19v 2.37a 45w Laptop Ac Adapter Charger For Acer Aspire Es1-512 711 Pa-1450-26 Es1-512 E5-721-66xj Es1-711-p3yr - Buy 19v 2.37a Adapter Charger For Acer,Adapter Charger For Acer,19v 2.37a 45w Laptop Product on

19V 3.42A 65W محول التيار المتردد بالتيار الكهربائي شاحن ل eMachines G430 G433G G443 G443G G627 G630 G640 G729G G729Z G729ZG G730 G730Z|charger for|charger chargercharger ac - AliExpress

19V 7.1A 135W ضئيلة شاحن لابتوب أيسر ConceptD 3 Ezel CC314 72 CC314 72G CC314 72P CC315 72 CC315 72G AC محول الطاقة|محول الكمبيوتر المحمول| - AliExpress

TLAXCA 90W Univeral Laptop Charger 15V-20V Power Supply with 10 Connectors, Compatible with 65W 45W AC Adapter for Notebook ACER, ASUS, HP, LENOVO ThinkPad, SAMSUNG, SONY TOSHIBA : Buy Online at Best

شاحن الكمبيوتر المحمول Acer Emachines E525 E625 E627 E725 ، شاحن 19V 3.42A 65w AC محول|19v 3.42a 65w|19v 3.42aac adapter charger - AliExpress

شاحن لاب توب ايسر 19 فولت 3.42 امبير 65 وات - مقاس السوكت 3.0 1.0 مم: اشتري اون لاين بأفضل الاسعار في مصر - سوق.كوم الان اصبحت امازون مصر

Buy محول ACDC لـ Asus VZ279 VZ279H VZ279HE VZ279N VZ279Q بدون إطار 27 & quot؛ لوحة IPS LED شاشة مزود الطاقة كابل PS شاحن البطارية Mains PSU Online at Lowest Price in

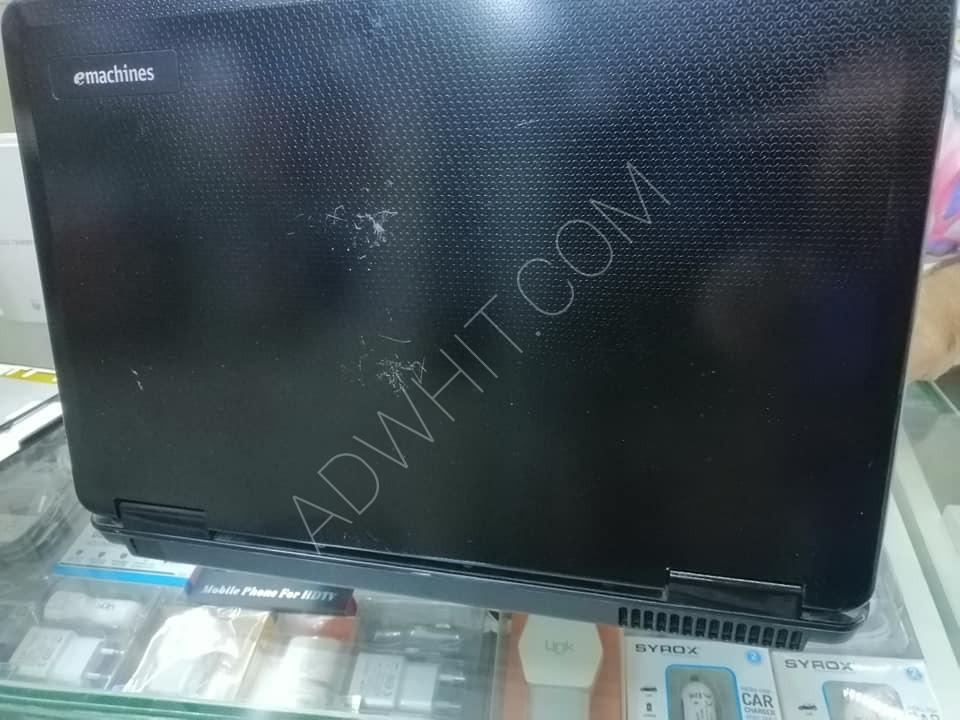

Amazon.com: Ac Adapter Charger replacement for eMachines eMG627 eMG720 eMG725 PEW86 eMachines G420 G427 G520 G525 G620 G625 G627 G720 G725 eMachines KAW00 KAW60 KAWF0 KAWG0 MX4624 MX4625 Laptop Notebook Battery Power

طريقه اصلاح شاحن لابتوب وتغييركابل الشحنHow to repair a laptop charger and change the charging cable - YouTube

شاحن لاب توب ايسر 19 فولت 3.42 امبير 65 وات - مقاس السوكت 3.0 1.0 مم: اشتري اون لاين بأفضل الاسعار في مصر - سوق.كوم الان اصبحت امازون مصر