Vector Sketch Classique Ceinture Avec Boucle Vecteurs libres de droits et plus d'images vectorielles de Ceinture - Accessoire - Ceinture - Accessoire, Dessin, Accessoire - iStock

Illustration De Vecteur De Ceinture Disolement Sur Le Fond Blanc Pour Le Livre De Coloriage Denfants Vecteurs libres de droits et plus d'images vectorielles de Ceinture - Accessoire - iStock

Illustration Simple De Boucle De Ceinture De Dessin Animé Vecteurs libres de droits et plus d'images vectorielles de Ceinture - Accessoire - iStock

Boucle Ceinture Icône, Style De Contour Clip Art Libres De Droits, Svg, Vecteurs Et Illustration. Image 76076915

Boucle Ceinture Icône, Style De Contour Clip Art Libres De Droits, Svg, Vecteurs Et Illustration. Image 76076915

Boucle de ceinture en métal rétro vintage, 2.5cm, pour ceinture, chaussures, sac, bricolage, ensemble artisanal en cuir, couleur argent antique, accessoires de vêtement, 1 ensemble - AliExpress

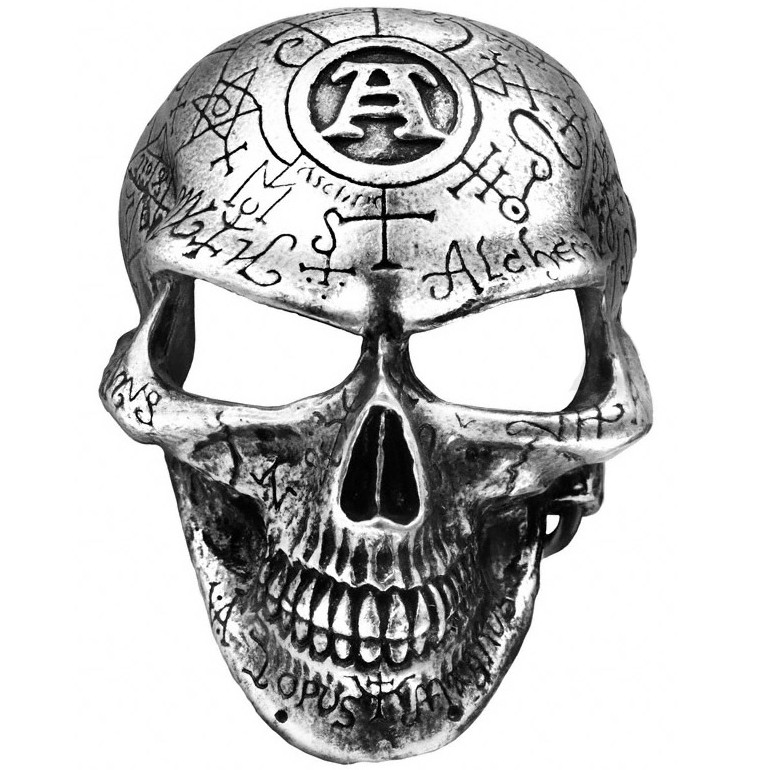

Boucle de ceinture de crâne de Film 3D avec revêtement blanc noir, boucle de ceinture fantôme de dessin animé, accessoires de Jeans pour hommes et femmes - AliExpress

Fond De Dessin Animé Classique Rouge Joyeux Noël Vector Avec Ceinture De Père Noël Et Boucle Dorée. Bannière De Noël De Vecteur, Flyer Ou Affiche Avec Espace De Copie Pour Le Texte