Leddiszkont - Mikró ledes Nano jégcsap fényfüzér, 3x1 méter, 100 db, színes, multi color leddel, 8 funkciós vezérlővel! 5V, USB csatlakozós! Life Light Led.

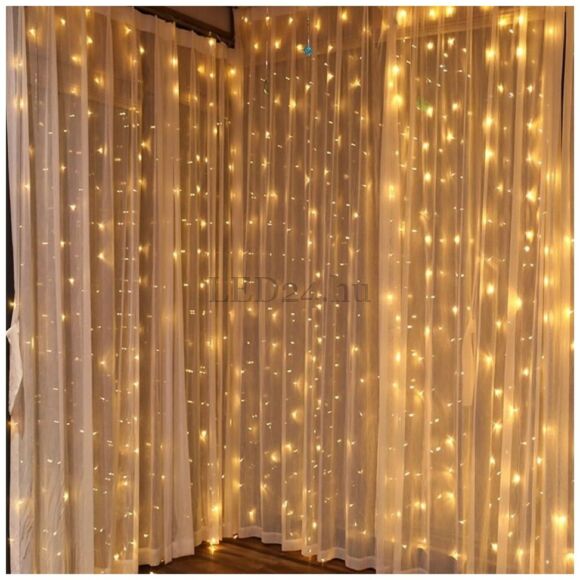

2 x 2 méter fényfüggöny 200 Led kültéri és beltéri használatra 6000k 220V / hidegfehér - TeleOnline.hu

Leddiszkont - Mikró ledes Nano jégcsap fényfüzér, 3x2 méter, 200 db, hideg fehér leddel, 8 funkciós vezérlővel! 5V, USB csatlakozós! Life Light Led 2 év garancia!

Leddiszkont - Mikró ledes Nano jégcsap fényfüzér, 3x2 méter, 200 db, hideg fehér leddel, 8 funkciós vezérlővel! 5V, USB csatlakozós! Life Light Led 2 év garancia!

Leddiszkont - Party Led függöny, meleg fehér, 12db gömbben 108 db meleg fehér Led, átlátszó vezetékkel. 8 funkciós vezérlővel, 5V, USB csatlakozós! Life Light Led.