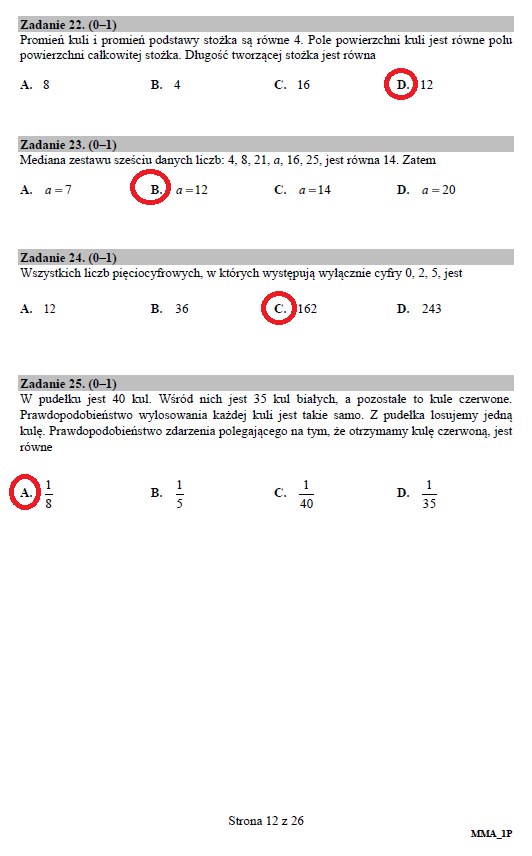

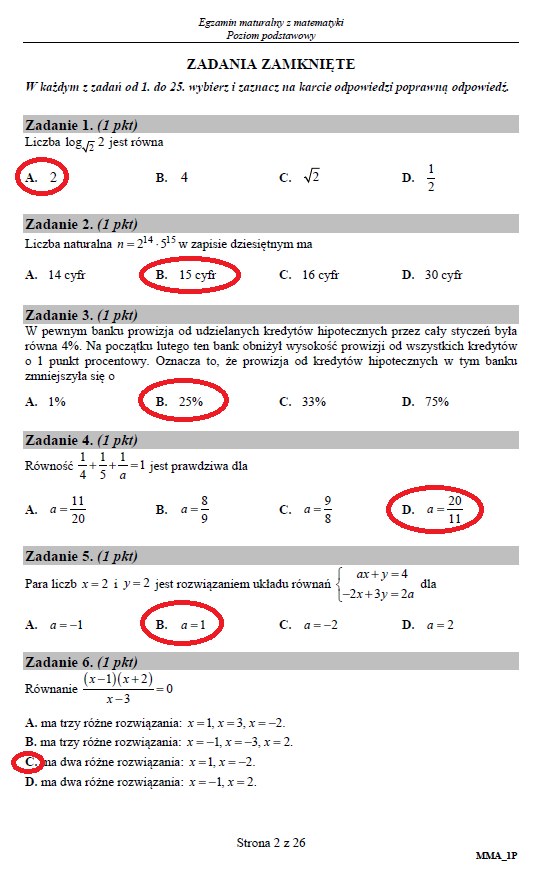

MATMA ROZSZERZONA MATURA 2019 Odpowiedzi, arkusze CKE 2019. Matura MATEMATYKA odpowiedzi. Sprawdź, jak Ci poszedł test 9.05.2019 | Express Ilustrowany

