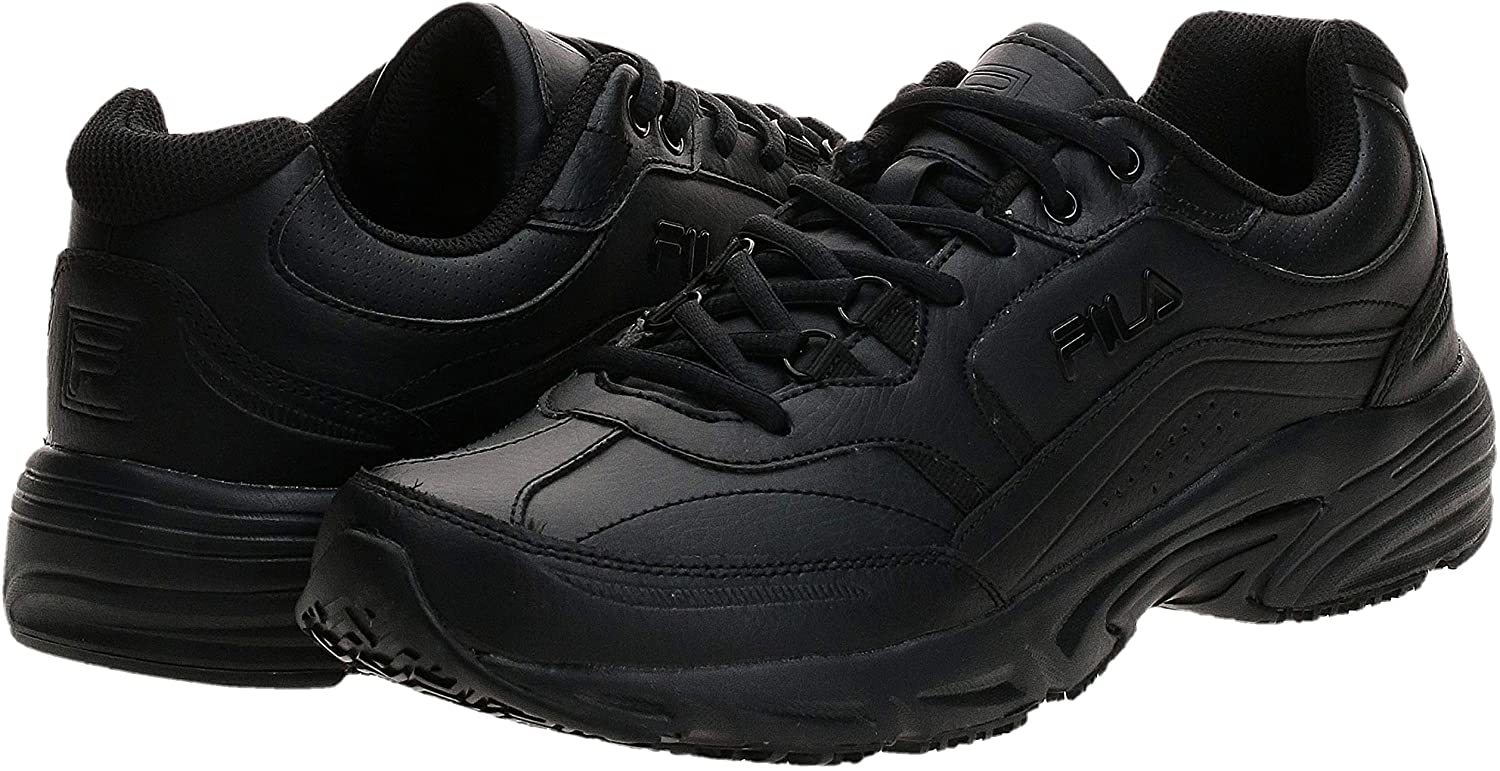

Los 30 mejores zapatos para estar de pie todo el día para reducir el estrés Actualización de 2022: Noticias escolares actuales

Las plantillas con más de 13.000 valoraciones en Amazon que valen para trabajar, hacer deporte o pasar muchas horas de pie | Escaparate | EL PAÍS

Los 30 mejores zapatos para estar de pie todo el día para reducir el estrés Actualización de 2022: Noticias escolares actuales

![🏅 TOP 5 | TENIS para estar de pie mucho tiempo ▻ y PORQUÉ 💡 [2022] - YouTube 🏅 TOP 5 | TENIS para estar de pie mucho tiempo ▻ y PORQUÉ 💡 [2022] - YouTube](https://i.ytimg.com/vi/HX_Tkrb-FRY/maxresdefault.jpg)