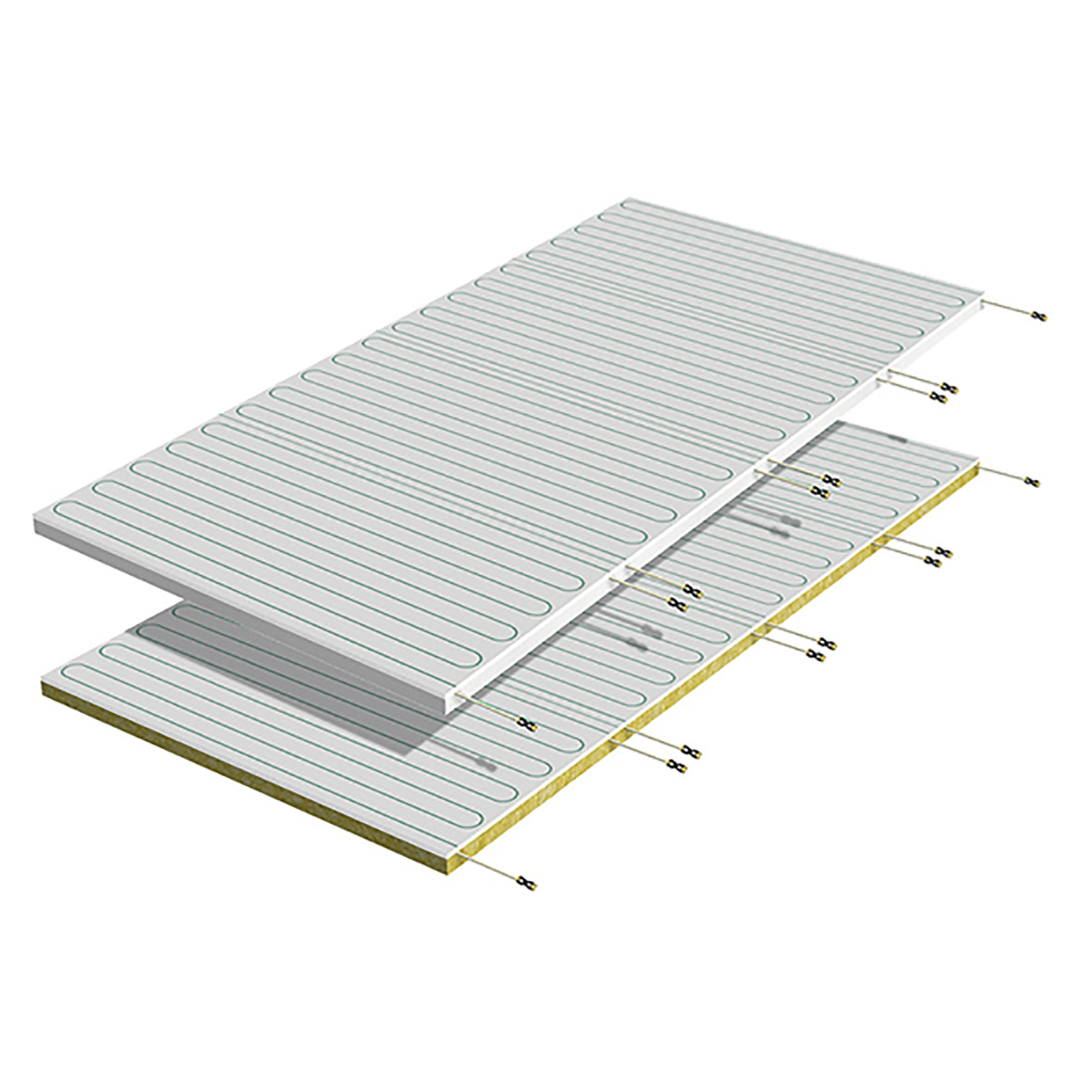

Coldfighting Pannello Radiante Infrarossi 600W- Pannelli Radianti Infrarossi con Termostato, Timer- Pannelli Infrarossi per Riscaldamento, Pannelli Radianti Infrarossi Ultima Generazione, 100 * 60cm : Amazon.it: Fai da te

Coldfighting Pannello Radiante Infrarossi 180W- Pannelli Radianti Infrarossi- Pannelli Infrarossi per Riscaldamento, Pannelli Radianti Infrarossi Ultima Generazione, 60 * 30cm : Amazon.it: Fai da te