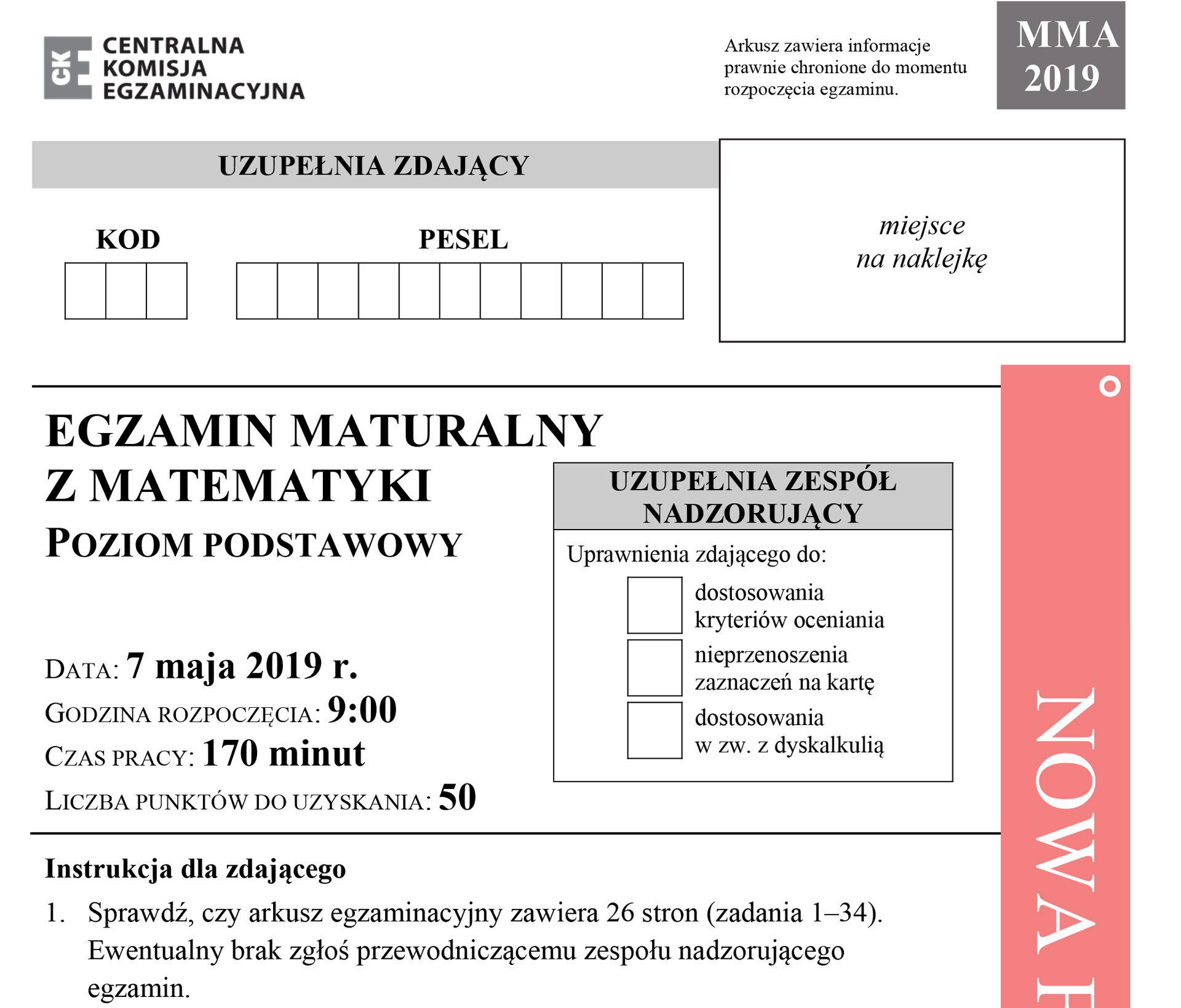

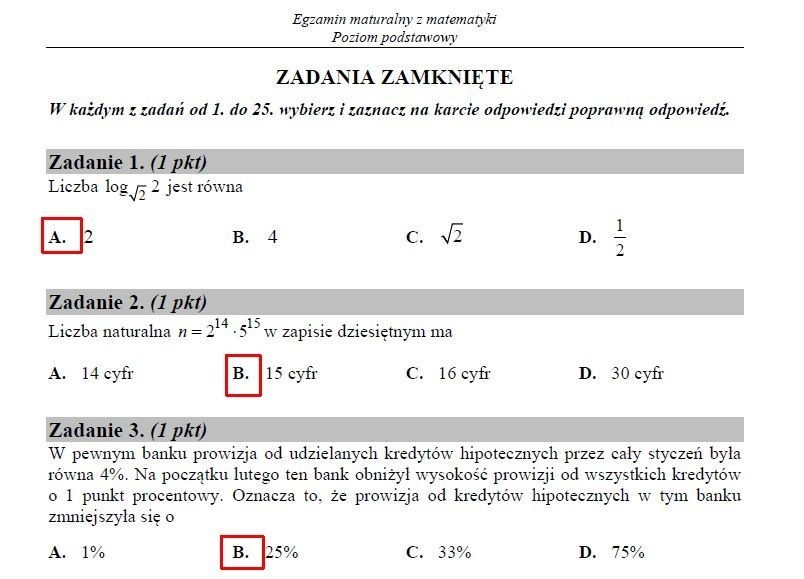

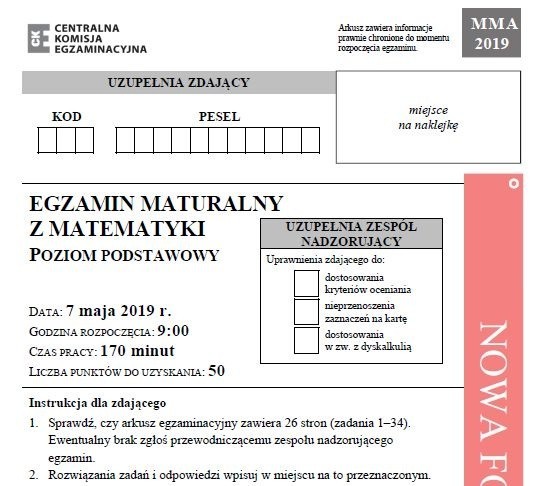

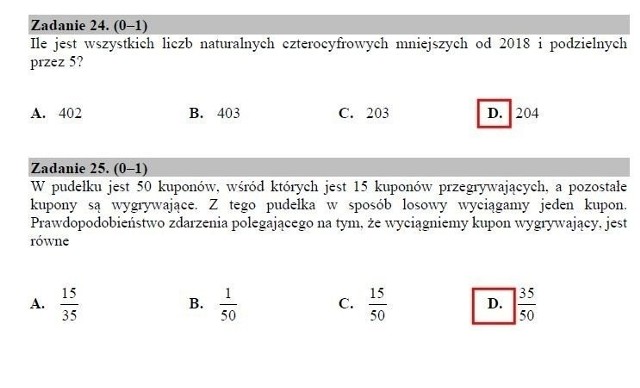

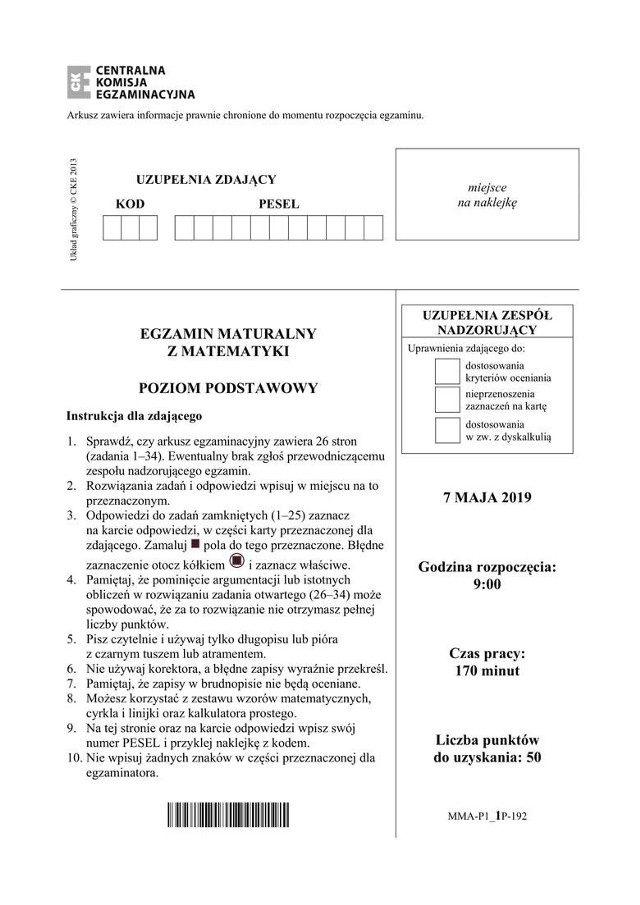

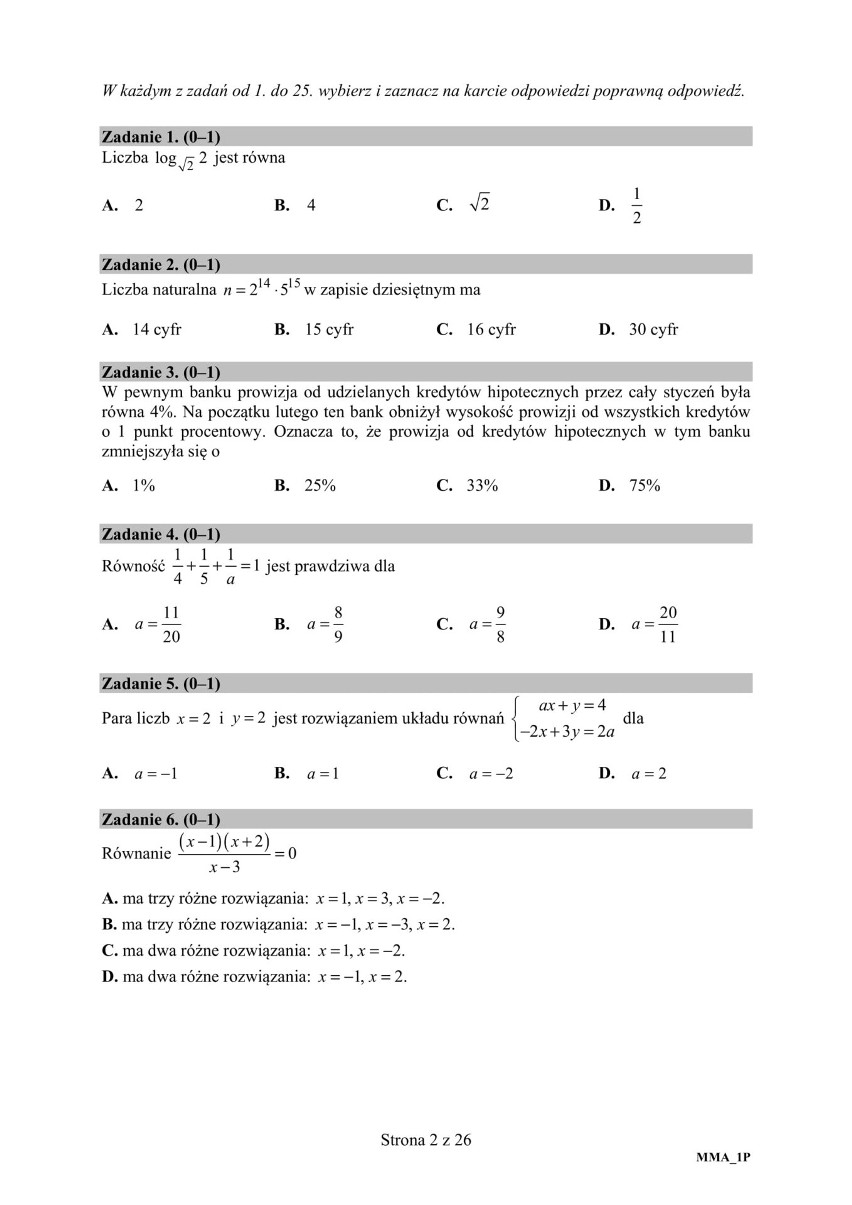

