Bosch Elettrodomestici HBA534BW0 Serie 4, Forno da incasso, 60 x 60 cm, bianco Classe A : Amazon.it: Grandi elettrodomestici

BOSCH - Forno Elettrico da Incasso CMG633BW1 Capacità 45 L Multifunzione Potenza 900 W Colore Bianco - ePRICE

Bosch Elettrodomestici HBA534BW0 Serie 4, Forno da incasso, 60 x 60 cm, bianco Classe A : Amazon.it: Grandi elettrodomestici

Bosch Elettrodomestici HBG633NB1 Serie 8, Forno da incasso, 60 x 60 cm, nero Classe A+ : Amazon.it: Casa e cucina

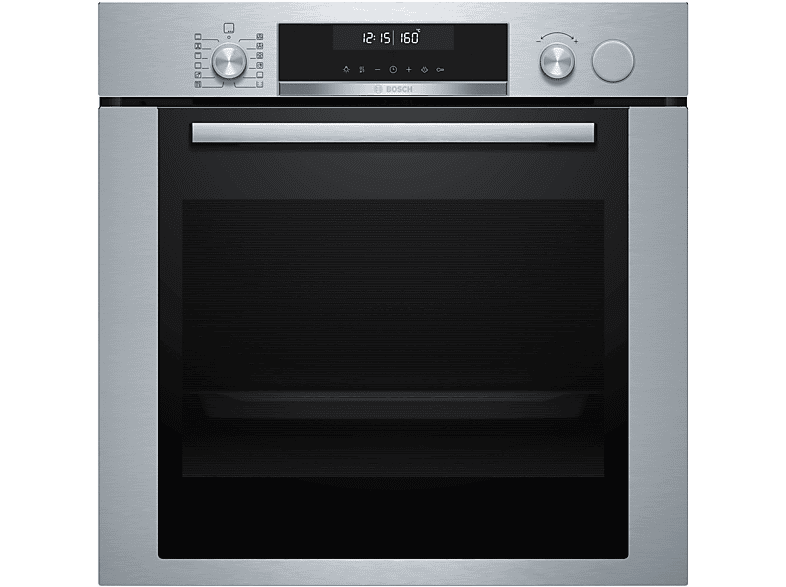

Bosch Elettrodomestici HBA534BS0 Forno Elettrico da Incasso 7 Programmi di Cottura in Acciaio Inox : Amazon.it: Grandi elettrodomestici

Bosch Elettrodomestici HBF011BR0 Serie 2, Forno da incasso, 60 x 60 cm, Acciaio inox Classe A & PGH6B5B90 Serie 4, Piano cottura a gas, 60 cm, acciaio inox : Amazon.it: Grandi elettrodomestici

Bosch Elettrodomestici HBA534BS0 Forno Elettrico da Incasso 7 Programmi di Cottura in Acciaio Inox : Amazon.it: Grandi elettrodomestici

Bosch Elettrodomestici HBA534BS0 Forno Elettrico da Incasso & Piano Cottura 5 Fuochi A Gas Serie 6, PCQ7A5B90 In Acciaio Inox 75 cm : Amazon.it: Grandi elettrodomestici

Bosch Siemens 612114 00612114 Originale Posteriore Lavastoviglie Spray Spray Soffione Doccia per Grandi Pezzi Teglie e Filtro Grasso| | - AliExpress

Bosch Forno Elettrico Ventilato da Incasso Multifunzione 71 L HBG675BS1J Prezzo in Offerta su Prezzoforte

Bosch Elettrodomestici HBA534BW0 Serie 4, Forno da incasso, 60 x 60 cm, bianco Classe A : Amazon.it: Grandi elettrodomestici