Where Do Los Angeles Rams Fall In 2024 Strength of Schedule Ranks? - Sports Illustrated LA Rams News, Analysis and More

Los Angeles Rams: Game-by-Game Predictions for 2019 - AthlonSports.com | Expert Predictions, Picks, and Previews

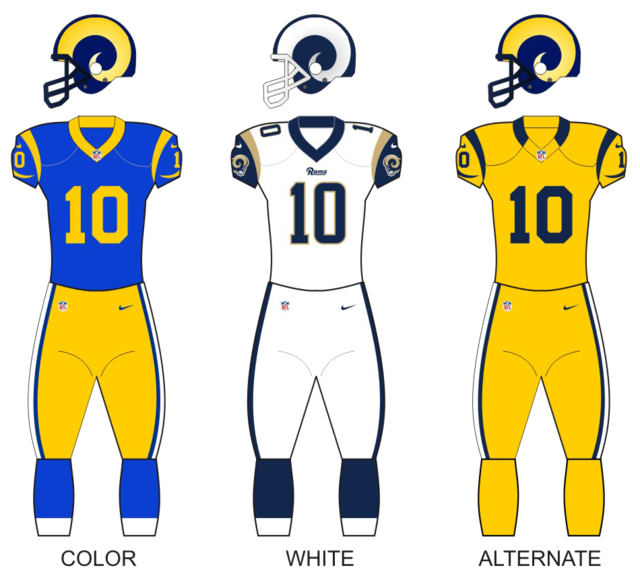

Los Angeles Rams on X: "White. Color Rush. Throwback. 🚨 The 2019 uniform schedule is here! 🚨 https://t.co/K1Ey2BS4FA" / X

Los Angeles Rams on X: "Ramping up to the regular season. 👀 🎟 » https://t.co/U4dSkVNApW 📺 2023 Schedule Release on NFL Network https://t.co/Z0dQLkqLws" / X

Los Angeles Rams | Which home game are you looking forward to the most?! #RamsHouse | 🎟️ Tap the link in our bio to buy tickets! | Instagram

/cdn.vox-cdn.com/uploads/chorus_image/image/65118251/Screen_Shot_2019_08_27_at_10.22.02_AM.0.png)

/cdn.vox-cdn.com/uploads/chorus_image/image/63613916/1081732742.jpg.0.jpg)