Pierścienie erekcyjne – Twój sposób na dłuższy seks | TrustedCosmetics.pl - popularny blog i magazyn o kosmetykach, urodzie, zabiegach i branży beauty

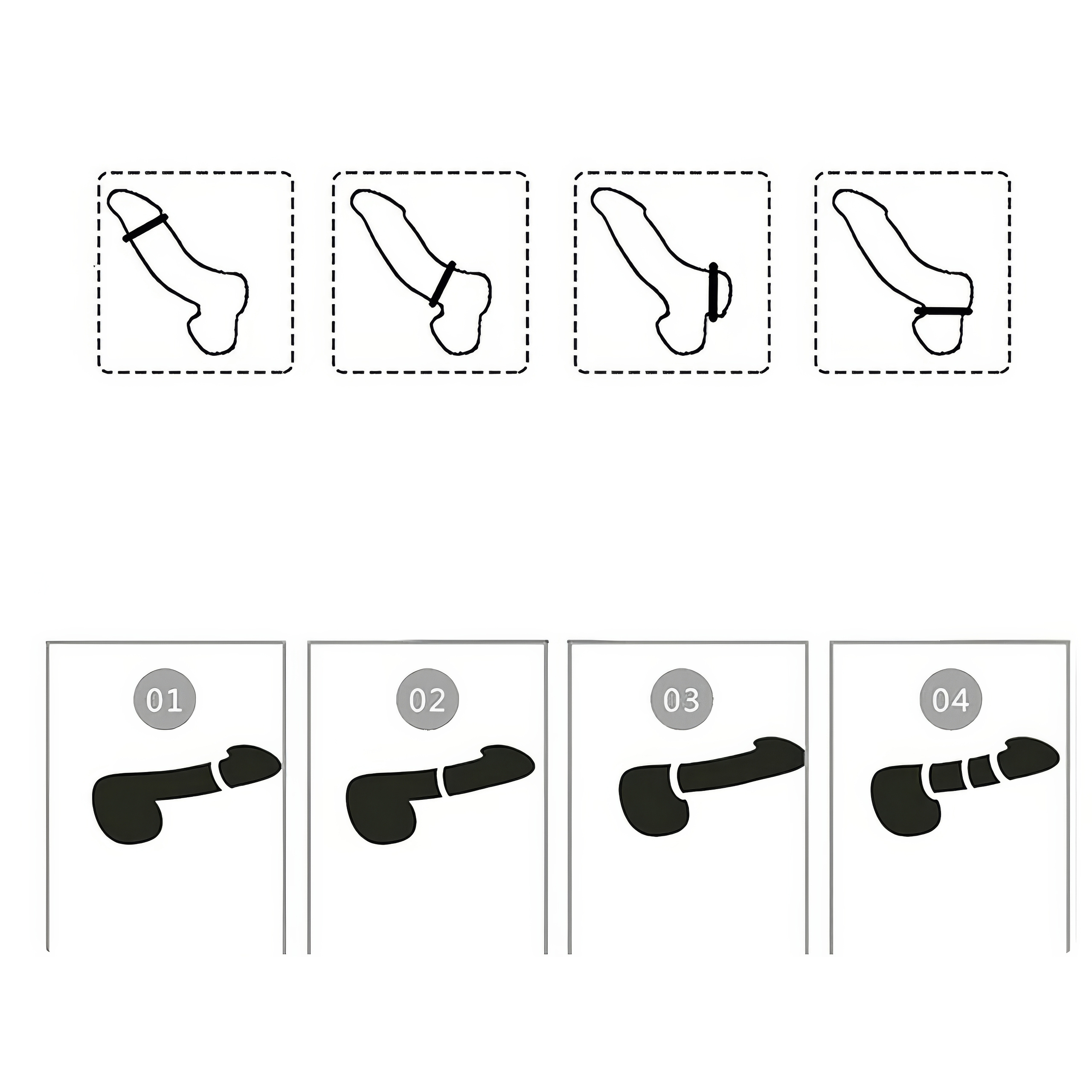

Pierścień Erekcyjny na Penisa - Blue Diamonds Medium - Sklep playtoy.pl - Najlepsze Akcesoria Erotyczne