Pijama dama pentru sarcina si alaptare, calitate premium, CULOARE VISINIU, Cod produs J40654 – epijamale.ro

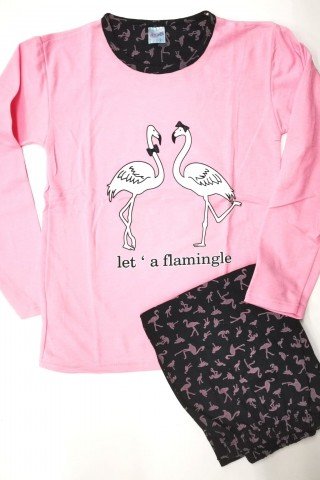

Pijama Dama Maneca 3/4, Model Perfection In Simplicity, Brand Cana Nouvelle, Material Bumbac 100%, Culoare Roz, Pijamale Dama Calitate Superioara | Fashion, Long sleeve blouse, Model