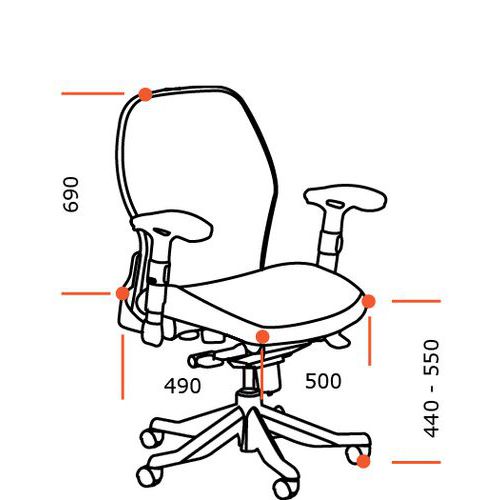

Kancelářská židle s posuvem sedáku ANTARES 1930 SYN Eclipse NET PDH s područkami BR16 nosnost 130 kg » Kancelářské židle, Kancelářské židle a křesla, Kancelářské židle XXL, Zátěžové židle a křesla 24/7,

interstuhl – Kancelářská otočná židle GOAL, výška opěradla 430 mm: leštěný podstavec, s měkkými kolečky | KAISER+KRAFT