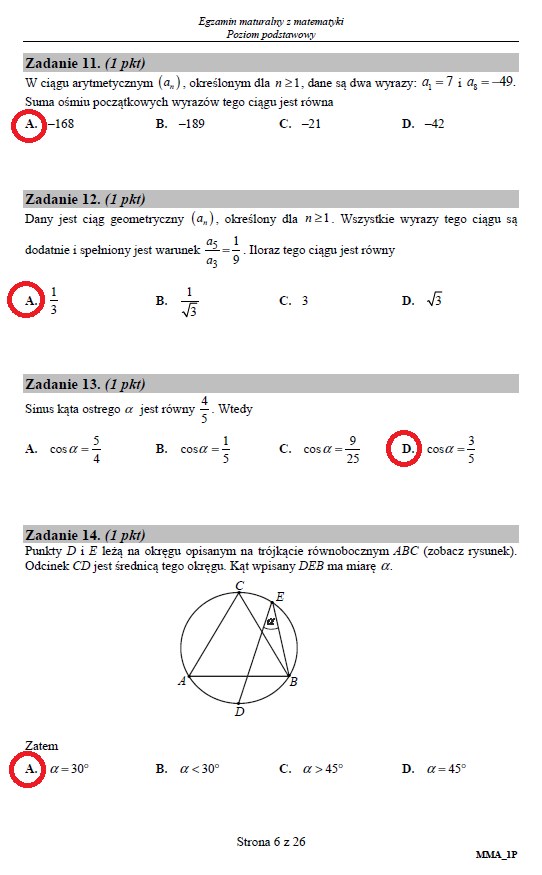

Matura 2019 matematyka arkusze CKE. Odpowiedzi. Matura 2019 matematyka poziom podstawowy. Egzamin z matematyki matura 2019 - podstawa | Łódź Nasze Miasto

Matura MATEMATYKA 2020. Arkusz CKE poziom podstawowy. Zadania