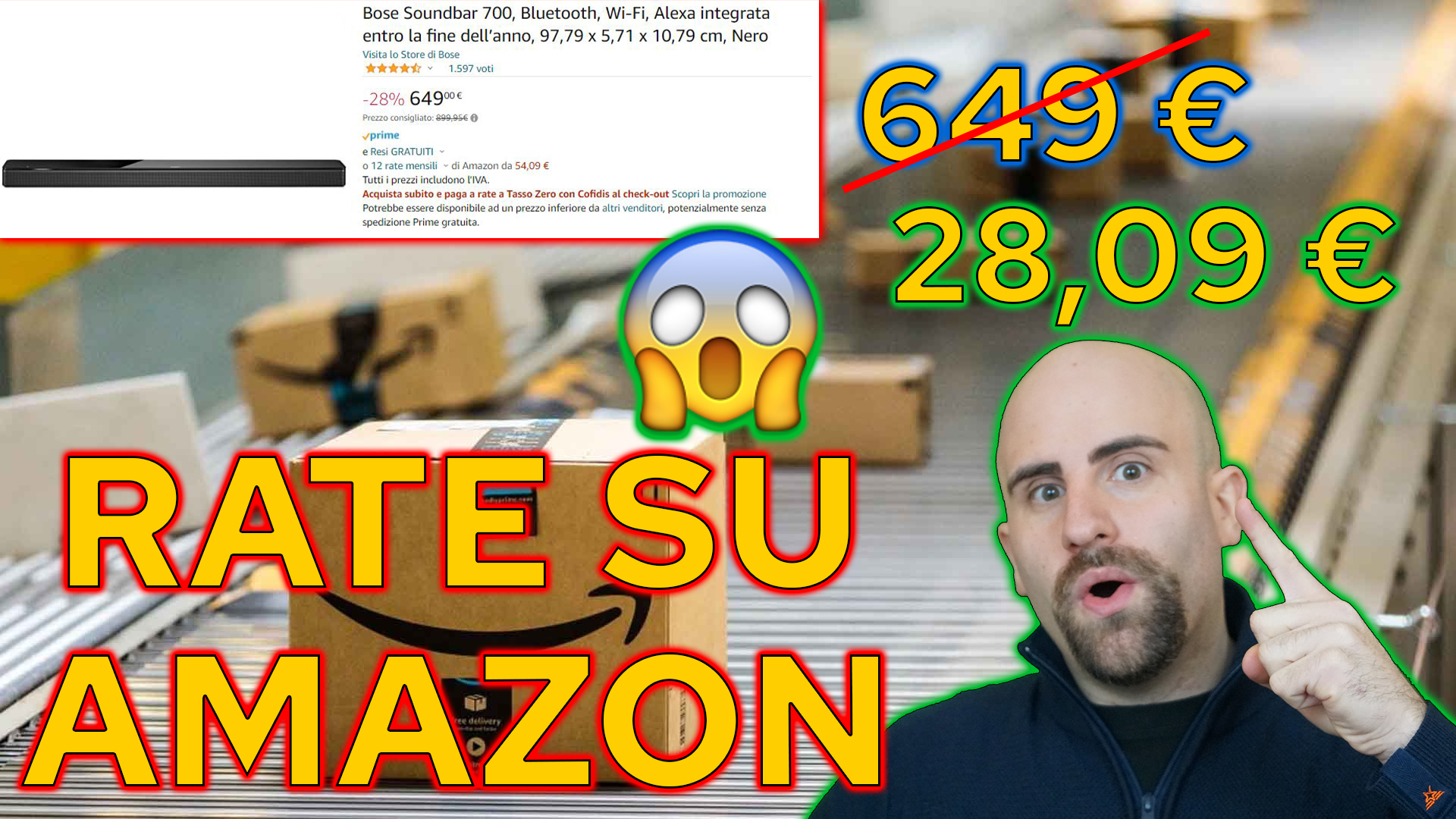

PAGARE a RATE su AMAZON a tasso ZERO, come funziona? FINO a 24 RATE con CREDIT LINE di COFIDIS - Daniele Subrizi

Come pagare in contrassegno in contanti comprando su Amazon al ricevimento della merce. Finalmente si può | BusinessOnLine.it

Amazon spedisce merce per siti concorrenti: ritiri e consegne sabato e domenica a prezzi concorrenziali | DDay.it