Beyond Dragon Ball Super: The New Angel Arrives! Merno Finds Whis, Goku And Vegeta On Beerus Planet | Dragon ball, Dragon ball super, Goku and vegeta

Dragon Ball Super - MB01 - Mythic Booster - SS4 Son Goku, Beyond All Limits - P-262 - TotalCards.net

BEERUS SAVES THE AVENGERS DBS 18: MARVEL MANGA Beyond Dragon Ball Super Beerus Saves The Avengers From Thanos On Earth As Beerus Ba... Dragon Ball Super Beerus Manga DBS Fan Manga Crossover

Beyond Dragon Ball Super: Kaioken Super Saiyan God Broly Overpowers Goku! Vegeta Rejoins The Battle - Bilibili

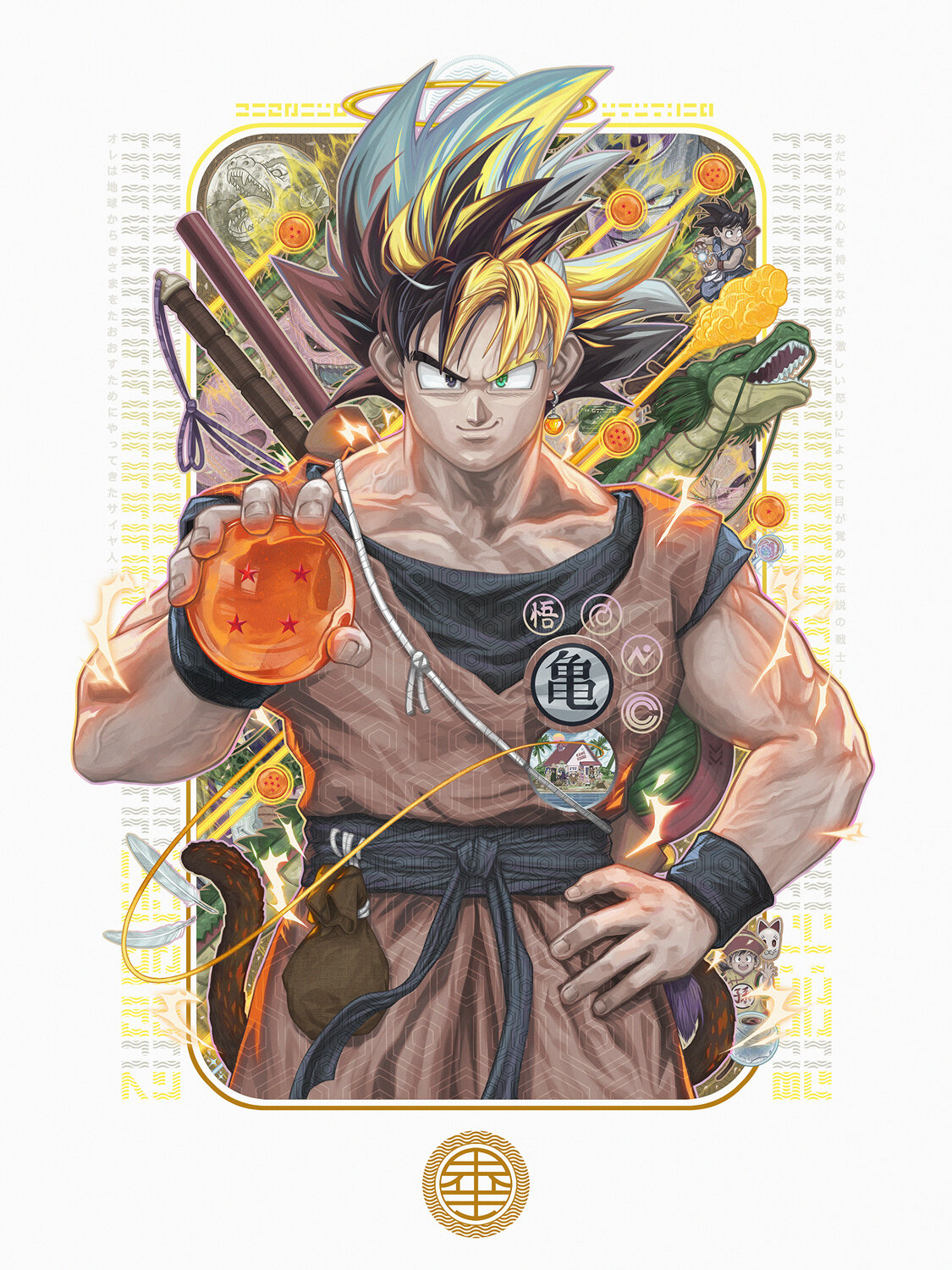

![OC] Would you like Dragon Ball Super to continue beyond the End of Z ? Hope you like the art ! : r/dbz OC] Would you like Dragon Ball Super to continue beyond the End of Z ? Hope you like the art ! : r/dbz](https://i.redd.it/hee044zgpku81.png)

OC] Would you like Dragon Ball Super to continue beyond the End of Z ? Hope you like the art ! : r/dbz

![Dragon Ball Super - Beyond The Limit [Epic Orchestral Cover] - YouTube Dragon Ball Super - Beyond The Limit [Epic Orchestral Cover] - YouTube](https://i.ytimg.com/vi/9XhaokGHBas/maxresdefault.jpg)