na maturze z matematyki (PEŁNY ARKUSZ CKE 9.06.2020) | Gazeta Wrocławska

Matura matematyka zadania. Matura 2019 matematyka poziom podstawowy 7.05.19. Matura matematyka: arkusze CKE, odpowiedzi. Znów alarmy bombowe | Dziennik Łódzki

Podręcznik szkolny Teraz matura. Matematyka. Arkusze maturalne. Poziom podstawowy - Ceny i opinie - Ceneo.pl

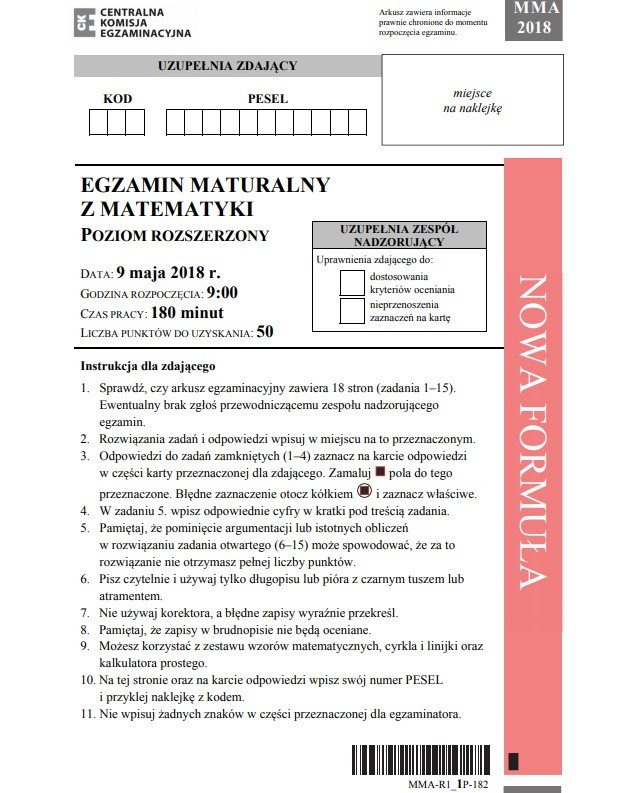

Teraz Matura. Matematyka. Arkusze maturalne. Poziom rozszerzony Marcin Wesołowski w sklepie TaniaKsiazka.pl

