/cdn.vox-cdn.com/uploads/chorus_asset/file/22671278/20210618_0264_e.jpeg)

ONE Championship signs top ranked kickboxer Qiu Jianliang, former TUF China champ Zhang Lipeng - MMA Fighting

Liu Jianli (L) of China punches champion Kim Dan-bi of South Korea during their 10-round bout for the IFBA (International Female Boxers Association) mini flyweight title in Anseong, about 80 km (50

WBA China Professional Boxing Champions League Starts<br>at Sports Center at the Beginning of Next Year-Media Focus-大连体育中心

Indian boxer beats Chinese rival then gives back belt in bid to ease 'tension' between two nations | The Independent | The Independent

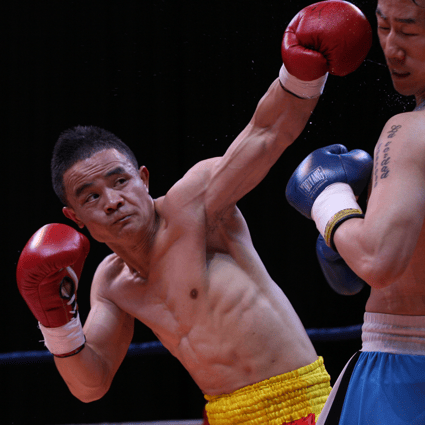

Chinese boxer Wang Hongxiang, front, fights Japanese boxer KING in their competition during the WLF World Champion 2016 in Shanghai, China, 23 January Stock Photo - Alamy

Xiong Chaozhong – the coal miner turned pro boxer who became China's first world champion | South China Morning Post

Chinese Olympic Boxing Champion Zou Shiming Front Poses Shouts His – Stock Editorial Photo © ChinaImages #241615356