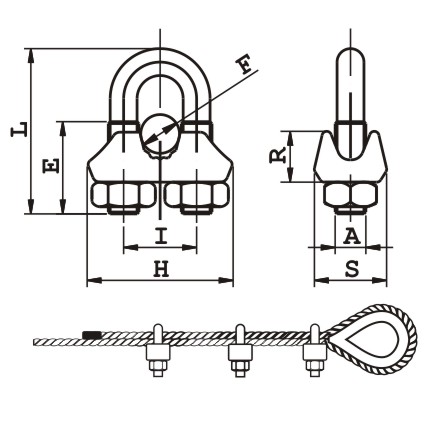

Dedeman - Brida zincata pentru legare cablu otel de 6 mm, Cablero CD011A06U, set 3 bucati - Dedicat planurilor tale

Dedeman - Brida usoara, din inox, Cablero CD016B03A, pentru prindere cablu de otel de 3 mm - Dedicat planurilor tale

Bride Cablu | Capete de Prindere pentru Cabluri | Elemente de Retinere si Siguranta | Elemente de Asamblare, Fixare si Montaj | UNSPSC | Categorii | SEA Romania

Dedeman - Cablu din otel zincat plastifiat, pentru ancorari usoare, 50 m x 3-4.5 / bucata - Dedicat planurilor tale