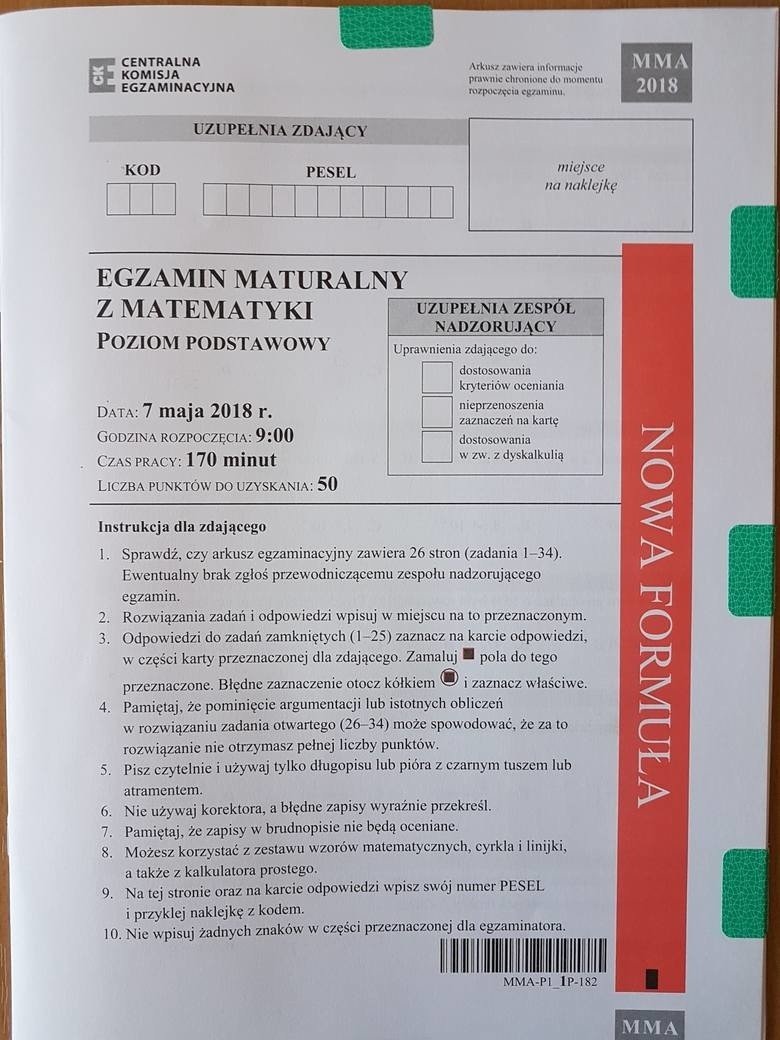

Matura 2019 matematyka. Mamy ARKUSZE I ODPOWIEDZI! Sprawdź, czy zdasz - Super Express - wiadomości, polityka, sport

MATURA 2019 MATEMATYKA ODPOWIEDZI NOWA FORMUŁA. Matura z matematyki - poziom podstawowy 7.05.2019 - arkusz CKE, zadania, rozwiązania | Dziennik Bałtycki

![Matura 2019. Odpowiedzi: Matematyka: podstawa + rozszerzenie. Przecieki, odpowiedzi, arkusze CKE [07.05.2019] | Gazeta Współczesna Matura 2019. Odpowiedzi: Matematyka: podstawa + rozszerzenie. Przecieki, odpowiedzi, arkusze CKE [07.05.2019] | Gazeta Współczesna](https://d-art.ppstatic.pl/kadry/k/r/1/dd/0a/5cd17f1ab101d_o_small.jpg)

