Amazon.com: Padmate Wireless Bluetooth Air Conduction Headphone-Waterproof, Noise Cancelling Headphones,Sport Running Bluetooth Headset Blue : Electronics

Amazon.com: Apple AirPods Max Wireless Over-Ear Headphones. Active Noise Cancelling, Transparency Mode, Spatial Audio, Digital Crown for Volume Control. Bluetooth Headphones for iPhone - Sky Blue : Electronics

Bluetooth Headphones Over Ear, Hi-Fi Stereo Wireless Headset, Foldable, w/Built-in Mic Wired Mode for Online Class, Home Office, PC/Cell Phones/TV, Blue - Walmart.com

MIDOLA Headphones Bluetooth Wireless Kids Volume Limit 85dB /110dB Over Ear Foldable Noise Protection Headset AUX

JVC Wireless Bluetooth 5.0 Earbuds - in Ear Headphones with Air Cushion Support Structure (HA-FX22W) - Sweat and Splash Proof (IPX2), 6.5 Hour Rechargeable Battery, 3-Button Remote with mic (Blue) - Walmart.com

Amazon.com: Apple AirPods Max Wireless Over-Ear Headphones. Active Noise Cancelling, Transparency Mode, Spatial Audio, Digital Crown for Volume Control. Bluetooth Headphones for iPhone - Sky Blue : Electronics

Creative SXFI AIR - Bluetooth and USB Headphones with Built-In Super X-Fi Technology for Personalized Audio Holography - Creative Labs (United States)

Fineblue Air55pro True Wireless Earbuds Bluetooth Headphones Earphones In-ear Built-in Mic Headset - Earphones & Headphones - AliExpress

Fineblue Air55pro True Wireless Earbuds Bluetooth Headphones Earphones In-ear Built-in Mic Headset - Earphones & Headphones - AliExpress

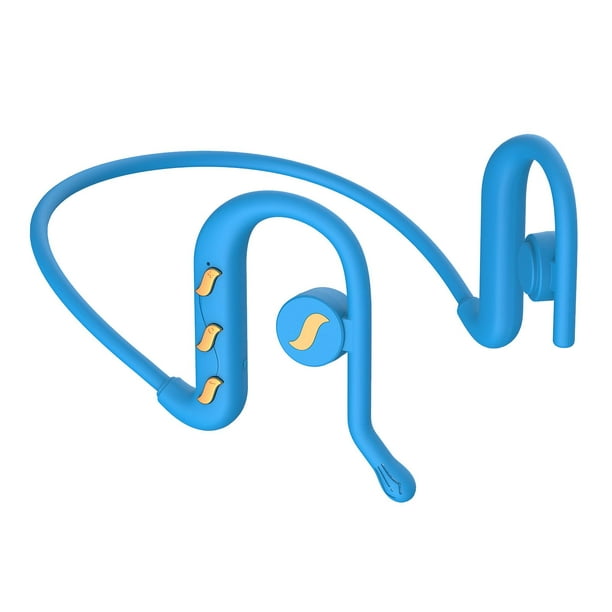

Buy Open-Ear Headphones, Wireless Air Conduction Headphones Lightweight Sweatproof Bluetooth Sports Headset with Mic Answer Phone Call Music for Running, Hiking, Driving, Bicycling (Blue) Online at Lowest Price in Ubuy Hungary. B091JW7HWF