New Balance 373 Grey / Violet - Free delivery | Spartoo NET ! - Shoes Low top trainers Women USD/$97.50

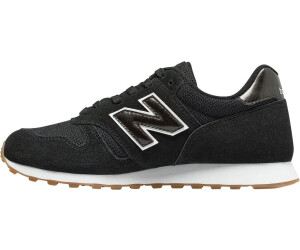

New Balance 373 trainers in black - ShopStyle Women's Fashion | Black new balance shoes, Womens sneakers, Sneakers fashion

Stone Island x Замшевые кроссовки new balance 373 Legacy Release Date | SBD | Ténis New Balance 373 v2 Summer Bright cinzento claro branco mulher

The New Balance 373…it's 3.53 times more efficient | Chaussures en jean, Chaussures de sport mode, Chaussure new balance