Matura 2019. Odpowiedzi: Matematyka: podstawa + rozszerzenie. Przecieki, odpowiedzi, arkusze CKE [07.05.2019] | Gazeta Współczesna

MATURA 2019 MATEMATYKA ODPOWIEDZI NOWA FORMUŁA. Matura z matematyki - poziom podstawowy 7.05.2019 - arkusz CKE, zadania, rozwiązania | Dziennik Bałtycki

Matura 2019: Matematyka. Odpowiedzi, arkusze i rozwiązania w internecie. Co było na maturze z matematyki? (07.05.2019) | Gazeta Współczesna

MATURA 2019 Matematyka ARKUSZE CKE Zadania, rozwiązania. Matura matematyka poziom podstawowy. ODPOWIEDZI 7 maja 2019 | Express Ilustrowany

Matura Matematyka 2019: ARKUSZE CKE + ROZWIĄZANE ZADANIA. Poziom podstawowy. Odpowiedzi z matematyki 7 MAJA 2019 | Dziennik Zachodni

Matura MATEMATYKA 2022: odpowiedzi, arkusz CKE - co było na maturze z matematyki na p. podstawowym? Jak poradzili sobie uczniowie? 7.05.2022 | Gazeta Krakowska

MATURA 2019 MATEMATYKA odpowiedzi. Arkusze CKE, zadania, rozwiązania. Matura matematyka - podstawa. Co było na egzaminie z matematyki? | Gazeta Współczesna

![Matura próbna 2019: matematyka, poziom podstawowy. Pobierz arkusze, tematy, klucz odpowiedzi [ZDAJ MATURĘ Z NOWINAMI] | Nowiny Matura próbna 2019: matematyka, poziom podstawowy. Pobierz arkusze, tematy, klucz odpowiedzi [ZDAJ MATURĘ Z NOWINAMI] | Nowiny](https://d-art.ppstatic.pl/kadry/k/r/1/ef/f7/5c98e40df09d8_o_small.jpg)

Matura próbna 2019: matematyka, poziom podstawowy. Pobierz arkusze, tematy, klucz odpowiedzi [ZDAJ MATURĘ Z NOWINAMI] | Nowiny

![Matura 2019 - MATEMATYKA: odpowiedzi, arkusz PDF, rozwiązania zadań [7.05] | Wiadomości Radio ZET Matura 2019 - MATEMATYKA: odpowiedzi, arkusz PDF, rozwiązania zadań [7.05] | Wiadomości Radio ZET](https://gfx.wiadomosci.radiozet.pl/var/radiozetwiadomosci/storage/images/polska/matura-2019-matematyka-odpowiedzi-arkusz-pdf-rozwiazania-zadan/egzamin-maturalny-z-matematyki-odpowiedzi.-nowa-matura/4281226-1-pol-PL/Egzamin-maturalny-z-matematyki-odpowiedzi.-NOWA-MATURA_embed-gallery.jpg)

![Matura 2019. Matematyka poziom podstawowy [ARKUSZE I ODPOWIEDZI] - RMF 24 Matura 2019. Matematyka poziom podstawowy [ARKUSZE I ODPOWIEDZI] - RMF 24](https://i.iplsc.com/matura-2019-matematyka-poziom-podstawowy/00082UEVNS1RQFXG-C116-F4.jpg)

![Matura z matematyki: Zadania. Poziom podstawowy [MATURA 2020, ZADANIA CKE] - Kielce, Super Express Matura z matematyki: Zadania. Poziom podstawowy [MATURA 2020, ZADANIA CKE] - Kielce, Super Express](https://cdn.galleries.smcloud.net/t/galleries/gf-DAba-3MXR-VHbP_arkusze-cke-matura-matematyka-poziom-rozszerzony-2019-co-bylo-na-maturze-z-matematyki-1280x960.jpg)