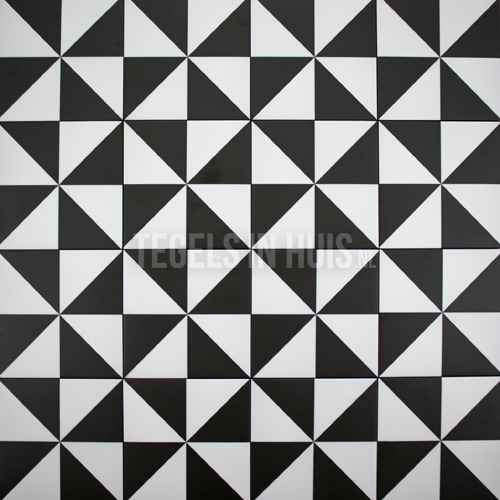

Vloertegel Ruzzini chess zwart wit 45x45 cm ( 4 in 1 tegel ) vintage | Tegels in Huis - De goedkoopste tegeloutlet van NL

0,87ct per stuk | zwart wit dambord GOOTSTEENTEGELS 50x50x5mm voor herstel grootmoeders gootsteen incl.verzendkosten 15 wit 15 zwart - tegels anno 1900-1930 | granito vloertegels | tegellambriseringen | dubbelhardgebakken tegels

Vloertegel Bredas 20x20cm vintage Zwart-Wit 10mm - Beperkt beschikbaar | Tegels in Huis - De goedkoopste tegeloutlet van NL