BOTANICALS Balsam do ciała Konopie nawilżający 240g Wysoka jakość produktów do włosów i ciała firmy Joanna w przystępnych cenach!

NOWOŚĆ Joanna Sensual do pielęgnacji ciała. Aloes, jedwab, kozie mleko, olejek arganowy, kolagen morski

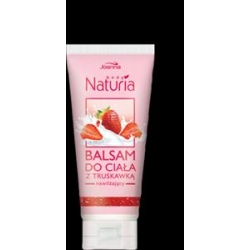

Joanna, Naturia Body, Balsam do ciała regenerujący z bzem do skóry bardzo suchej - cena, opinie, recenzja | KWC

NOWOŚĆ Joanna Sensual do pielęgnacji ciała. Aloes, jedwab, kozie mleko, olejek arganowy, kolagen morski

JOANNA Sensual Balsam do ciała Olejek Arganowy skóra sucha i zmęczona 200 g - Opinie i ceny na Ceneo.pl