تابلت هواوي ميدياباد تي 3- 10 انش، 16 جيجا، 2 جيجا رام، واي فاي، سبيس جراي: اشتري اون لاين بأفضل الاسعار في السعودية - سوق.كوم الان اصبحت امازون السعودية

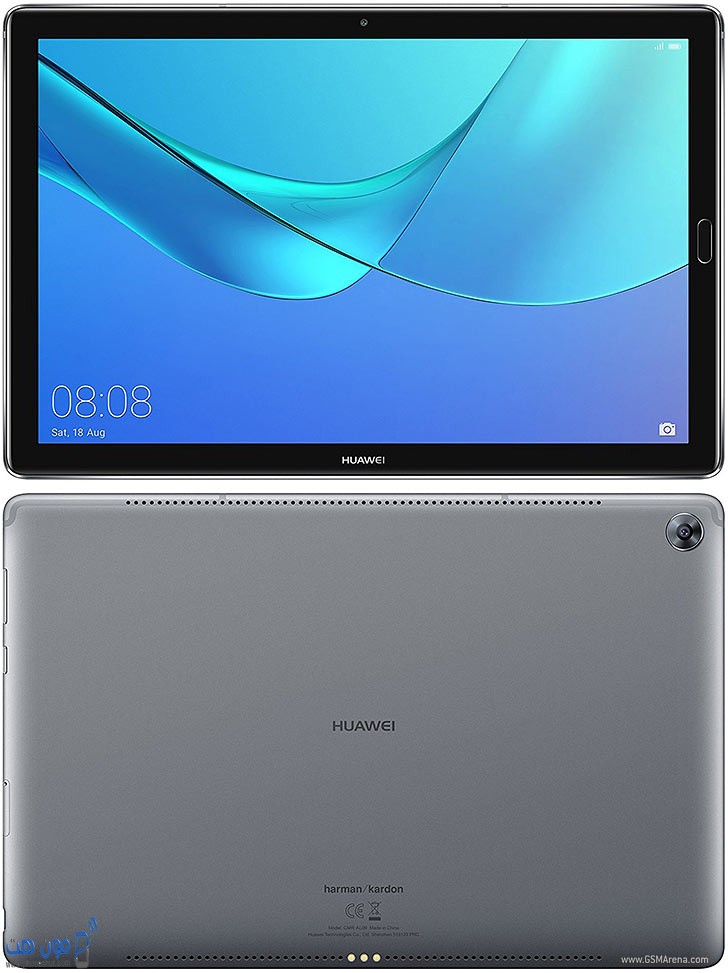

سعر ومواصفات Huawei Mediapad M5 Lite – تابلت هواوي ميديا باد M5 لايت بشريحة اتصال – شاشة 10.1 انش، 32 جيجا، رام 4 جيجا | تسعيرة دوت كوم

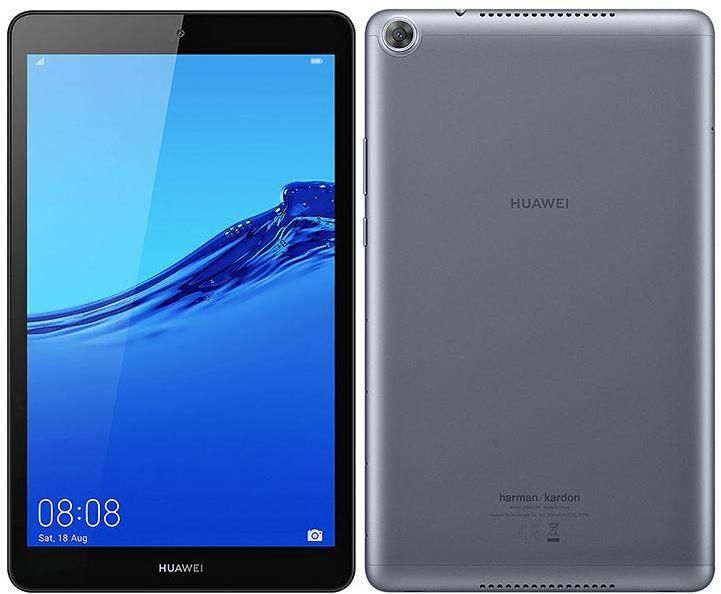

تابلت هواوي ميديا باد T3، شاشة 7 بوصة، ذاكرة داخلية 16 جيجابايت، رامات 1 جيجابايت، شبكة الجيل الثالث، رمادي الغزاوي

Huawei MediaPad M5 Lite Tablet - 10.1 inch, 64GB, 4GB RAM, 4G, Grey: Buy Online at Best Price in Egypt - Souq is now Amazon.eg

سعر ومواصفات تابلت هواوي ميديا باد M5 لايت 8"، الجيل الرابع، 32 جيجابايت، 3 جيجابايت رام، معالج Kirin 710 ثماني النواة (4x2.2 GHz Cortex-A73 & 4x1.7 GHz Cortex-A53)، كاميرا (13 + 8 )

Xcite on Twitter: "تابلت هواوي ميدياباد تي ٣ ٧ بوصة للأطفال سعة ٨ جيجاب متوفر بسعر 23.9 دك! Huawei MediaPad T3 7 Kids 8GB WiFi Only Tablet Available for 23.9KD! Shop Now:

افضل سعر تابلت هواوي ميديا باد T5، شاشة 10.1 بوصة، 16 جيجا، شبكة الجيل الرابع ال تي اي - اسود في مصر 2021| بي تك

مواصفات وسعر تابلت هواوي ميديا باد T3، شاشة 10 بوصة، 16 جيجا، شبكة 4G LTE - رمادي مع بطاقة ذاكرة كينجستون فئة 10 - موديل SDCS/16GB في مصر 2021| بي تك

سعر تابلت هواوي ميديا باد إم ٥ لايت - سعة ٣٢ جيجابايت - ٤ جي ١٠،١ بوصة - ذهبي فى الكويت | اكسايت الكويت | كان بكام

سعر تابلت هواوي ميدياباد 9. 6 بوصة 16 جيجا بايت 4 جي إل تي إي - رمادي فى السعودية | اكسايت السعودية | كان بكام

تابلت هواوي ميديا باد T3 مقاس 8 بوصة ، 16 جيجا ، 2 جيجا رام ، شبكة الجيل الرابع ال تي اي - رمادي فلكي | 0711XXFGGOO اشتر الآن، أفضل الأسعار في عمان، مسقط، صلالة، السيب، صحار