Burberry Men Heritage Trench Coat Collection: The Timeless Must-Have – The Fashionisto | Burberry trench coat, Burberry coat, Men's trench coat

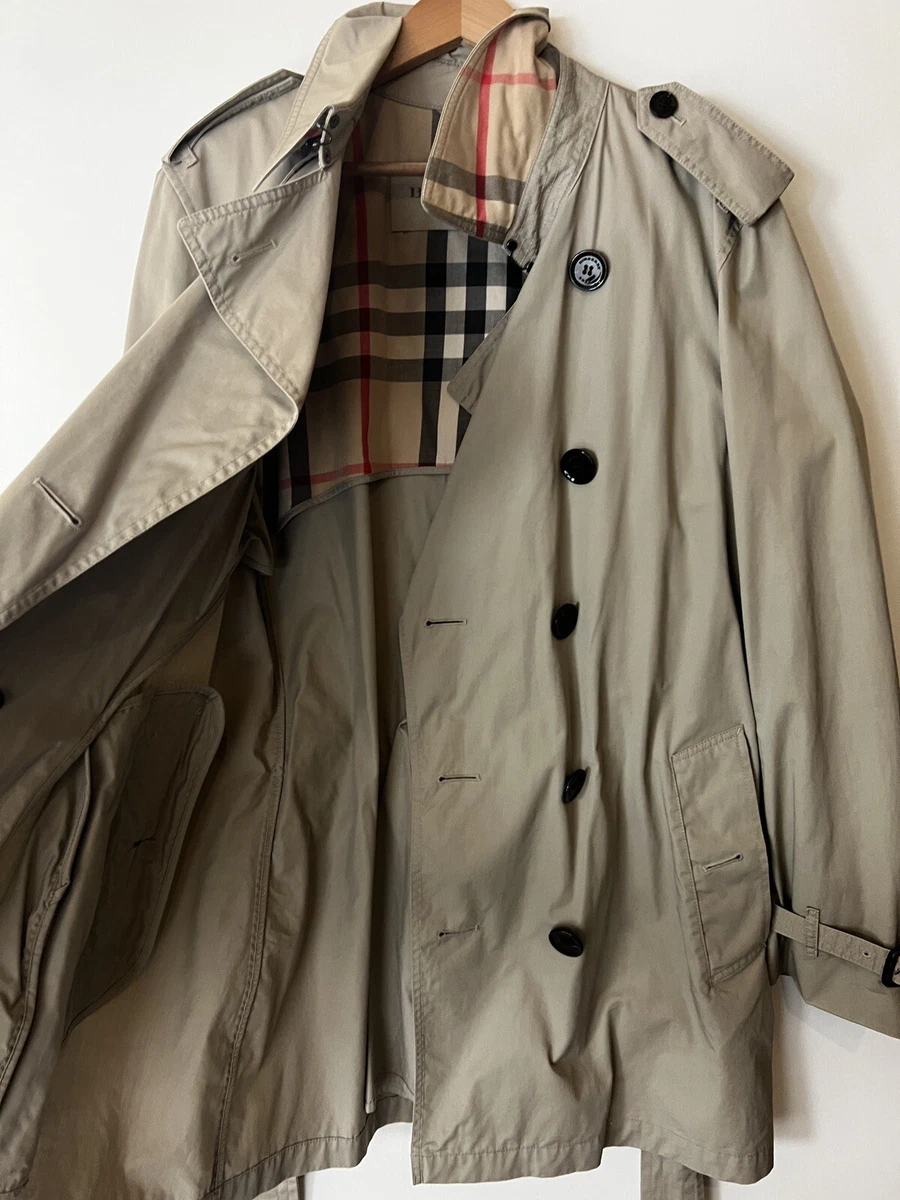

Burberry trenchcoat khaki vintage t 48 immaculate condition Cotton Polyester ref.135629 - Joli Closet